PlanB, the notorious creator of the stock-to-flow (S2F) mannequin for Bitcoin, has seemingly deserted the HODL technique in favor of “quant investing” by means of ByBit.

In a tweet Friday, he introduced a “copy my commerce” partnership with ByBit that “outperforms purchase&maintain 100x.” An article detailing the strategy was launched Monday through PlanB’s web site.

The article on quant investing is sort of prepared. It features a buying and selling rule that outperforms purchase&maintain 100x. You’ll be able to copy my commerce right here (signup + deposit): https://t.co/8OI2agrLDD pic.twitter.com/jgW8AmCjlc

— PlanB (@100trillionUSD) August 5, 2022

PlanB and the Inventory-to-Movement mannequin

The S2F creator has amassed a big following on-line after he created the methodology by which many buyers speculate on the long run worth of Bitcoin.

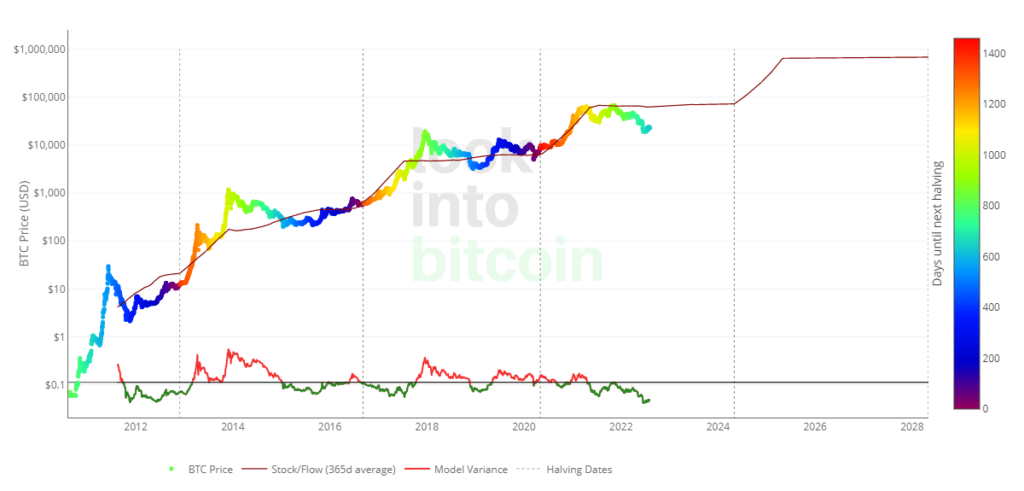

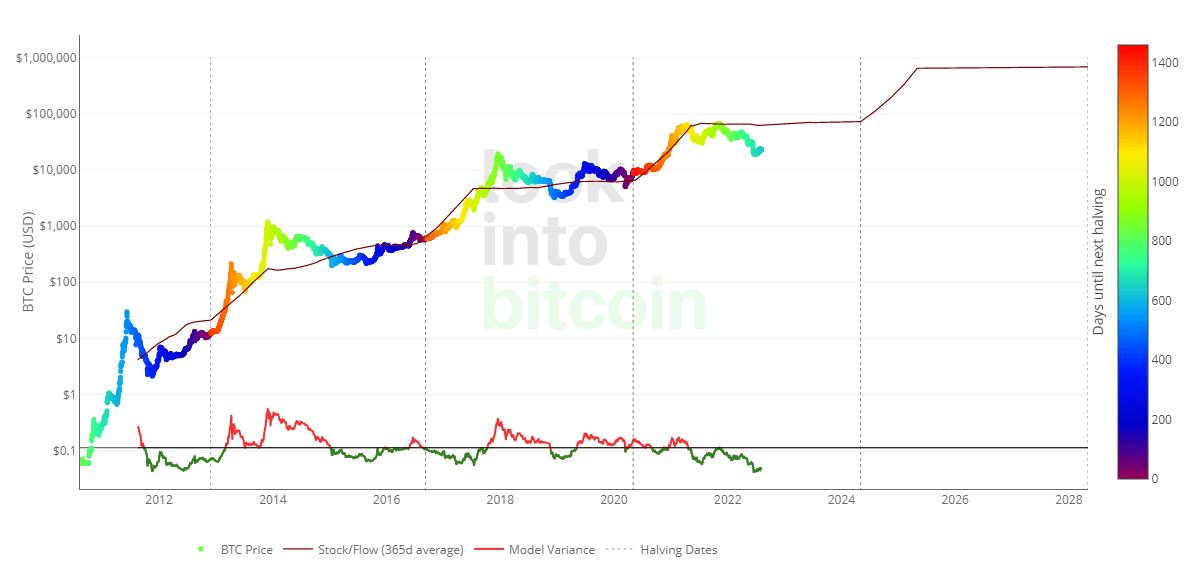

The mannequin is predicated on the fastened provide of Bitcoin and its predefined launch schedule tied to Bitcoin halvings. In line with the stock-to-flow mannequin, the value of Bitcoin will attain near $1 million by 2026.

