Mining

Bitcoin miners might catch a break in per week or so, on or round Dec. 5, 2022, as the following problem retarget is anticipated to see a considerably giant discount. Estimates present the following problem retarget might drop wherever between 6.13% and 10% decrease. Presently, the issue change appears to be like as if it might be 2022’s largest discount if it surpasses the 5.01% decline recorded on July 21.

Bitcoin’s Subsequent Issue Retarget Is Anticipated to Lower, Knowledge Suggests a Notable Drop within the Playing cards

When the final Bitcoin problem change occurred on Nov. 20, 2022, at block top 764,064, it elevated by a mere 0.51% that day. The rise did, nevertheless, propel the community’s problem to its lifetime excessive of 36.95 trillion. Since then, throughout the previous week, the community’s common hashrate has been round 249.1 exahash per second (EH/s).

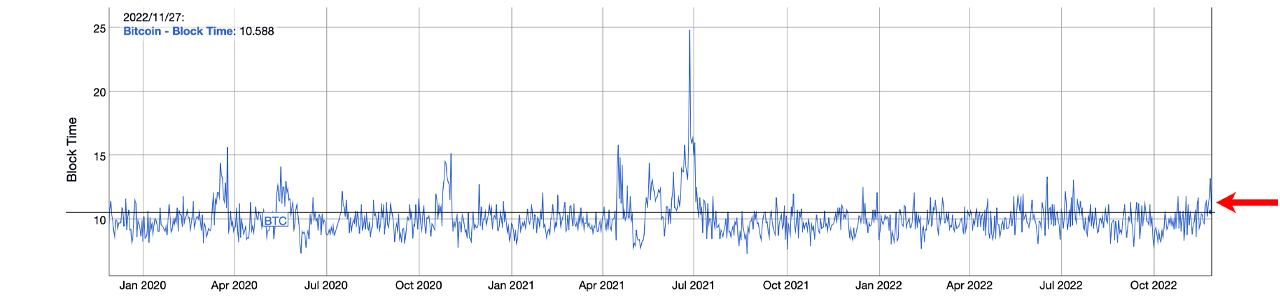

Block instances on Nov. 28, 2022, through bitinfocharts.com.

The common Bitcoin community block time has been slower than normal as properly, operating between 10.2 minutes to 11.06 minutes on Monday night (ET). The block intervals have been so much greater because the problem change on Nov. 20, as previous to that day, block instances had been on common lower than ten minutes since Sept. 29.

Issue retarget information on Nov. 28, 2022, through bitcoin.clarkmoody.com/dashboard/.

The longer block instances counsel the two,016 blocks mined previous to the following retarget shall be slower than the typical of two weeks. On the time of writing, statistics point out that the retarget might drop as little as 10% on Dec. 5, and metrics from Btc.com point out the drop is estimated to be round 6.13%.

Issue retarget information on Nov. 28, 2022, through Btc.com.

Each estimates would outpace the most important problem contraction the Bitcoin community has seen all yr with the most important lower to date recorded on July 21, which was roughly -5.01%. Miners are at present coping with the very best problem ever recorded, and bitcoin (BTC) costs are 76% decrease than the all-time excessive ($69K) recorded on Nov. 10, 2021.

