- ADA retests assist degree of $0.3300 and a resistance degree of $0.3407

- Improved weighted sentiment, however ADA holders are nonetheless not locking in good points

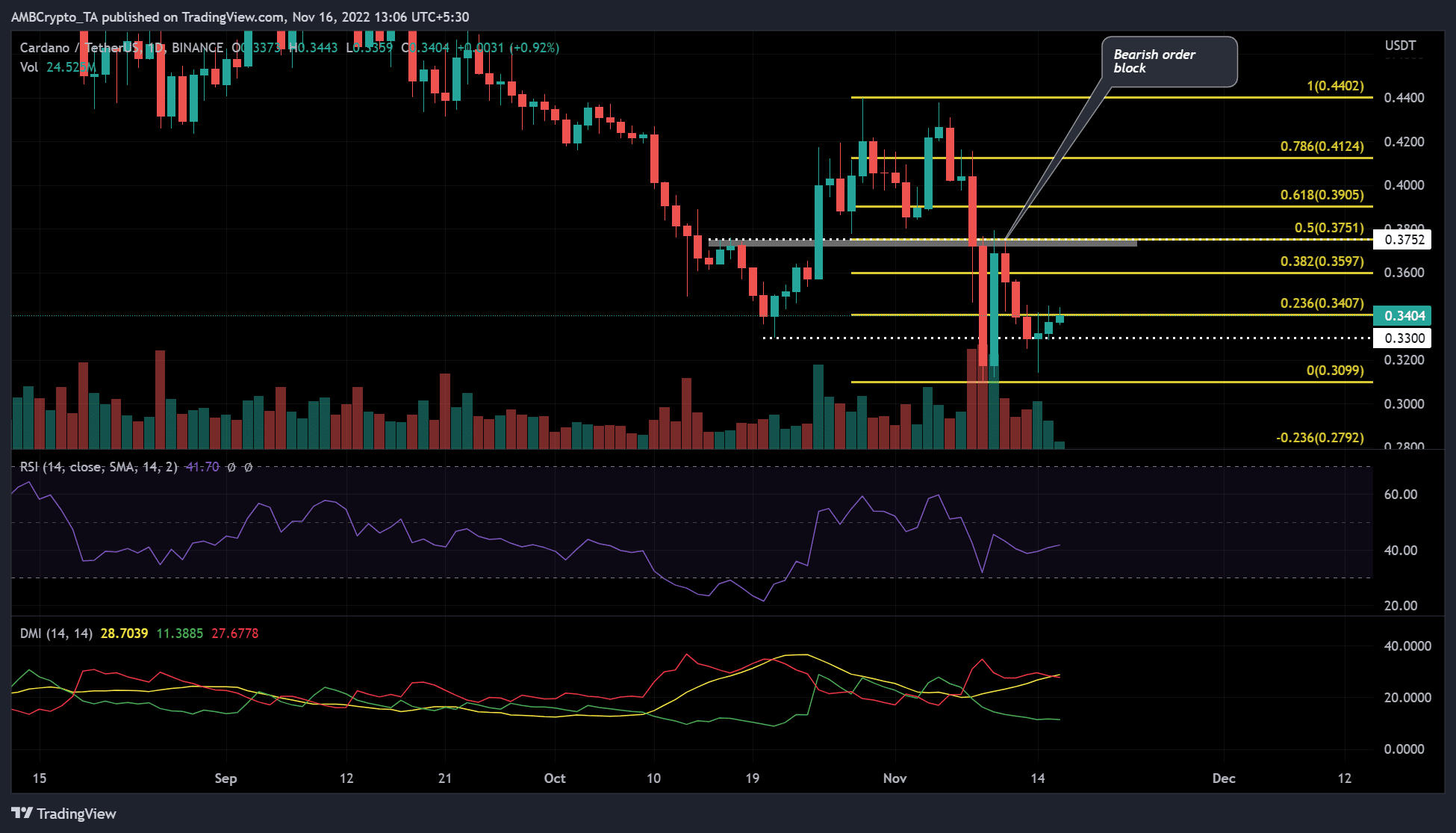

Cardano [ADA] has shaped a worth rally on the day by day chart and reveals a bullish market construction on the decrease time timeframe. That is a powerful efficiency in an total market that’s bearish in the meanwhile. ADA was buying and selling at $0.3404 at press time, up about 1% within the final 24 hours.

A flip of the 0.236 Fib degree (resistance) into the assist zone and a subsequent uptrend might present extra shopping for alternatives for day merchants. If the bulls fail to construct sufficient shopping for strain, buyers ought to regulate these ranges to cease losses.

Retesting the 0.236 Fib degree, will the bulls proceed to prevail?