Traditionally, the S2F mannequin has been surprisingly correct; nonetheless, throughout the current bull run, there was an elevated variety of crypto natives who’ve renounced the idea’s legitimacy.

Way back to June 2021, Ethereum Founder Vitalik Buterin described those that consider within the mannequin as deserving “all of the mockery they get.”

Inventory-to-flow is de facto not wanting good now.

I do know it is rude to brag and all that, however I feel monetary fashions that give folks a false sense of certainty and predestination that number-will-go-up are dangerous and deserve all of the mockery they get. https://t.co/hOzHjVb1oq pic.twitter.com/glMKQDfSbU

— vitalik.eth (@VitalikButerin) June 21, 2022

The methodology affirms that purchasing and holding Bitcoin gives the most secure methodology to spend money on Bitcoin as a result of assumption that it’s going to proceed to comply with the expected worth in a given timeframe. The worth can deviate from the mannequin over a set interval, however it would ultimately return to the stock-to-flow line as a result of fastened provide and distribution of cash.

Criticism of S2F has grown throughout the bear market as the value of Bitcoin is now properly under the mannequin’s prediction and has been since December 2021.

Quant buying and selling and 100x returns

PlanB seems to have taken the chance to deviate from the “purchase&maintain” philosophy to advertise a brand new buying and selling system together with ByBit. His technique allegedly will beat a HODL strategy by “100x” and is out there to repeat through ByBit now that his new article on “quant investing” has been launched.

He claims he’s receiving “the identical reactions as after I revealed the S2F article in March 2019.” Nonetheless, a lot of the criticism comes from these questioning the transfer away from HODLing and in direction of copy buying and selling, whereby PlanB will certainly obtain a kickback from ByBit. The copy buying and selling web page of ByBit’s web site states that principal merchants can obtain “as much as 30% fee and 500 USDT in bonuses.”

Humorous to see the identical reactions as after I revealed S2F article in Mar2019 when BTC<$4K and I used to be calling for $55K. “scammer” “demand is just not within the mannequin” “$55K unimaginable”.

Now folks can’t think about 100x B&H outperformance in 10y and hate exchanges. Let’s watch for the article. https://t.co/tjDpqnA2Nx— PlanB (@100trillionUSD) August 6, 2022

The quant buying and selling technique is printed in full in PlanB’s article entitled Quant Investing 101.” The core philosophy seems to be primarily based on buying and selling the RSI ranges of Bitcoin backtested over the previous ten years.

The buying and selling rule PlanB is utilizing for the technique is detailed under.

“IF (RSI was above 90% final six months AND drops under 65%) THEN promote,

IF (RSI was under 50% final six months AND jumps +2% from the low) THEN purchase, ELSE maintain.”

For additional particulars on how ITM choices are used to optimize returns, see the total article on PlanB’s web site.

Accountable methods for “influencers.”

Hodlonaut, the writer of the Bitcoin Zine, Citadel21, tweeted their dismay on the idea of PlanB partnering with what they name a “leverage shitcoin on line casino” and reneging on “purchase and maintain.”

Wait, am I understanding this accurately? PlanB is telling folks to enroll with a leverage shitcoin on line casino to allow them to copy his trades and get 100x extra btc than if they simply purchase and maintain?

I have to be misunderstanding one thing, proper?

Proper?

— hodlonaut ?⚡? ? (@hodlonaut) August 7, 2022

Cory Kilppsten of Swan Bitcoin, one of many first to determine points at Celsius, went so far as to name PlanB a “scammer.”

PlanBrandolini @100trillionusd is such a charlatan scumbag. What an absolute joke. pic.twitter.com/9sbMgakoQ1

— Cory Klippsten (@coryklippsten) August 6, 2022

Crypto dealer, Eric Wall, prolonged the sentiment that PlanB is now not related throughout the business, claiming “Bitcoin maxis didn’t defend this charlatan.”

Fortunately Bitcoin maxis didn’t defend this charlatan… Saifedean, Adam Again, Caitlin Lengthy, Vijay Boyapati, Pierre Rochard, Bitstein, Preston Pysh & a bunch of others of the Swan-advisors, plus nearly all Bitcoin podcasts have been an irrelevant minority within the grand scheme of issues

— Eric Wall (@ercwl) August 7, 2022

Additional, PlanB’s article on quant investing raises an attention-grabbing downside because it states that

“nothing on this article is monetary recommendation. All content material is for informational and academic functions solely.”

Nonetheless, the article has been identified as a precursor to his copy buying and selling technique on ByBit. So, whereas PlanB could also be stating that he’s not giving funding recommendation, he’s then selling customers to comply with this technique by copying his “quant investing” trades.

PlanB claims to offer the data on his trades totally free on Twitter, permitting for a “DIY” choice. Additional, he confirms that he’s buying and selling solely 10% of his portfolio “primarily due to credit score danger.”