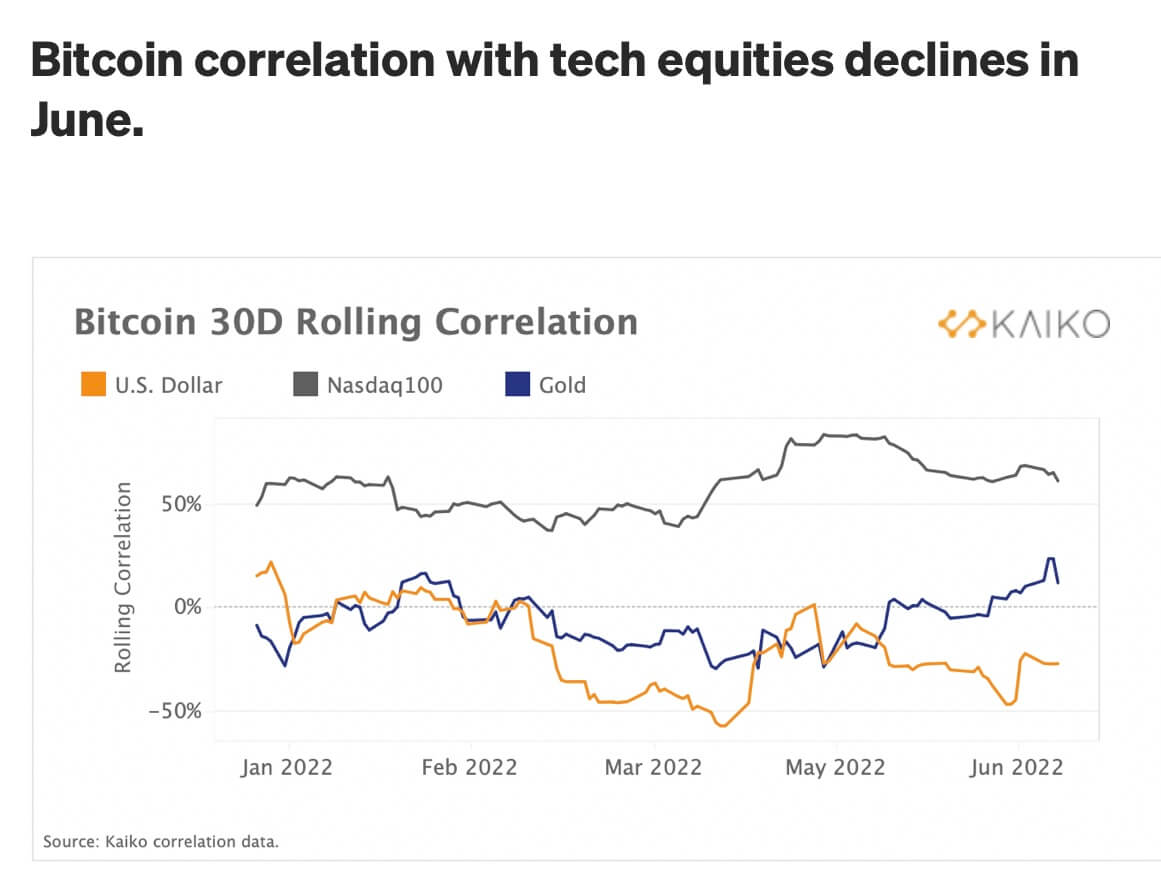

The correlation between Bitcoin (BTC) and Nasdaq 100 lowered this month after reaching a file of .8 final month, based on a brand new Kaiko report.

Whereas Nasdaq closed the week on a constructive word of over 7%, Bitcoin continues to commerce within the $21,000 vary. However Bitcoin stays largely uncorrelated to the asset it has been in contrast with on a number of events, gold.

The correlation between Bitcoin and the valuable steel asset is at over 50% presently. However its correlation with the US {dollars} has been alternating all year long between 0 and a destructive .6.

Bitcoin and Nasdaq 100 have had their efficiency correlating for a while as a result of elevated curiosity of institutional buyers in crypto. However the latest hike in pursuits fee and fears of recessions seems to have affected Bitcoin greater than tech equities.

Bitcoin sell-off was spot pushed

In keeping with Kaiko, on-chain knowledge reveals that the present crypto sell-off was attributable to the spot merchants quite than the derivatives market.

Per the report, Ethereum (ETH) and Bitcoin buying and selling quantity have declined because the begin of the 12 months. After peaking in Might 2021, volatility additionally began decreasing in September 2021.

However the weekly buying and selling quantity and worth motion have been comparatively steady and on the identical ranges since then.

In keeping with the report, this reveals that there was a calculated effort by buyers to de-risk their place. Thus, the decline shouldn’t be resulting from a futures market sell-off.

Moreover, the funding charges on Bitcoin’s derivatives markets present that the futures market wasn’t liable for the sell-off. The funding charges on BTC perpetual futures have maintained a steady development regardless of the sharp worth decline.

Funding charges are at present at 0.005% above impartial. If the futures market have been liable for the sell-off, it will be destructive, just like Terra’s failure final month.