Key Takeaways

- Bitcoin has risen by almost 13% over the previous week.

- A spike in community progress and open curiosity level to additional positive factors.

- Breaching the $42,100 resistance degree would validate the optimistic outlook.

Share this text

A number of on-chain metrics recommend that Bitcoin is gaining energy for a major bullish impulse. Nonetheless, the highest crypto has an enormous hurdle to beat first.

Bitcoin On-Chain Metrics Decide Up

Bitcoin appears to be like prefer it’s gaining energy once more.

The main cryptocurrency has loved a powerful uptrend over the previous week. It’s gained almost 5,000 factors in market worth, rising from a low of $37,600 on Mar. 14 to a excessive of $42,400 on Mar. 19.

Though costs have retraced by roughly 5% within the final 48 hours, Bitcoin’s uptrend seems to be gaining energy.

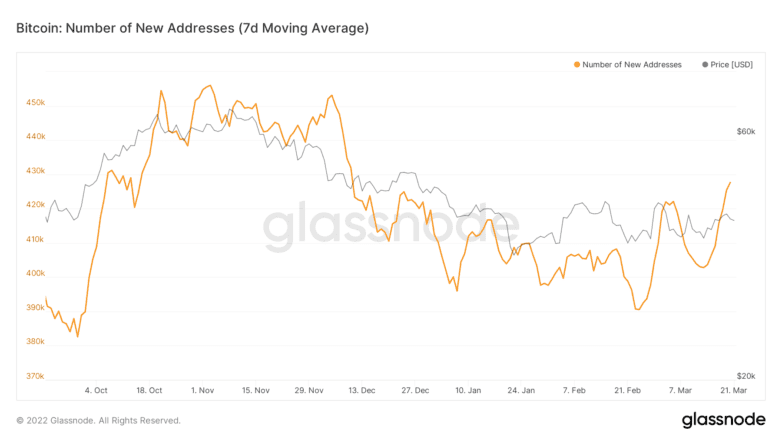

The variety of new addresses becoming a member of the Bitcoin community has considerably elevated since Feb. 21, making a sequence of upper highs and better lows. The uptrend on this on-chain metric suggests rising curiosity from sidelined traders who seem like re-entering the market.

Greater than 480,000 Bitcoin addresses had been created in Mar. 17 alone, which is a robust constructive sign for additional upward worth motion.

Community progress is usually thought-about one of the vital correct worth predictors for cryptocurrencies. A gradual uptrend within the variety of new addresses created on a given blockchain typically results in rising costs over time.

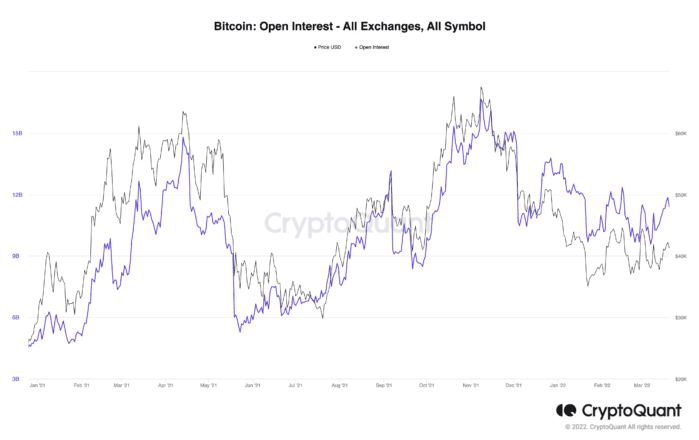

The same uptrend might be seen within the futures markets, the place the variety of open positions, together with each lengthy and brief positions, has been steadily rising since Mar. 7. As open curiosity will increase, it signifies extra liquidity, volatility, and a spotlight is coming into the derivatives markets. A steady improve in open curiosity to surpass 12.36 million may assist Bitcoin’s latest worth improve.

Nonetheless, transaction historical past exhibits that Bitcoin has one substantial resistance wall to interrupt to have the ability to advance additional.

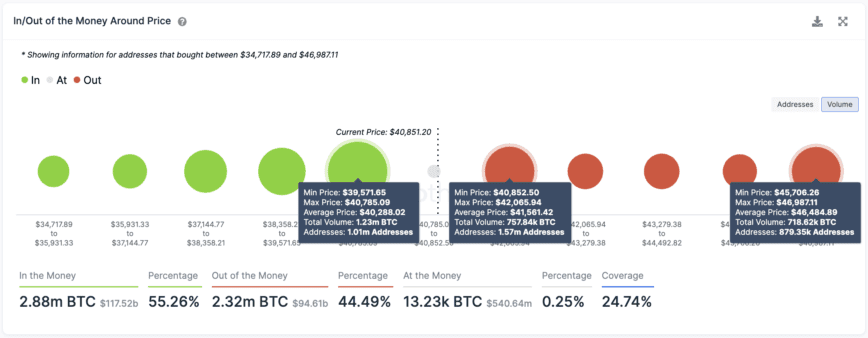

IntoTheBlock’s In/Out of the Cash Round Value mannequin reveals that 1.57 million addresses have beforehand bought almost 760,000 BTC between $40,900 and $42,100. A decisive each day candlestick shut above this hurdle may give Bitcoin the energy to interrupt the subsequent crucial barrier, which is sitting at $46,500.

The IOMAP additionally exhibits that the top-ranked cryptocurrency is holding above secure assist as over 1 million addresses have beforehand bought 1.23 million BTC at a mean worth of $40,300. So long as Bitcoin stays buying and selling above this foothold, it has an opportunity at advancing additional. Nonetheless, failing to take action may lead to a downswing to $37,500.

Disclosure: On the time of writing, the writer of this piece owned BTC and ETH.