BNB, like most different cryptos out there, registered a promising efficiency over the previous couple of weeks, because of the bullish market situation.

Not solely did BNB’s value enhance by greater than 15% within the final seven days, however progress was additionally marked in different facets as effectively. As an example, BNB witnessed a slight enhance in staking numbers as the worth of BNB staked went from $19.3 million in September to $19.4 million in October.

Right here’s AMBCrypto’s Worth Prediction for BNB for 2023-24

4/ #BNB staking stats:

BNB Chain noticed a slight enhance in staking numbers from September to October:

♦️ ~0.5% enhance in $BNB staked (19.3M to 19.4M)

♦️ 4th largest staking market cap

♦️ ~11.9% staking ratio pic.twitter.com/G6U5Wu3BQG— pSTAKE for BNB (@pSTAKE_stkBNB) November 1, 2022

Furthermore, Stader BNB lately introduced that they’ve crossed $20 million price BNB staked with them. This new milestone was undoubtedly a bit of constructive information for BNB.

It is celebration time at Staderverse?

We have crossed $20M price #BNB staked with us.We’re overjoyed & admire the help from @BNBCHAIN

& our companions @WombatExchange @ImpossibleGD @ape_swap @izumi_Finance @beefyfinance @Coneswap @Ellipsisfi @MidasCapitalxyz @OpenLeverage pic.twitter.com/Vm5wrQbajj— Stader.BNB (@stader_bnb) November 2, 2022

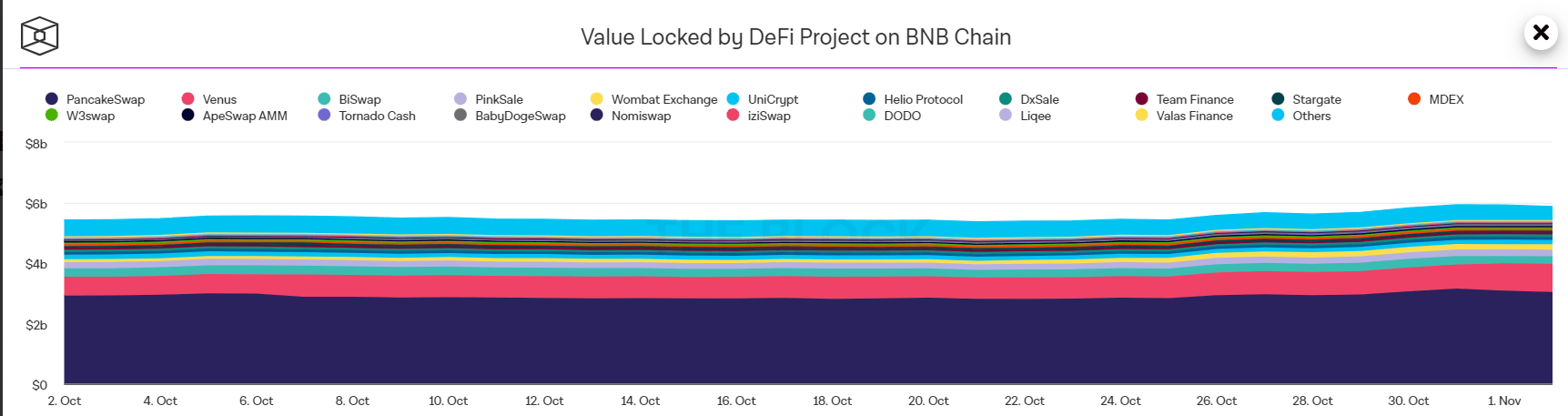

The Block’s information additionally supplemented these developments. In response to the chart hooked up under, the Complete Worth Locked (TVL) by DeFi tasks on the BNB chain was about to the touch $6 billion.

Supply: The Block

Moreover, BNB’s community, at press time, had 51 complete validators (26 energetic and 25 inactive).

At press time, BNB was up by over 3% within the final 24 hours and was trading at $333.83 with a market capitalization of over $53.4 billion.

That being mentioned, it’s vital to check out BNB’s on-chain metrics to place issues in correct perspective.

This must be regarding

CryptoQuant’s data revealed that BNB’s Relative Power Index (RSI) was in an overbought place, which indicated that the nice days would possibly come to a halt quickly.

