Bitcoin value lastly hit the $25K psychological stage in the present day, however fails to construct momentum and fell beneath $23.7K. The sudden fall got here after U.S. Federal Reserve officers’ hawkish feedback.

Stronger-than-expected US financial information and hawkish remarks from Federal Reserve officers together with Loretta Mester and James Bullard suggesting one other 50 bps price hike brought about the U.S. Greenback Index (DXY) to leap above 104.50 on Friday, hitting its highest ranges in six weeks.

Nevertheless, crypto analysts are nonetheless bullish on Bitcoin value to hit at the least $27K. Widespread analyst Michael van de Poppe predicted a fall to the essential assist of $22.8K after which making a continuation in the direction of $27K.

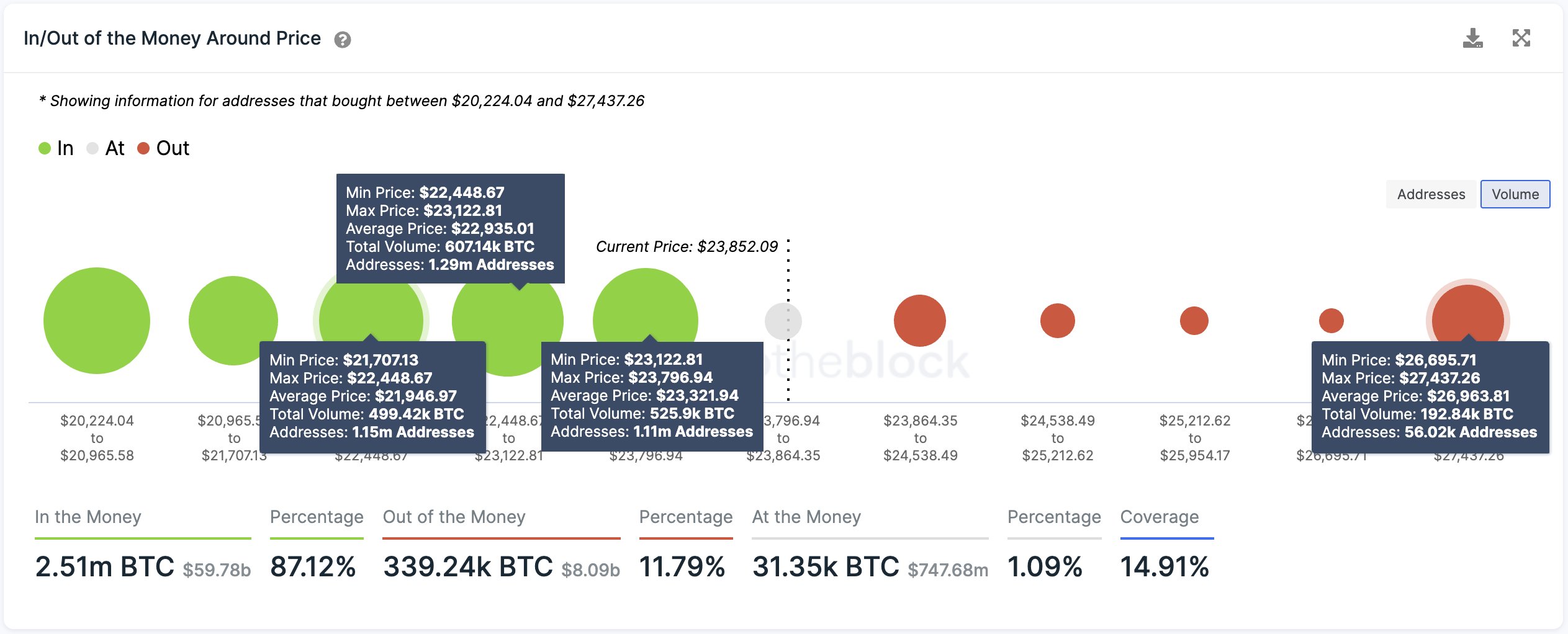

Furthermore, analyst Ali Martinez‘s evaluation additionally supported the bullish continuation in Bitcoin value. He shared that IntoTheBlock’s In-Out Cash Across the Present Worth (IOMAP) information reveals a significant assist barrier between $21,700 and $23,700, the place 1.60 million addresses purchased over 1.32 million BTC.

He predicts Bitcoin value to hit at the least the $27K resistance stage if this demand wall can maintain the value to fall decrease.

In the meantime, the on-chain information Williams %R (60-day interval) for BTC: Estimated Leverage Ratio signifies Bitcoin nonetheless has room for an extra bullish momentum to $27,100. There’s a niche in on-chain buying and selling quantity earlier than the resistance at this stage. Thus, there’s low promoting stress on Bitcoin.

Additionally Learn: Crypto Market Liquidation Breaches $185 Million; Bitcoin Falls Again To $23.6K

Can Bitcoin Worth Hit $30,000?

Bitcoin (BTC) value fell almost 4% within the final 24 hours, with the value at present buying and selling at $23,796. The 24-hour high and low are $23,460 and $25,134, respectively. Moreover, the buying and selling quantity has elevated by simply 7% within the final 24 hours, indicating a light curiosity amongst merchants.

BTC value can doubtlessly hit $30,000 however is more likely to stay below stress as a result of U.S. Fed’s hawkish stance. Furthermore, assist from whales and institutional buyers is required to hit the $30,000 psychological stage.

Additionally Learn: Ethereum Shanghai Improve Might Undergo Delay As Builders Discovered Points

The offered content material could embody the private opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any accountability to your private monetary loss.