Knowledge from Santiment revealed that the intraday buying and selling session for 1INCH was marked by a rally within the depend of whale transactions. This rally got here after the extreme worth volatility that plagued the cryptocurrency market on 23 and 24 October.

_____________________________________________________________________________________

Right here’s AMBCrypto’s Value Prediction for 1INCH for 2023-2024

_____________________________________________________________________________________

Based on the on-chain analytics platform, 1INCH’s whale transactions above $100,000 stood at a complete of 18 on 31 October. This was the very best depend recorded by the altcoin within the final seven days. Different cryptocurrency property that registered important whale exercise throughout the identical interval included USDT, USDC, and GLM.

Ought to this development in 1INCH whale exercise proceed, Santiment opined that “main market motion ought to proceed.” Nonetheless, are different on-chain metrics in tandem with this place? Allow us to take a look.

1INCH on the chain

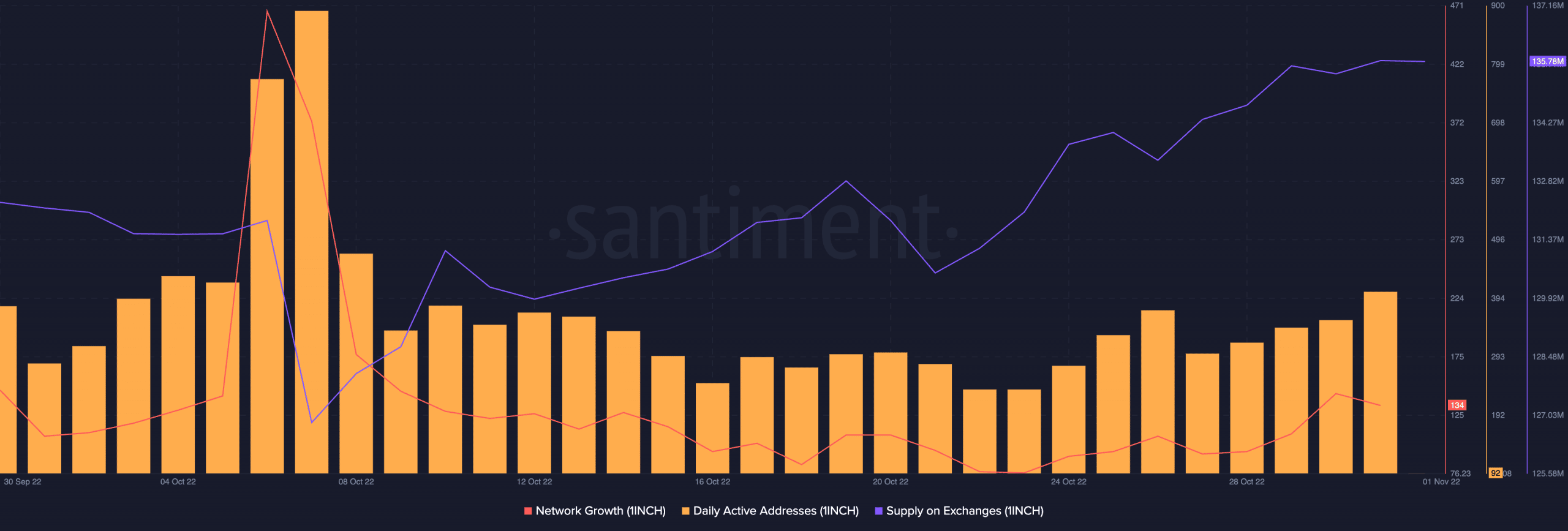

A have a look at 1INCH’s change exercise revealed a surge within the quantity of the altcoin’s provide on exchanges within the final month. Per Santiment, 1INCH’s provide on exchanges rallied by 3% within the final 30 days. As of this writing, 9.05% of 1INCH’s whole provide was held inside exchanges. A month in the past, this sat at 8.82%.

A spike in an asset’s provide on exchanges prompt a rally in such an asset’s short-term promote strain. As 1INCH’s worth grew within the final month, sellers more and more distributed to comprehend earnings. Subsequently, sustained development within the asset’s provide on exchanges may lead to a worth draw down within the quick time period.