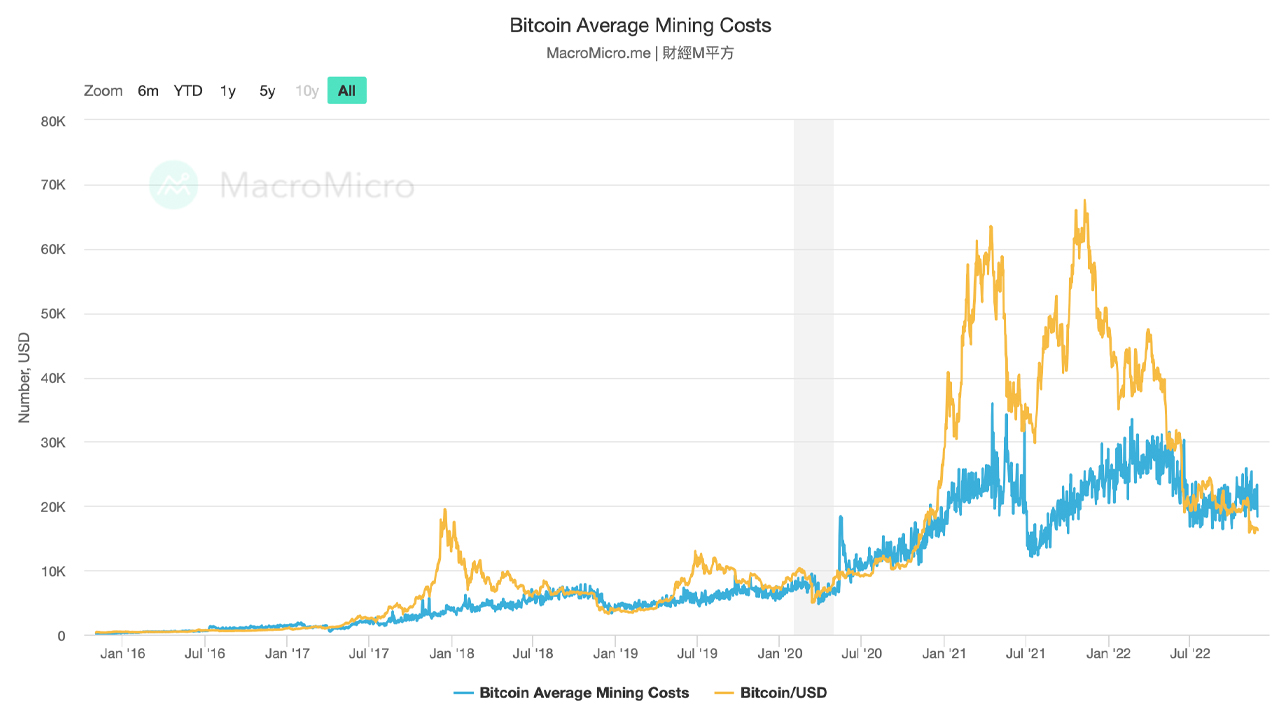

Bitcoin common mining prices on Nov. 28, 2022, through macromicro.me.

Mining insights from braiins.com and macromicro.me present BTC’s price of manufacturing ($18,360) is above the present spot market worth ($16,250). Moreover, market intelligence from Glassnode signifies that bitcoin miners are tapping into their treasuries.

The onchain analytics agency Glassnode tweeted about how the bitcoin mining sector and business is “below immense monetary stress,” whereas saying a mining report the agency revealed with Cryptoslate.

“What we discover is that [bitcoin] miners are distributing round 135% of mined cash,” Glassnode mentioned. “This implies miners are dipping into their 78K [bitcoin] robust treasuries.” In the course of the latter half of the yr, publicly-listed mining operations have disclosed that they’ve been promoting BTC to bolster money reserves and pay down debt.

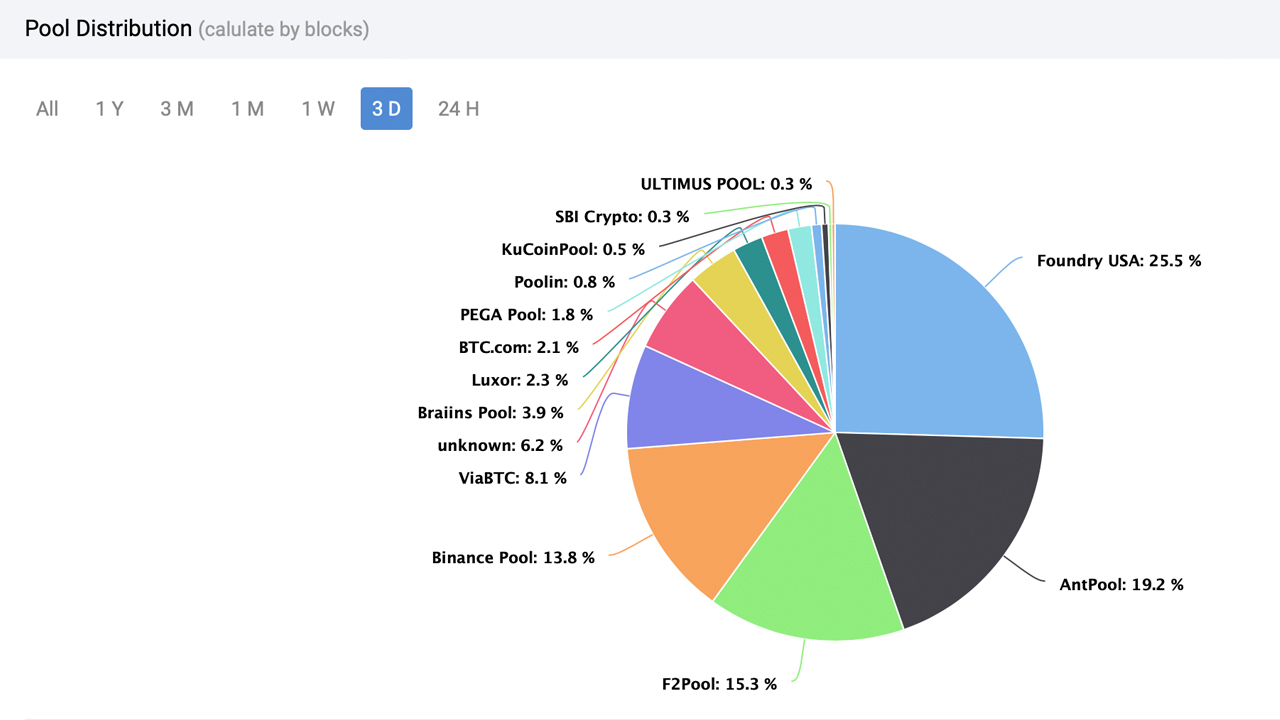

On the time of writing at 7:30 p.m. (ET), Foundry USA’s three-day hashrate is round 60.66 EH/s, which represents 25.45% of the worldwide hashrate. In three days, the most important mining pool Foundry mined 98 BTC blocks out of 385 found by all of the miners.

Three-day mining pool distribution on Nov. 28, 2022, through Btc.com.

Foundry’s hashrate is adopted by Antpool, F2pool, Binance Pool, and Viabtc respectively. Between all 5 swimming pools over the past three days, the highest 5 mining swimming pools had been capable of uncover 315 blocks out of the 385 complete.