To learn the information, you’ll assume the sky is falling.

Crypto corporations are freezing investor funds. Others are submitting for chapter. As the value of bitcoin has crashed, so has the remainder of the market, inflicting a domino impact that has unfold via a lot of the crypto ecosystem.

I’ve two good items of stories for you.

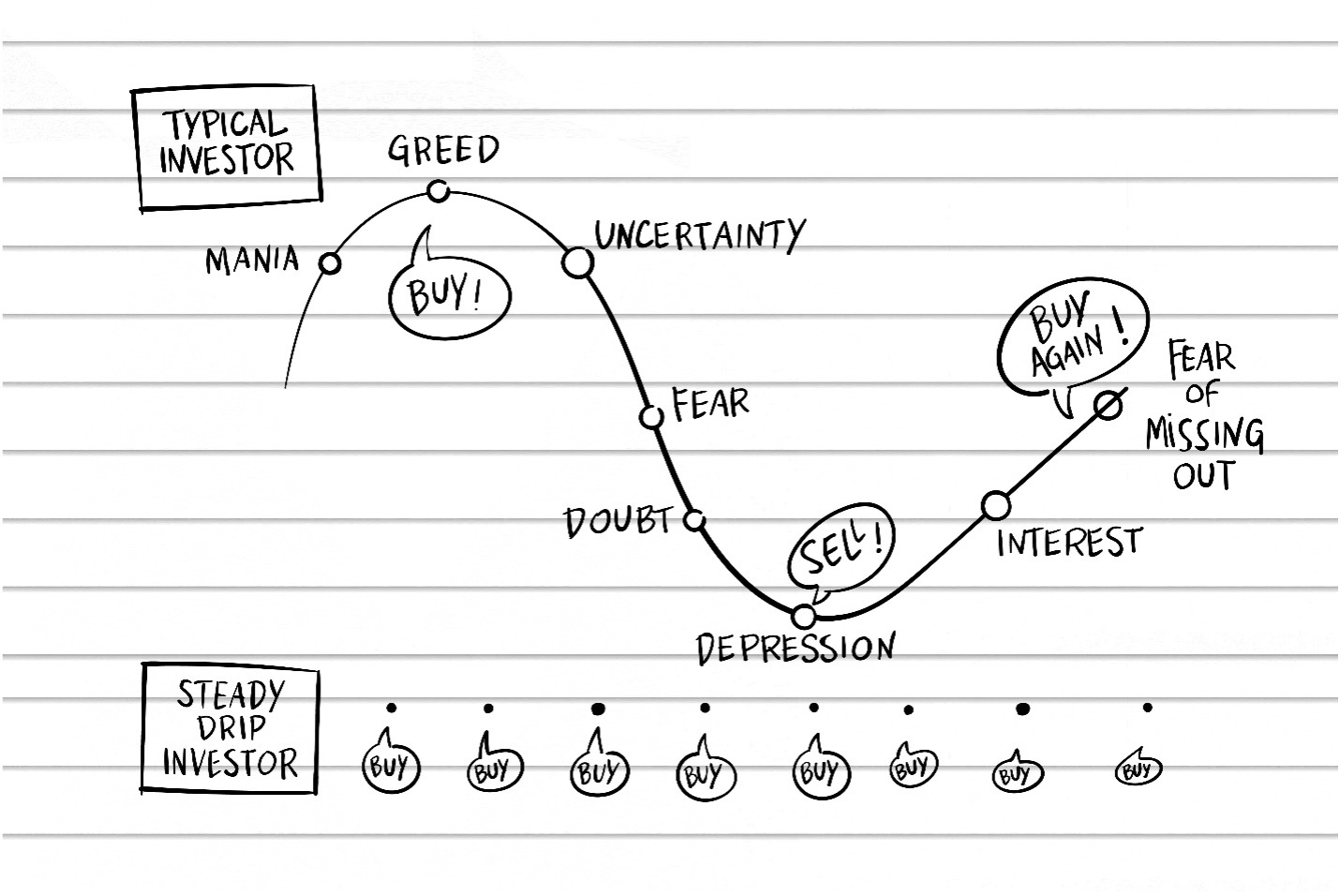

The primary is that buyers who’ve adopted our easy investing plan — a steady-drip month-to-month funding utilizing set-it-and-forget-it instruments like Coinbase and Betterment – are doing simply advantageous. These companies have stood the check of time, which is why we advocate them.

The second is that long-term buyers in our plan are nonetheless beating the inventory market. The Blockchain Believers, as we name ourselves, are beating the Non-Believers.

Rome wasn’t inbuilt a day, and nice fortunes aren’t constructed in a single day. Should you acquired into crypto investing over the past yr, it might have been dazzling to see your on the spot wealth, then dizzying to see it vanish in a matter of weeks. Keep the course.

In my guide Blockchain for Everybody, I inform my very own rags-to-riches-to-rags story of going “all in” on the primary huge bitcoin growth, then dropping it everywhere in the subsequent few months. I’m so glad I stayed the course, as a result of in time it turned rags-to-riches once more.

Immediately, actually, I’ve a Zen perspective concerning the market. The truth that bitcoin has misplaced 2/3 its worth in lower than a yr bothers me in no way, as a result of I’ve diversified (the nice lesson that I hope my guide will educate you).

