One other publicly traded cryptocurrency miner has printed a monetary report for Q2 2022, reflecting complicated market circumstances and combined leads to the face of low Bitcoin (BTC) costs and rising mining problem. On one hand, Canaan Inc. (NASDAQ: CAN) confirmed important development in computing energy and Bitcoin mining revenues. Nevertheless, it additionally highlighted the challenges it faces, together with regulatory modifications and market pressures, which have affected its gross sales and mining operations.

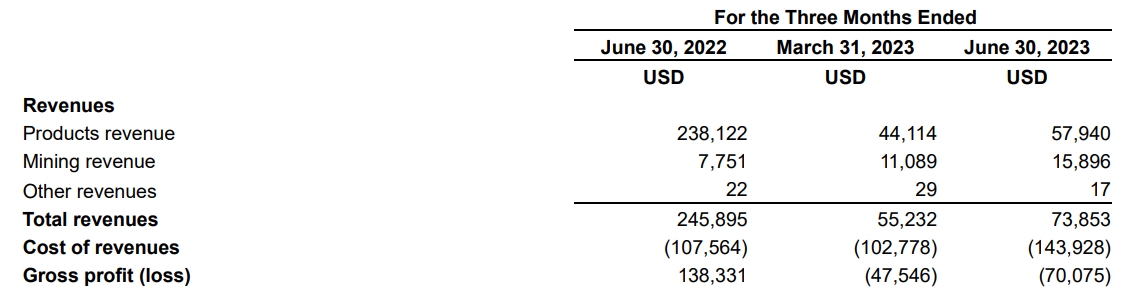

The corporate offered a complete computing energy of 6.1 million Thash/s, marking a rise of 44.2% from the primary quarter of 2023. Revenues for the quarter stood at $73.9 million, in comparison with $55.2 million in Q1 2023. Regardless of these positive factors, the corporate is grappling with a market that has but to recuperate, affecting its gross sales and mining operations solely.

Moreover, the outcomes improved quarterly, however they’re much worse on an annual foundation. Within the income class, $73.9 million for the final quarter is considerably lower than $245.9 million in the identical interval in 2022. Nonetheless, the end result was higher than market expectations.

Canaan Inc. Studies Unaudited Second Quarter 2023 Monetary Outcomes#Canaan #Mining #Bitcoin

Be taught extra: https://t.co/Mg01dyC1SX pic.twitter.com/HuVLnHC7Zi

— Canaan Inc. (@canaanio) August 29, 2023

Nangeng Zhang, the Chairman and CEO of Canaan, acknowledged that the corporate managed to surpass its income steering regardless of a stagnant Bitcoin market. James Jin Cheng, the CFO, added that the better-than-expected income was as a consequence of enhancements in each gross sales and mining actions. Nevertheless, each executives acknowledged the challenges that would impede future operations, together with regulatory shifts and market unpredictability.

The outcomes from mining operations alone additionally deserve particular point out. Income on this class stood at $15.9 million, rising by 43.3% from $11.1 million reported three months earlier. On an annual foundation, the expansion exceeded 105% from $7.8 million.

“Our mining income additional set a brand new historic excessive within the second quarter of 2023. Lately, we’ve expanded into new mining tasks in Africa and South America,” Zhang added.

For the third quarter of 2023, Canaan expects complete revenues to be roughly $30 million. This forecast is influenced by the difficult market circumstances throughout the trade and ongoing regulatory points.

Regulatory and Worth Challenges

Canaan faces regulatory hurdles in Kazakhstan, the place it needed to briefly shut down roughly 2.0 Exahash/s of its mining computing energy. The corporate can also be concerned in a authorized dispute within the US over a breached ‘Joint Mining Settlement’, including one other layer of complexity to its operations.