Supply: TradingView

ADA’s latest correction discovered assist at $0.3300 (white, dotted ), corresponding with a bullish order block on 20 October. The assist degree supplied a bounce base for the bulls, and the worth rally was nonetheless ongoing on the day by day chart as of press time.

On the time of writing, the Relative Energy Index (RSI) indicator was climbing from the oversold entry degree and shifting in direction of the equilibrium degree at 50.

This steered that promoting strain was easing because the bulls battled with the bears for management. This might permit the bulls to focus on and attain new resistance ranges within the coming days or perhaps weeks.

Ought to the bulls preserve momentum and switch resistance at $0.3404 into assist, this would offer an entry level for lengthy trades. Ought to the bullish momentum proceed, quick targets for lengthy trades could be $0.3957 and the bearish order block could be within the $0.3719 – $0.3752 vary.

Nevertheless, a day by day shut under the assist degree of $0.3404 would negate this bullish inclination.

The Directional Motion (DMI) indicator confirmed that sellers (purple line) are outperforming patrons (inexperienced line). So the present market continues to favor sellers.

If the bulls fail to construct sufficient shopping for strain, ADA costs may slide decrease. In such a state of affairs, it’s best to set your cease loss under the zero fib degree ($0.3099).

ADA’s weighted sentiment improves

Supply: Santiment

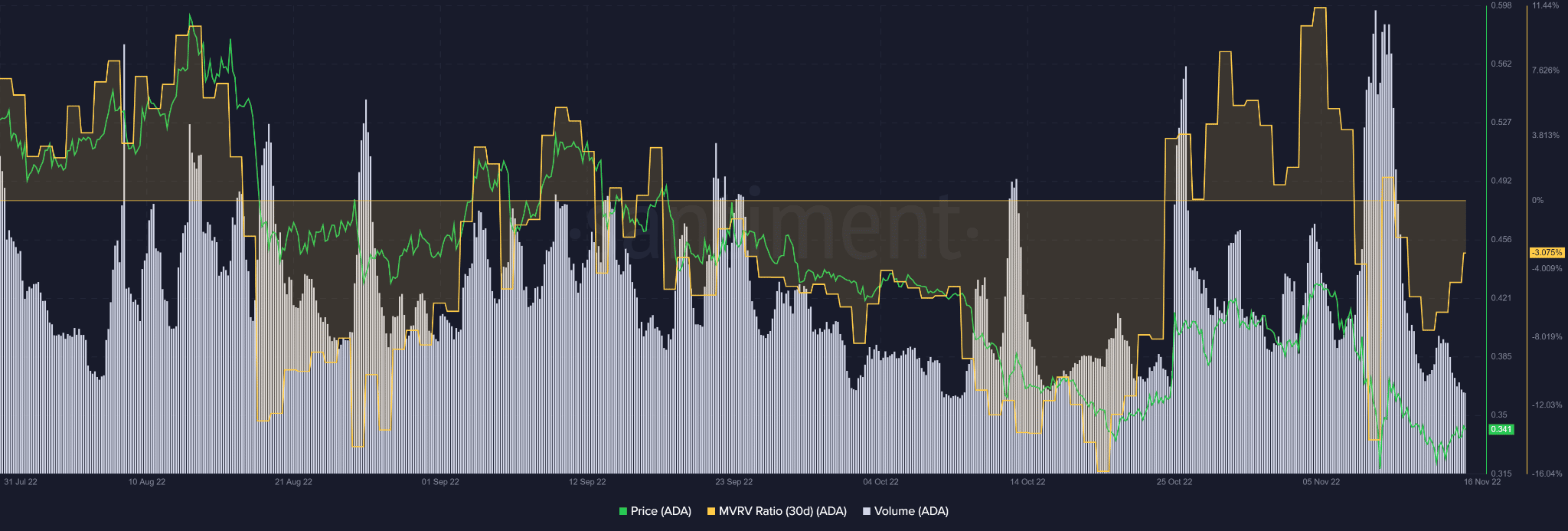

An evaluation of Santiment data reveals that Cardano (ADA) recorded optimistic weighted sentiment on 12 November and has steadily risen since then. The development was mirrored within the worth improve of ADA that adopted on 14 November.

Brief-term ADA holders nonetheless undergo losses

Supply: Santiment

Even so, short-term ADA holders suffered losses because the 30-day MVRV was nonetheless in negative territory. Nevertheless, it moved upward, suggesting that losses have narrowed resulting from improved sentiment and worth restoration.

However the improved sentiment and worth restoration haven’t but resulted in adequate buying and selling quantity. In response to Santiment, the worth improve has been accompanied by declining quantity. This might have an effect on shopping for strain, stopping ADA from reaching lengthy commerce targets.

That stated, merchants ought to monitor the sentiment on ADA and the BTC motion earlier than buying and selling.