Mining

A U.S. chapter courtroom has granted Bitcoin (BTC) miner Core Scientific interim approval to entry a $37.5 million mortgage from current collectors to fund the agency amid its liquidity points.

Core Scientific is without doubt one of the largest cryptocurrency mining corporations in the USA, however filed for Chapter 11 chapter on Dec. 21 because of rising vitality prices, declining income and the worth of BTC in 2022.

In a public assertion made on that very same day, Core Scientific outlined that it intends to “transfer swiftly by means of the restructuring course of” and keep its self-mining and internet hosting operations.

The mortgage comes from a gaggle of collectors known as the Advert Hoc Noteholder Group — which holds greater than 50% of Core Scientific’s convertible notes — which agreed to offer debtor-in-possession (DIP) facility dedication loans as much as a complete of $75 million, based on courtroom filings.

The agency’s software was authorized on Dec. 22 and courtroom filings present that the DIP mortgage can have a ten% each year rate of interest hooked up.

Core Scientific will be capable of entry $37.5 million instantly to maintain the lights on, whereas it intends to use to entry the remaining $37.5 million in January as per a Dec. 23 report from Reuters, citing an organization lawyer.

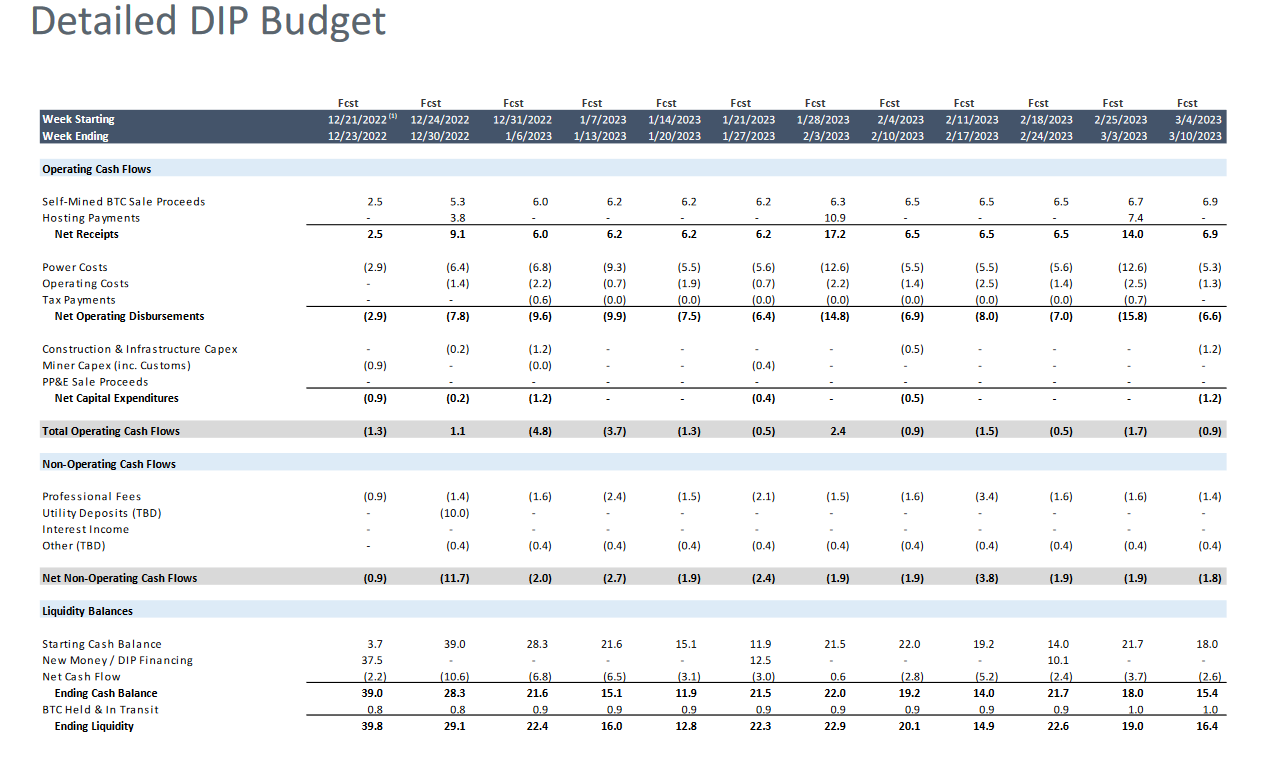

Within the preliminary DIP finances nevertheless, it was forecasted to use for $12.5 million by Jan. 21.

Core Scientific DIP finances: Stretto

The Reuters report additionally suggests the collectors perceive the challenges of the bear market and are a long-term play with Core Scientific.

Kris Hansen, a consultant of the collectors, instructed the information outlet that the present stakeholders “have religion” within the firm’s future regardless of its current troubles.

In its Q3 monetary report, Core Scientific reported having $1.4 billion value of belongings and $1.33 billion value of liabilities as of Sept. 30, displaying a decent stability sheet amid the bull market.

Notably, the agency stories a lack of $434.8 million in Q3 which when added to losses from the earlier two quarters, witht complete losses reaching $1.71 billion thus far this yr. As such, the agency indicated in late November that it was almost definitely heading in direction of chapter and not using a recent injection of money.

The agency has reportedly mined nearly 12,000 BTC this yr, marking a big enchancment on the 5,769 BTC mined in 2021, nevertheless that in fact has not been in a position to save Core Scientific from its monetary woes.