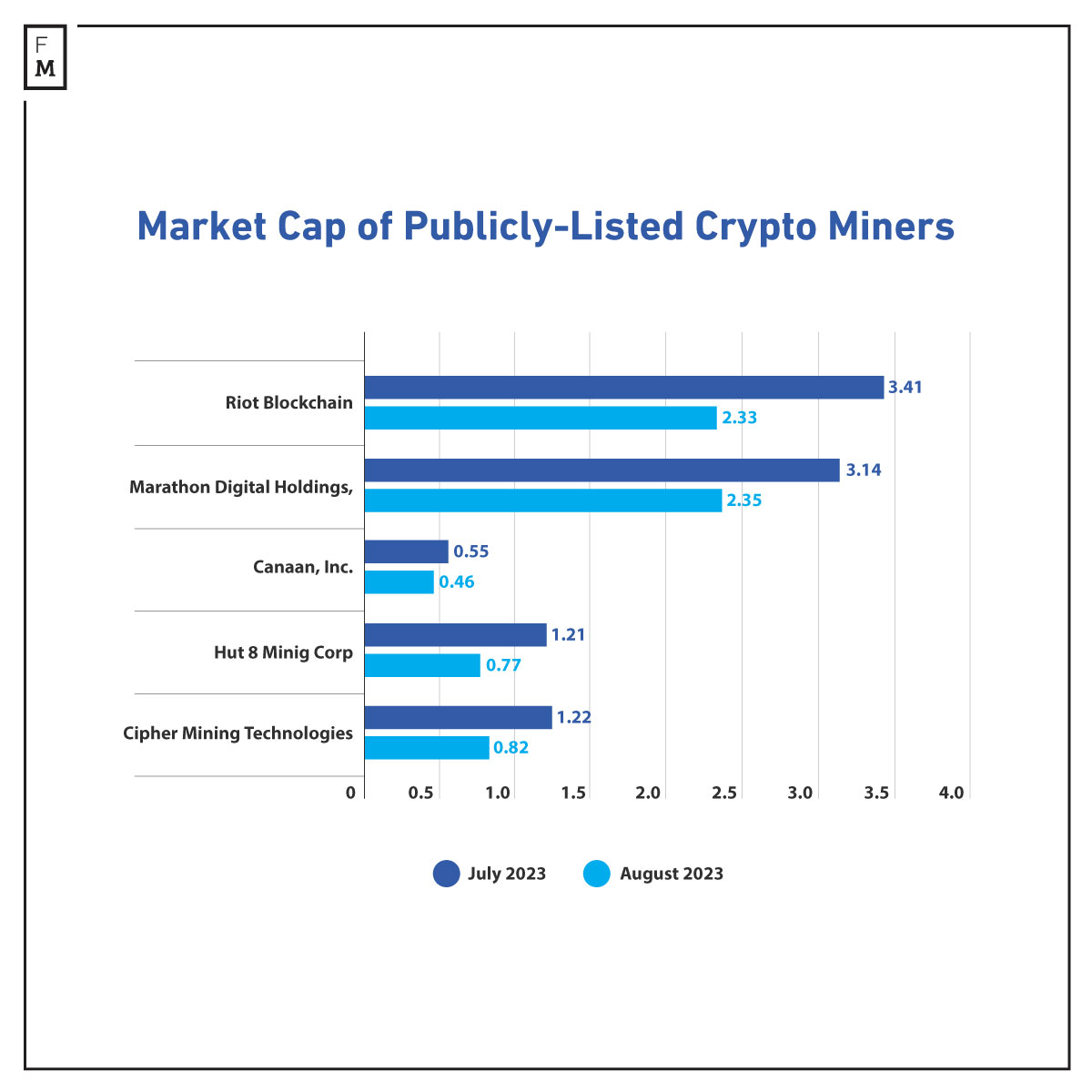

Furthermore, the corporate is amongst 5 publicly-listed corporations that suffered a $2.8 billion loss following a pointy decline in Bitcoin and the general cryptocurrency market in mid-August. Knowledge from AltIndex reveals a 30% drop out there capitalization of publicly listed crypto miners inside a month.

Different main gamers like Riot Platform and Marathon Digital Holdings additionally skilled important capitalization losses, amounting to $1.1 billion and $800 million, respectively. Corporations like Canaan, Hut 8 Mining, and Cipher Mining Applied sciences noticed a substantial discount of their market shares.

Arduous to Swallow Financials

As well as, these corporations reported combined monetary outcomes for the second quarter of 2023. Argo Blockchain decreased its non-mining operational prices however confronted a 31% income decline as a consequence of falling Bitcoin costs and elevated world hashrate competitors. Riot Platforms Inc. and Galaxy Digital Holdings Ltd. additionally posted destructive monetary outcomes for Q2 2023.

Galaxy Digital, based by American investor Michael Novogratz, reported a lack of $46 million, contrasting sharply with its earlier quarter’s revenue. Riot Blockchain disclosed a Q2 2023 income of $76.7 million however nonetheless posted a web lack of $27.7 million, albeit an enchancment over the earlier 12 months’s loss.

???? #Bitcoin $BTC Miner Income simply reached a 1-month low of $169,708.61

Earlier 1-month low of $179,351.54 was noticed on 17 August 2023

View metric:https://t.co/UYhnd9eeZH pic.twitter.com/hXbbDPERHl

— glassnode alerts (@glassnodealerts) August 22, 2023

Regardless of preliminary optimism for 2023, the cryptocurrency trade is once more dealing with market stagnation, following a lackluster efficiency in 2022.