Researchers behind the well-known Cambridge Bitcoin Electrical energy Consumption Index (CBECI) have formally revised its methodology to reinforce the accuracy and reliability of the Index’s estimates for the primary time since its inception in 2019.

The CBECI was launched in July 2019 in an effort to supply dependable>BTC) community’s electrical energy consumption and contextualizing the info in a approach that’s digestible for the layman on the road.

Key takeaways from the revised methodology included a concentrate on latest developments in Bitcoin mining {hardware} and hash price and whether or not the CBECI was precisely reflecting the altering panorama. The researchers honed in on questions round what had pushed substantial will increase in hash price lately as newer mining gear eclipsed older fashions in computing energy.

Associated: Nuclear and fuel quickest rising power sources for Bitcoin mining: Information

Neumueller and his fellow researchers famous that the shortage of hardware-related knowledge posed a major problem because it restricted the CBECI’s capacity to precisely assess the sorts of {hardware} that miners use in addition to their ubiquity.

This led the researchers to beforehand create a technique that simulates a every day {hardware} distribution based mostly on efficiency and energy utilization knowledge of actual {hardware}. Neumeuller notes that the spine of the earlier CBECI methodology assumed that each worthwhile {hardware} mannequin launched lower than 5 years in the past equally fuelled the full community hashrate.

This in flip led to a “disproportionally massive quantity” of older mining {hardware} in comparison with newer fashions within the methodology’s assumed {hardware} distribution throughout exceptionally worthwhile mining durations.

Associated: Iris Vitality buys 248 Nvidia GPUs price $10M for generative AI and Bitcoin mining

The researchers subsequently found that extra not too long ago launched gear seemed to be underrepresented whereas gear nearing the top of its life cycle was overrepresented. This prompted the change within the CBECI methodology.

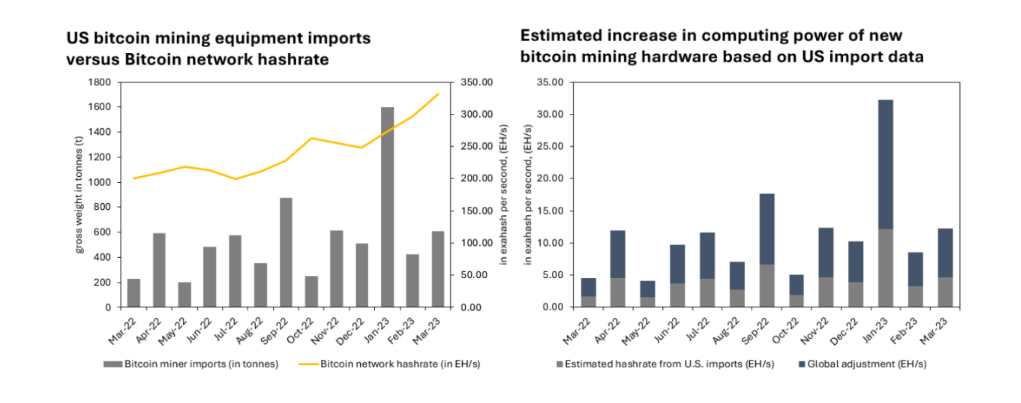

Neumeller then defined how his workforce started evaluating hashrate will increase with United States import knowledge reflecting latest Bitcoin mining {hardware} deliveries. This was mixed with an examination of publicly accessible gross sales knowledge from mining {hardware} producer Canaan.

CBECI checked out U.S. import information on Bitcoin mining gear (left) and estimated computing energy derived from import knowledge (proper). Researchers used the hash price (in TH/s) and gross weight said by the producer and utilized an equally weighted mixture of the next fashions from Canaan’s Avalon A1246, Avalon A1266, Avalon A1346 and Avalon A1366.

The evaluation, which thought of a lot of in-depth components, was used to check the speculation that will increase in community hash price might be attributed to extra not too long ago launched mining {hardware}.

“This speculation was based mostly on U.S. import knowledge, and we sought extra proof to validate it. If Canaan’s gross sales knowledge is consultant of the trade, it corroborates this declare.”

Neumueller highlighted a divide in opinion, with critics suggesting that Bitcoin “jeopardizes environmental developments and will exacerbate local weather change,” whereas supporters argue that the mining trade may fight local weather change and supply different societal advantages.

“Nevertheless, the intricate nature of the trade and the lack of knowledge are sometimes under-recognised, making room for cherry-picked knowledge factors and biased views.”

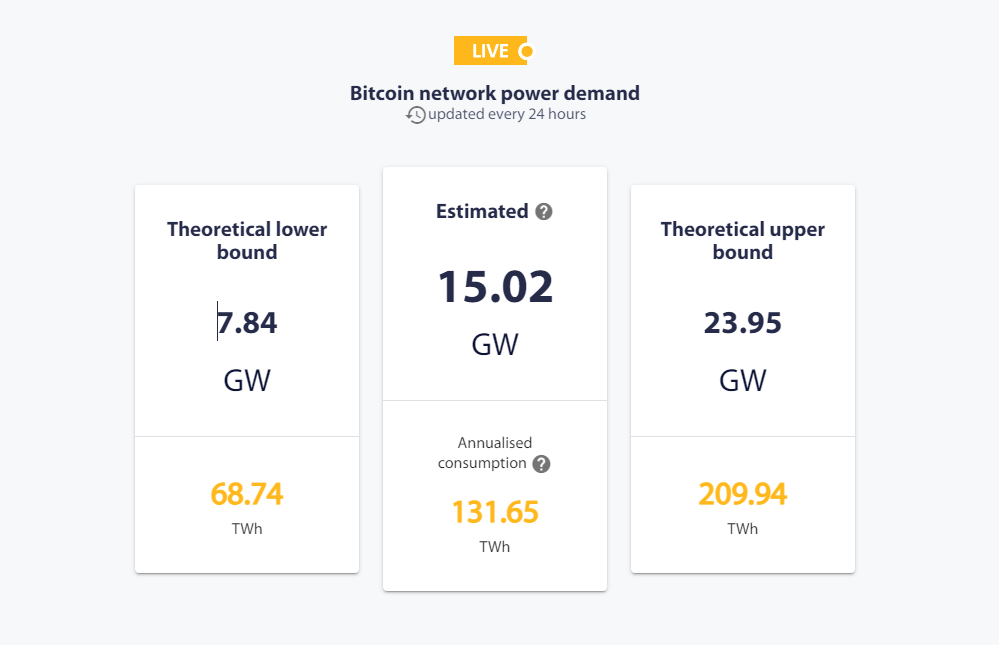

The CBECI consists of a variety of wealthy knowledge factors and visualizations, together with the index’s Bitcoin community energy demand, a mining map reflecting the geographic distribution of Bitcoin’s mining hash price in addition to a greenhouse fuel emissions index.

The CBECI and greenhouse fuel emissions indexes present three totally different estimates for each sectors, offering a hypothetical vary for these particular metrics.

Acquire this text as an NFT to protect this second in historical past and present your help for unbiased journalism within the crypto house.

Journal: Recursive inscriptions: Bitcoin ‘supercomputer’ and BTC DeFi coming quickly