A Searching for Alpha evaluation reveals that Bitcoin costs should not solely greater than triple to $100,000 however needs to be sustained above this stage for miners to stay worthwhile in 2024 and past.

Contemplating what lies forward, mining farms, particularly these whose shares are listed on bourses in the USA, together with Riot and Marathon, are at a important juncture. There may very well be a shake-up except there are modifications in hash fee, issue, or electrical energy prices in mild of scarce BTC.

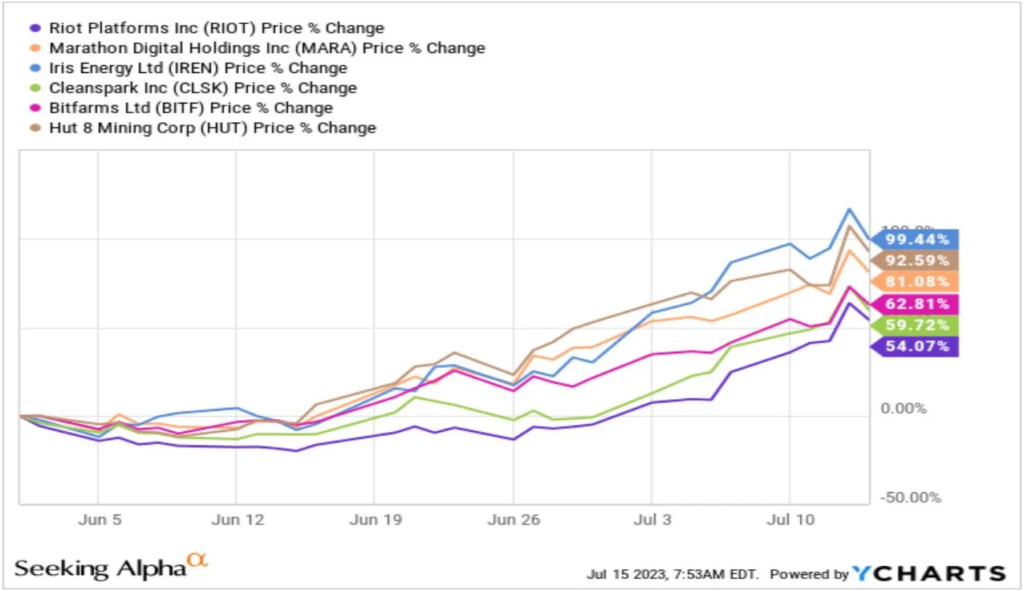

Uniquely in 2023, Bitcoin mining shares have been superior. Whereas Bitcoin’s volatility has been tapering and costs pinned under $31,800 registered in late H1 2023, shares of Riot, Marathon Digital, and different well-liked mining farms have greater than doubled in the previous few months.

You may also like: Marathon mined 21% much less bitcoin in June partly because of dangerous climate in Texas

Often, the efficiency of crypto mining shares is intently linked to the efficiency of Bitcoin within the secondary market. When Bitcoin costs rise, crypto mining inventory costs are inclined to soar and vice versa. Nevertheless, this development has been damaged because of the divergence between crypto miner shares and BTC costs within the higher a part of 2023.

Efficiency of crypto miner shares: Searching for Alpha

In mild of the upcoming halving occasion the place miners’ rewards shall be halved, questions are being floated on how a lot the BTC value must rise for miners to be worthwhile.

The report says BTC costs should surge above $100,000 for these miners to remain in enterprise long-term. This 6-digit value prediction components within the crypto mining dynamics and the way these farms function.

Particularly, the report shared on Reddit highlights the dangers of Bitcoin mining because it reduces block rewards in half, considerably impacting miners’ income.

Assuming costs stay at spot charges, mining firms like Riot Platforms may need to situation new shares to boost cash and safe operational funding. With the brand new shares, there shall be dilution, forcing share costs down.

Consultants predict that the hash fee, a measure of Bitcoin’s computing energy, might additionally fall by as a lot as 30% halving. Analysts contend that although the community manages its provide economics with halving, miners should spend their enter to verify the identical block; a transfer that may heap much more strain on prime miners and farms.

Learn extra: Riot Platforms expands operations with 33,000 new miners