As dangerous information concerning FTX’s chapter preserve showing in crypto (and mainstream) media, buyers have rushed to wager in opposition to bitcoin and the crypto market, with bear positions hitting two-year highs.

In accordance with the “Digital Asset Fund Flows Weekly Report” from European cryptocurrency funding agency CoinShares, a bearish sentiment took maintain of the crypto market over the past week to such an extent that brief positions accounted for 75% of all trades out there.

Which means the overwhelming majority of institutional buyers are betting closely on the autumn of BTC and different cryptocurrencies, reminiscent of ETH, which registered the best quantity of shorts ($14M).

1/ What’s the crypto market sentiment this week?

A deeply damaging one with the biggest inflows into short-investments on document.Our Head of Analysis @jbutterfill shares his newest insights.

All the information will be present in our weekly report:https://t.co/mCc3kw8twn pic.twitter.com/7Z7HMf8gi9— CoinShares ?? (@CoinSharesCo) November 21, 2022

Bitcoin (BTC) Shorts Elevated by Extra Than 10%

James Butterfill, Head of Analysis at CoinShares, stated that final week’s BTC brief inflows reached $18.4M, representing a rise of greater than 10% week on week.

The distinction between lengthy and brief BTC positions was $4.3M, which in line with the report, reveals that there’s nonetheless numerous uncertainty out there about the way forward for the BTC value.

When it comes to whole belongings below administration (AuM), the report discovered that the entire of BTC shorts is over $173 million, very near the document of $186 million.

The FTX Collapse Unfold Panic Amongst Traders

The CoinShares report argues that the rise briefly inflows is especially because of the attainable “fallout from the FTX collapse.” In 2022, a handful of huge gamers have died on the hand of the brutal crypto market. Celsius, 3AC, Terra, and FTX are a few of the most notorious examples.

All this rising concern on the a part of buyers will be mirrored within the withdrawal of greater than $6 million from completely different altcoins reminiscent of Solana, XRP, Polygon, and BNB.

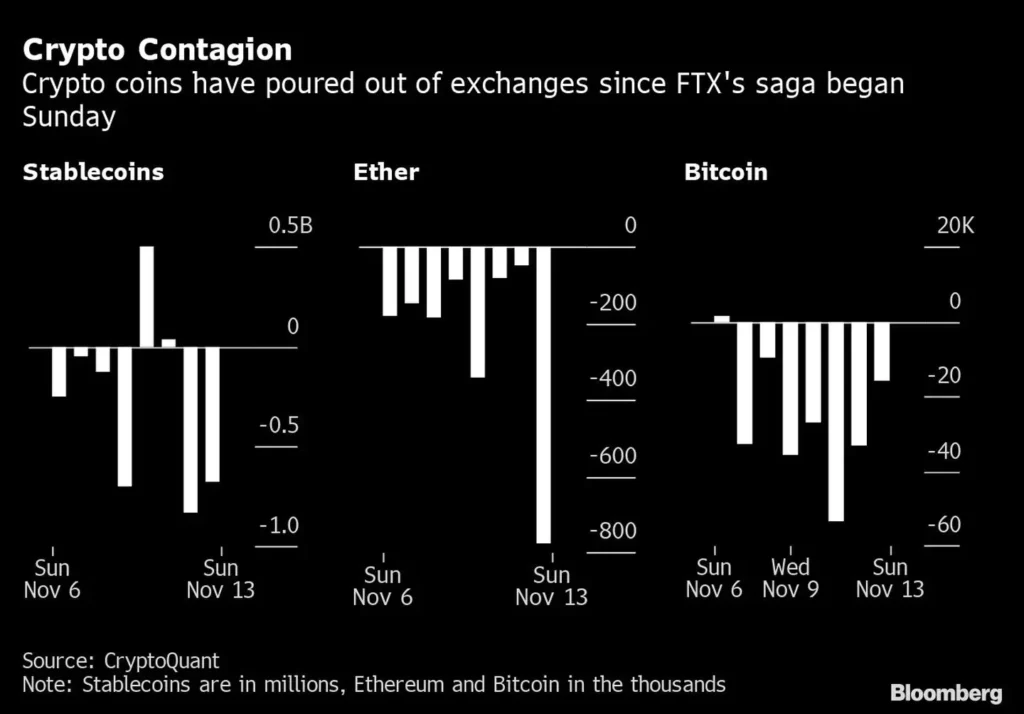

In accordance with Bloomberg, between November 6 and 13, a number of crypto funds withdrew greater than $3.7 billion in Bitcoin (BTC) and $2.5 billion in Ethereum (ETH) from numerous exchanges following the panic brought on by the FTX crash.

As well as, over $2 billion in altcoins had been withdrawn throughout the identical interval, in line with stories from CryptoQuant, a crypto analytics agency that tracks knowledge from main crypto exchanges.

The market’s actions observe what appears to be the market’s sentiment. The Crypto Fear & Greed Index reveals that proper now, merchants are in a state of “excessive concern,” touching 22 factors on a scale that goes from 0 to 100, with zero being a theoretical stage of absolute panic the place no person is prepared to put money into an asset and 100 is a stage of absolute greed the place no person is prepared to promote its belongings.

Binance Free $100 (Unique): Use this hyperlink to register and obtain $100 free and 10% off charges on Binance Futures first month (phrases).

PrimeXBT Particular Provide: Use this hyperlink to register & enter POTATO50 code to obtain as much as $7,000 in your deposits.