In fact, I’m involved for these first-time buyers who’ve misplaced nice quantities of cash, however that’s why we repeatedly preach this easy plan, via each good occasions and unhealthy:

- Purchase bitcoin, plus a small variety of high-quality digital belongings

- Set them up on a steady-drip plan, investing the identical quantity every month

- Make them a part of an general portfolio (shares, bonds, as much as 10% crypto)

- Suppose long-term (5+ years)

- Full directions right here.

This technique appears silly within the growth occasions, when crypto companies are providing 120% rates of interest, 10x leverage, and free tokens. However within the powerful occasions, everybody needs that they had adopted it. Keep the course.

A few of you’ll have to promote your crypto to remain afloat throughout these lean occasions, and lots of of you’ll swear it off altogether. In my opinion, a greater method is to be taught out of your errors, promote what you have to, then put the remaining into this long-term investing plan.

I just lately confirmed you that our easy “Large Believers Portfolio” has even beat the crypto hedge fund trade, at a fraction of the fee. The crypto hedgies themselves would do higher to only comply with this plan, however then they couldn’t cost their exorbitant charges.

The Blockchain Believers Plan has one downside: it’s boring. However good investing often is. (Warren Buffett, keep in mind, made most of his cash on insurance coverage.) If you wish to gamble, go to Vegas. If you wish to construct long-term wealth to share with the world, keep the course.

Mind Hacks for the Investor Mindset

When the market is down, it’s tough to assume rationally. “Why purchase now, when the market could go even decrease?” your mind will let you know. “I’m not going to fall for that one once more.”

Listed below are a number of strategies you should use to maintain the Investor Mindset.

Consider crypto as software program corporations. If bitcoin was a software program firm, do you see it going out of enterprise anytime quickly? Or is there sufficient demand, and sufficient model, to hold it via the powerful occasions? (Bear in mind: tech corporations like Netflix and Amazon are staying the course, and even ramping up hiring, throughout this downturn.)

Consider crypto like cash. We could not like how cash markets are behaving, however few of us query the validity of cash itself. Should you consider the transfer towards crypto as a continued step within the evolution of cash — from cash and paper, to ones and zeroes — that makes it simpler to remain the course. It is arduous to see us going again to paper.

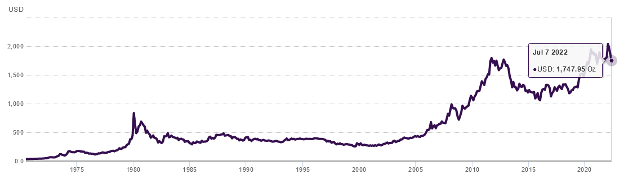

Consider crypto like gold. Consider this time just like the California Gold Rush, throughout which fortunes had been made – each in gold mining, and within the “picks and shovels” – that modified the character of the USA. (The value of gold was set by the federal government till 1968: this chart is an argument for HODLing if ever there was one.)

George Hearst: The OG Miner

Certainly one of my favourite rags-to-riches tales is that of George Hearst, a miner who left a legacy.

Hearst grew up throughout the early 1800s on a small farm in Missouri, with little entry to formal schooling, however he didn’t let that cease him. He cultivated an curiosity in mining, and commenced to show himself about gems and minerals, studying every little thing he might by visiting native mines.

After a number of years of studying the mining enterprise, he heard the information of gold in California (the crypto growth of its day). He did his homework, researching to see if the rumors had been true, then pulled collectively a celebration of 16 prospectors to make the lengthy, arduous journey to California, together with hundreds of others looking for fortune.

At first, they tried Sutter’s Mill, the place gold was first found, however they discovered it had been picked clear, and the corporate virtually didn’t make it via their first winter. Undaunted, they moved to a different website the next yr, however that additionally got here up empty.

Hearst pivoted his mining technique from gold to quartz, drawing on his in depth information of minerals. He additionally diversified into prospecting (i.e., shopping for and leasing parcels of land that probably contained precious mines). He opened a normal retailer to promote the “picks and shovels.” He raised livestock. These further income streams helped him trip out the powerful occasions.

It was almost ten years earlier than his endurance paid off. He acquired a tip on a silver mine in present-day Nevada. Once more, he did cautious analysis to verify the chance was a very good one, then hurried down to purchase a 16% curiosity within the mine.

It was almost ten years earlier than his endurance paid off. He acquired a tip on a silver mine in present-day Nevada. Once more, he did cautious analysis to verify the chance was a very good one, then hurried down to purchase a 16% curiosity within the mine.

That winter, Hearst and his companions mined 38 tons of high-grade silver ore.

From there, he had sufficient capital to repeat the method, shopping for partnerships in high-potential mines, investing within the infrastructure to maintain them worthwhile and safe, and directing his newfound wealth into enterprises to learn his shareholders and society.

The teachings we are able to take away from the George Hearst story are:

- Do your analysis; be taught every little thing you possibly can.

- Diversify your income streams, and your investments.

- Persistence and persistence repay.

By studying this, you’re doing all of your analysis. By following the Blockchain Believers plan, you’re diversifying your investments. The ultimate step is straightforward: simply keep the course.

We’re on this for the lengthy haul. Get wealthy slowly. And through down occasions, you may even take into account doubling down. The mine is prepared and ready.