Blockchain

Though the cryptocurrency market has solely simply began to get better from the aftermath of the FTX collapse and the following disaster, the underlying expertise has remained robust, particularly the place blockchain video games are involved.

Certainly, the person exercise in Web3 video games throughout October and November has accounted for practically half of all blockchain exercise (42.67%) throughout 50 networks, in keeping with a brand new DappRadar report shared with Finbold on November 30.

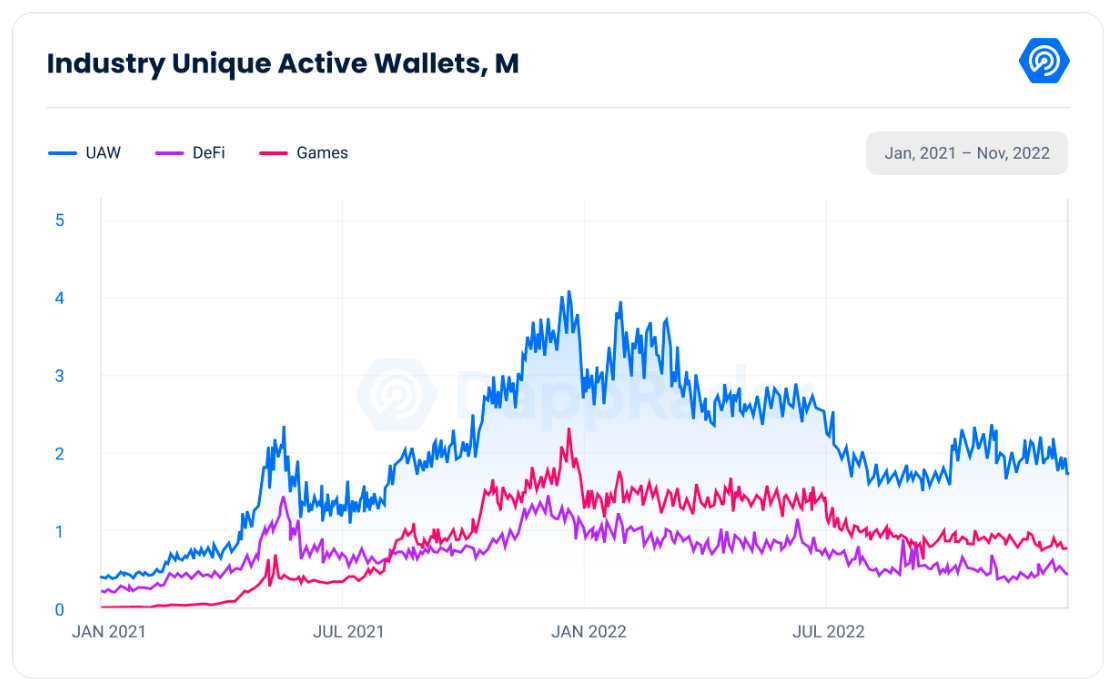

In November alone, a median of 800,875 distinctive energetic wallets (UAW) have been interacting with video games’ good contracts every day, recording a lower of solely 12% since September, throughout which the trade had 911,720 energetic wallets.

That stated, the present state nonetheless represents a decline as in comparison with the tip of 2021 and early 2022. The Solana (SOL) blockchain suffered essentially the most important blow of all of the related networks, because it noticed a whopping decline in distinctive pockets exercise of near 90% in the course of the month, with a median of two,326 day by day energetic wallets.

Funding continues on smaller scale

Regardless of the disaster, funds continued to pour into the blockchain video games and metaverse initiatives, which raised $534 million in October and November, with essentially the most investments directed towards constructing and sustaining infrastructure.

Thus far, the operating expectations of investing in blockchain video games for this yr stand at round $8.16 billion, a 104% enhance from the overall of $4 billion in 2021. The fourth quarter of 2022 recorded the bottom quantity of funding – $500 million.

As Finbold earlier reported, blockchain video games and metaverse initiatives raised $1.3 billion over the course of the third quarter of 2022, which represents a lower of 48% in comparison with Q2 2022.

In the meantime, the overall in-game buying and selling quantity of non-fungible tokens (NFTs) amounted to $55 million in October and November, with the favored blockchain card sport Gods Unchained topping the checklist by producing 64.25% of the overall buying and selling quantity, reaching $21.6 and $13.45 million within the two months, respectively.

Disclaimer: The content material on this web site shouldn’t be thought of funding recommendation. Investing is speculative. When investing, your capital is in danger.