The monetary outcomes of one more publicly traded cryptocurrency miner confirmed that it’s difficult to make a internet revenue underneath present market circumstances. Cathedra Bitcoin Inc. (TSX: CBIT), a Toronto-based Bitcoin mining firm, has disclosed its monetary efficiency for the second quarter of 2023. Regardless of the report revealing important development in mining output and income, the web loss nonetheless appears sizable.

Within the second quarter of 2023, Cathedra Bitcoin mined 77.15 BTC, marking a rise of 19.5 BTC from the 57.65 BTC mined in the identical interval final 12 months. This development is attributed to the corporate’s hash fee growth from 231 PH/s to 382 PH/s. Regardless of a surge within the community mining problem and a drop in Bitcoin’s common worth, the corporate’s income rose from C$2.5 million in Q2 2022 to C$2.9 million in Q2 2023.

The corporate has additionally considerably diminished its internet loss. Final 12 months, it was C$11.9 million for the three-month interval ending in June, and it has now been diminished to C$2.9 million. The web loss for the complete first half of the 12 months was C$5.2 million, in comparison with C$15.8 million reported within the first half of 2022.

“Current weeks have seen the improved bitcoin mining circumstances of H1 2023 regress to ranges akin to essentially the most difficult durations of This autumn 2022. Throughout this time, we stay centered on discovering inventive, capital-efficient methods to create worth for our shareholders,” the corporate commented within the official press launch.

Nevertheless, this does not change the truth that Cathedra Bitcoin is one other publicly traded crypto miner that lately revealed a monetary report displaying a internet loss. The sample is normally the identical: firms are mining extra Bitcoins however can’t obtain profitability.

Simply yesterday, firms like Canaan and Argo Blockchain launched their stories. The previous noticed a quarterly income enhance to $73.9 million, however this was considerably decrease than the $245.9 million reported in Q2 2022. The latter reported a 31% decline in income to $24 million for H1 2023. Riot Platforms Inc. and Galaxy Digital Holdings Ltd. additionally posted adversarial monetary outcomes for Q2 2023.

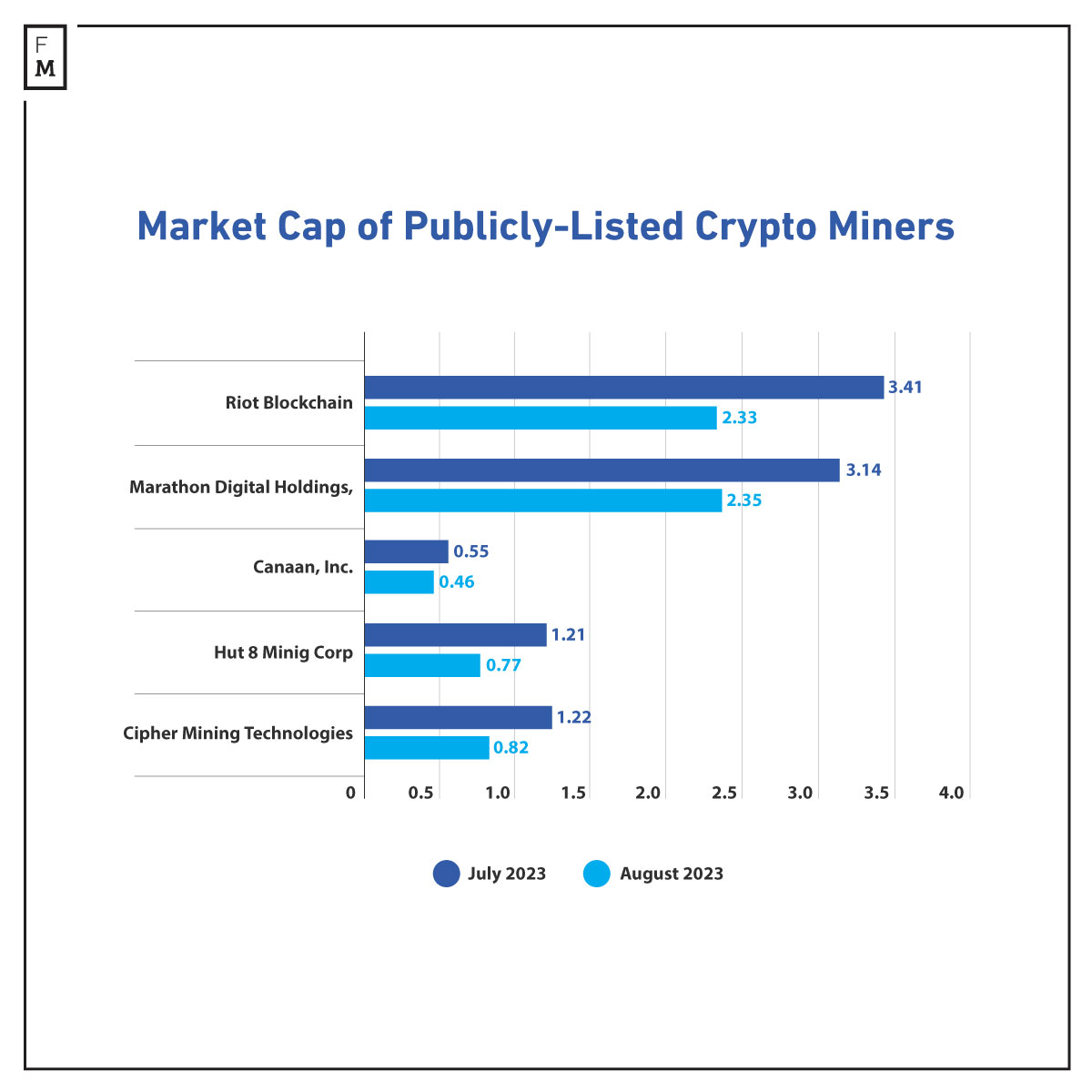

These firms are amongst 5 publicly-listed companies which have suffered a $2.8 billion loss following a pointy decline in Bitcoin and the general cryptocurrency market in mid-August.

Growth regardless of Troublesome Circumstances

Though market circumstances usually are not favorable, Cathedra Bitcoin is continually attempting to develop its enterprise. The corporate managed its money owed successfully, changing C$2.5 million of its 3.5% senior secured convertible debentures into 18.5 million frequent shares. As of the tip of August 2023, the corporate holds roughly C$4.4 million in money and Bitcoin, offering a strong liquidity place.

The corporate accomplished the deployment of Bitmain Antminer S19J Professional and XP machines at its information facilities in Washington and a facility in Kentucky. A renewed internet hosting settlement with a companion in Tennessee and a brand new strategic partnership with 360 Mining in Texas additional expanded its operational footprint.

“This focus is exemplified by our current partnership with 360 Mining, underneath which we are going to proceed to deploy idle hash fee and infrastructure with minimal capex, in addition to our ongoing efforts to underclock our machines utilizing customized firmware to make sure profitability. As all the time, we thank our shareholders for his or her continued assist,” the corporate added.

Cathedra Bitcoin goals to boost its vitality effectivity by underclocking its mining machines, thereby decreasing the break-even hash worth by 12%. This transfer is predicted to keep up the machines’ optimistic money circulation.