On-chain knowledge reveals indicators aren’t trying good for Bitcoin because the NVT ratio is indicating that the crypto remains to be overvalued proper now.

Bitcoin NVT Ratio Continues To Be At Excessive Values

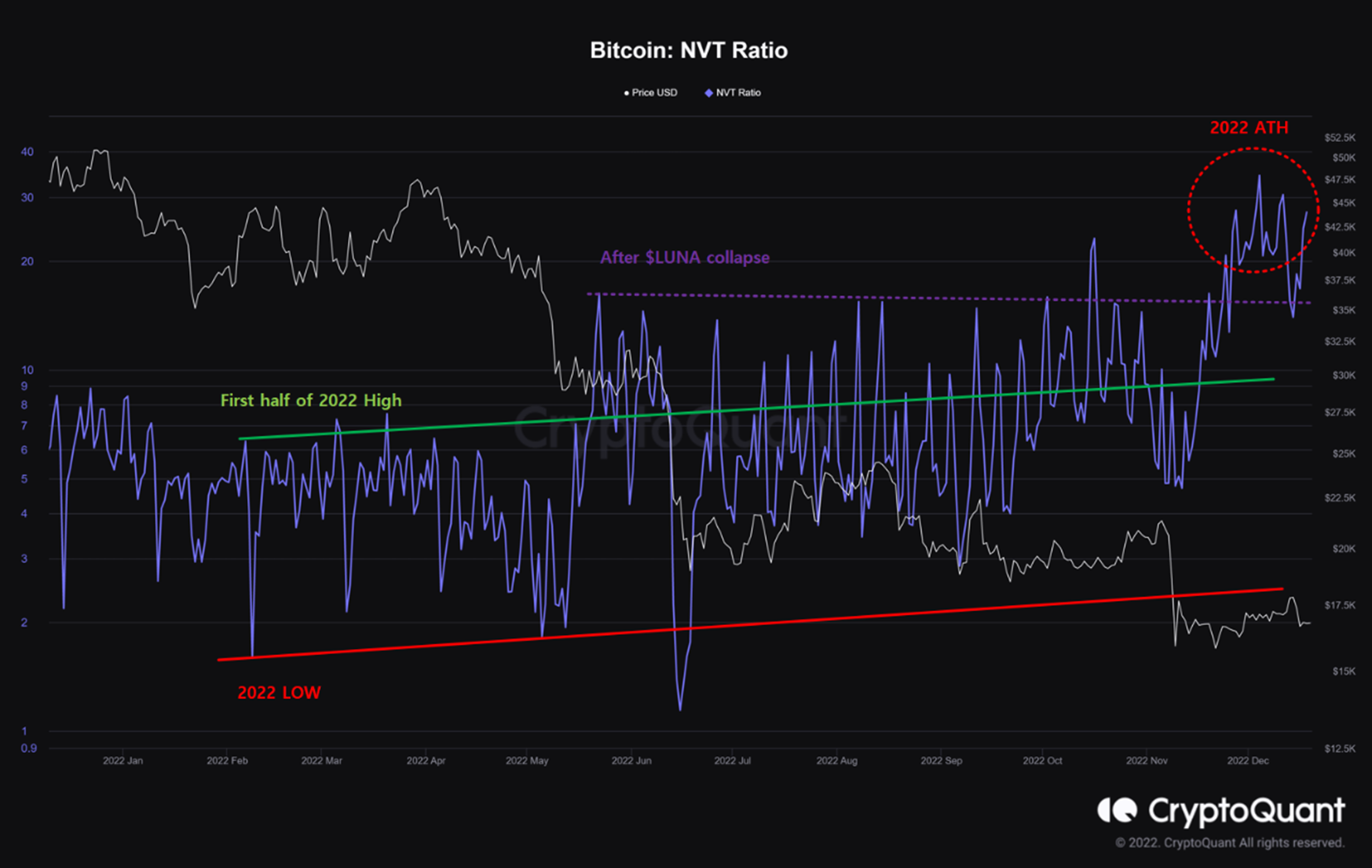

As identified by an analyst in a CryptoQuant post, BTC is presently overvalued from an on-chain perspective. The “Community Worth to Transactions (NVT) ratio” is an indicator that measures the ratio between the market cap of Bitcoin and its transaction quantity (each in USD).

This ratio judges whether or not the present worth of Bitcoin (that’s, the market cap) is truthful or not, by evaluating it towards the community’s capability to transact cash proper now (the transaction quantity). When the metric has a excessive worth, it means the value of BTC is excessive in comparison with the amount, and thus the coin may very well be inside a bubble in the meanwhile. Alternatively, low values recommend BTC could also be undervalued because the chain has a excessive capability to transact cash (compared to the market cap) proper now.

Here’s a chart that reveals the development within the Bitcoin NVT ratio over the previous yr:

Appears to be like just like the metric's worth has been fairly excessive throughout latest weeks | Supply: CryptoQuant

Because the above graph highlights, the Bitcoin NVT ratio jumped up following the LUNA collapse again in Might of this yr and has since largely stayed at related or larger ranges. Because of this regardless of the value observing a number of crashes within the interval, the coin’s worth nonetheless grew to become more and more overvalued as volumes throughout the market sharply dropped.