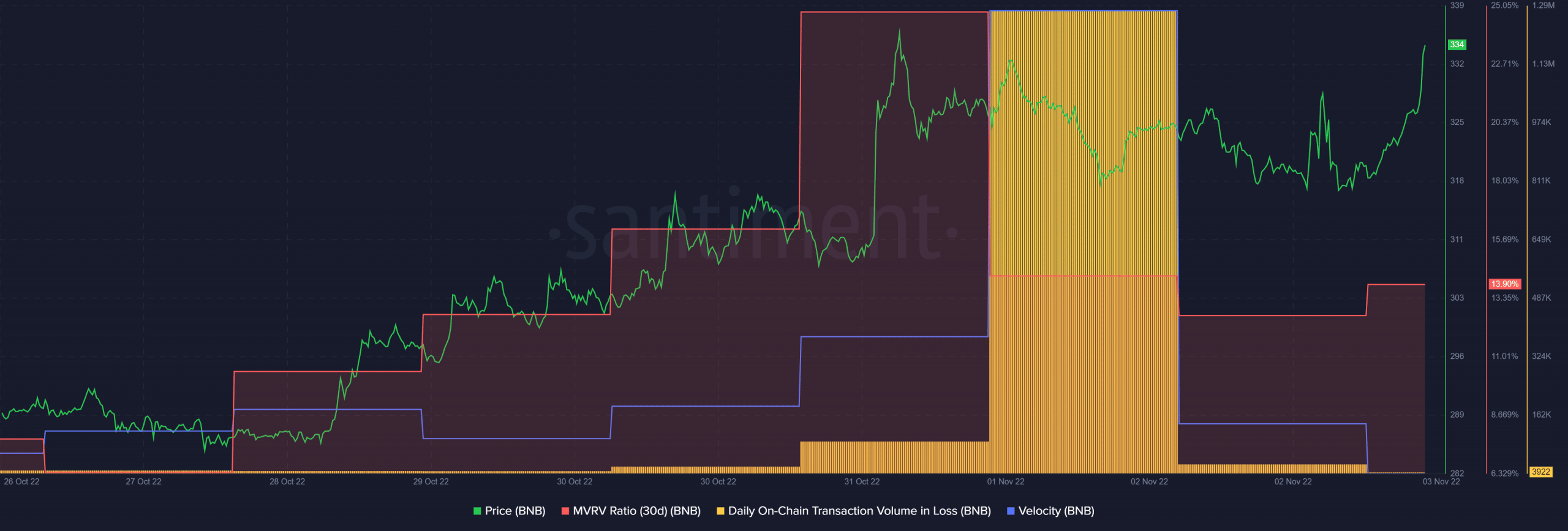

BNB’s MVRV Ratio registered a downtick, suggesting a attainable sell-off within the coming days. Moreover, BNB’s velocity additionally decreased these days. Furthermore, the every day on-chain transaction in loss registered a spike on 1 November, which was yet one more unfavourable sign.

Supply: Santiment

Nonetheless, this would possibly assist

Although many of the metrics gave a unfavourable notion for BNB’s value within the coming weeks, just a few of them appeared optimistic.

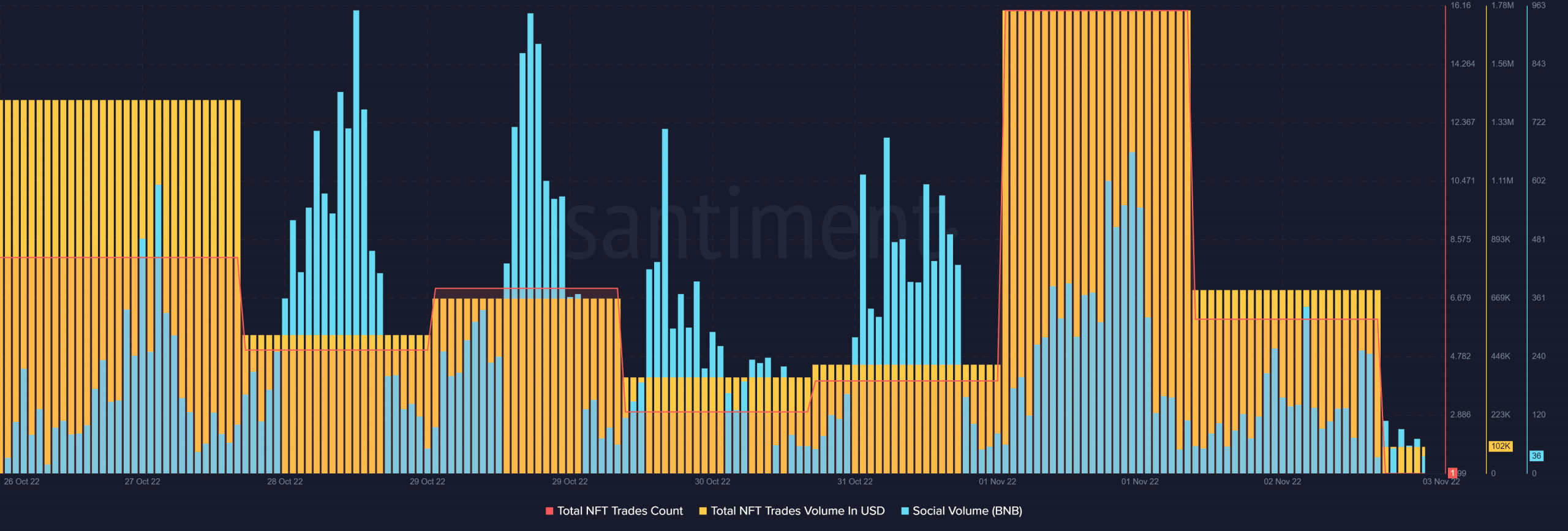

As an example, BNB’s NFT ecosystem managed to indicate progress. BNB’s complete NFT commerce depend and buying and selling quantity in USD went up lately, reflecting BNB’s recognition within the NFT group.

Furthermore, BNB’s recognition was additional established after its social quantity went up during the last week, with a slight downfall on 2 November.

Supply: Santiment