Moreover, 1INCH suffered a decline in its community exercise within the final month, information from Santiment confirmed. The depend of distinctive addresses that traded the altcoin dropped steadily since 7 October. At 92 addresses at press time, the depend of every day lively addresses on 1INCH’s community has fallen by 90% since then.

Along with this, new addresses created on the community every day additionally suffered the identical destiny within the final 30 days. Following the every day excessive of 467 addresses on 6 October, the variety of new addresses on 1INCH’s community had declined by 71% by press time.

Supply: Santiment

1INCH has a lot to supply

1INCH’s worth rally within the final week coincided with a change within the profitability ratio of the alt. Based on information from Santiment, the asset’s Market Worth to Realized Worth (MVRV) ratio on a 30-day shifting common turned constructive on 25 October when the value began to climb. At press time, this was pegged at 6.346%, indicating {that a} sizeable variety of 1INCH buyers held at a revenue.

Nonetheless, regardless of the rally in worth within the final week and the expansion within the profitability ratio, buyers continued to harbor a unfavourable bias towards 1INCH.

Supply: Santiment

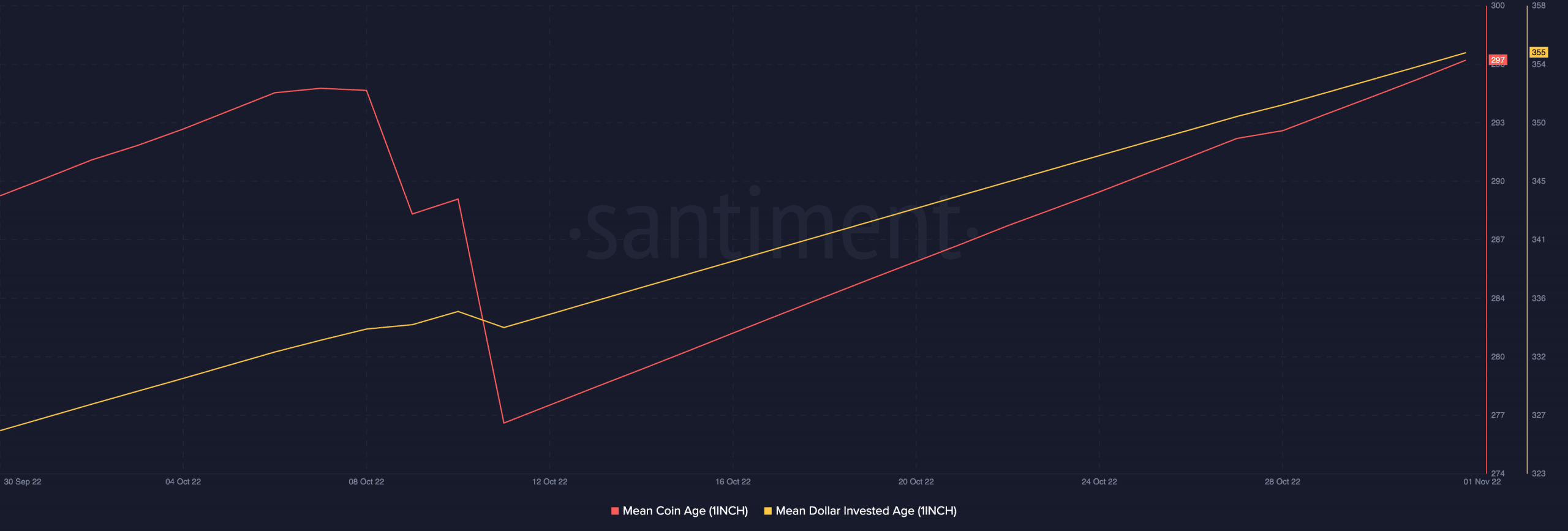

Whereas a sustained rally in whale exercise would possibly event a continuance of “main market motion,” as posited by Santiment, no important development in 1INCH’s worth was potential in the long run. This was due to the expansion within the quantity of dormant 1INCH tokens held inside addresses.

For this to alter, the uptrend motion of the asset’s Imply Coin Age and Cash Greenback Invested Age must change course. This is able to imply that beforehand dormant tokens have began to alter arms; therefore a worth rally would comply with.

Supply: Santiment