Even after the FTX crash, which has delivered one other stable blow to the crypto’s market cap, the metric has solely climbed larger because it has registered a brand new excessive for the yr lately. BTC has solely been getting increasingly overpriced because the bear has gotten deeper, suggesting the dire state of the market by way of buying and selling volumes.

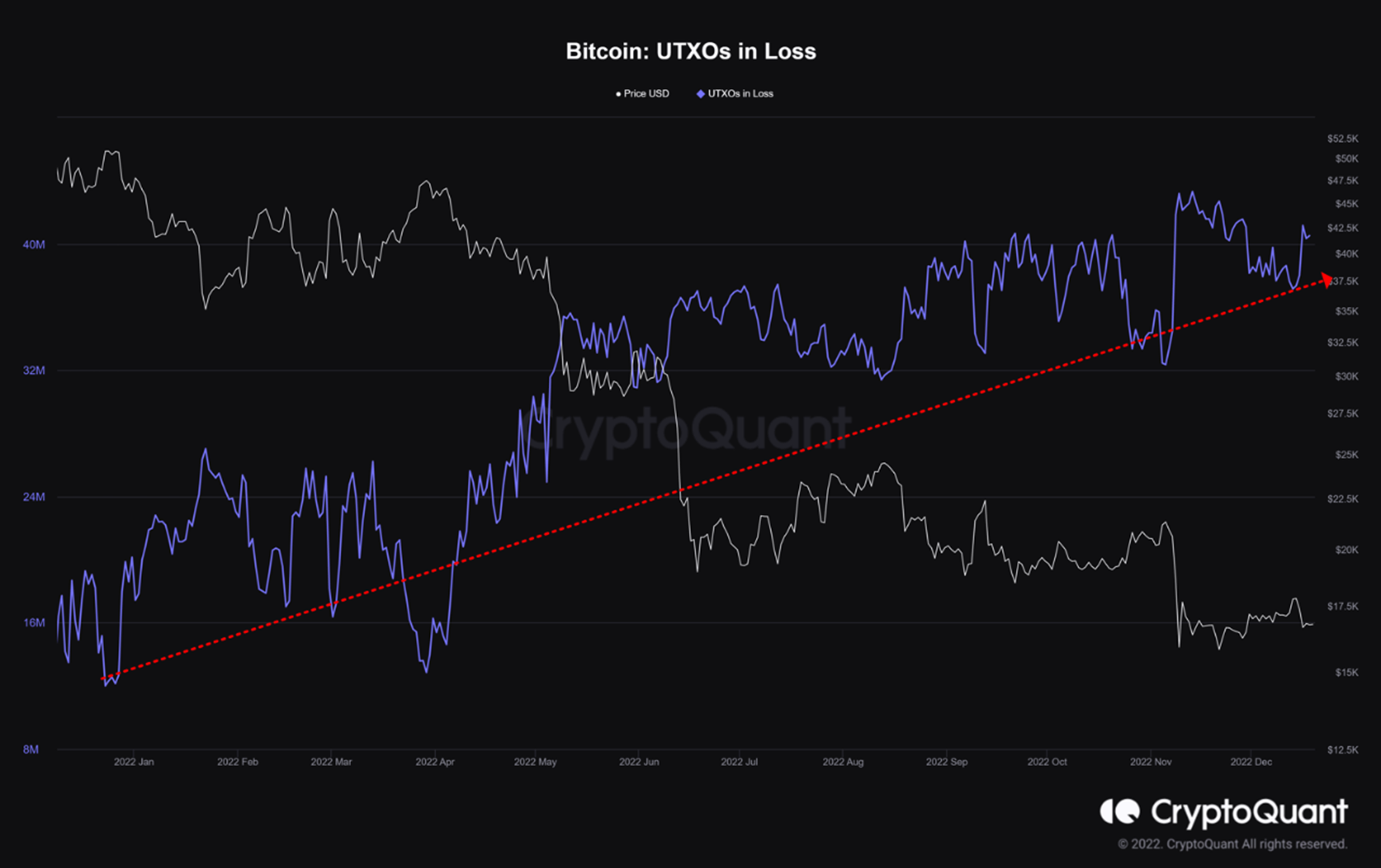

The quant additionally notes that the variety of UTXOs in loss (principally the quantity of wallets/traders in loss), has been persistently rising all through the bear.

The metric continues to trip on a continuing uptrend | Supply: CryptoQuant

Each these indicators are actually not within the favor of Bitcoin and will indicate there’s additional ache forward for traders. “A extra prolonged bear market may very well be seen as a possible threat that might add promoting stress,” explains the analyst.

BTC Worth

On the time of writing, Bitcoin is buying and selling round $16,800, down 5% within the final week.

The value motion within the asset appears to have been stale in the previous few days | Supply: BTCUSD on TradingView

Featured picture from Maxim Hopman on Unsplash.com, charts from TradingView.com, CryptoQuant.com