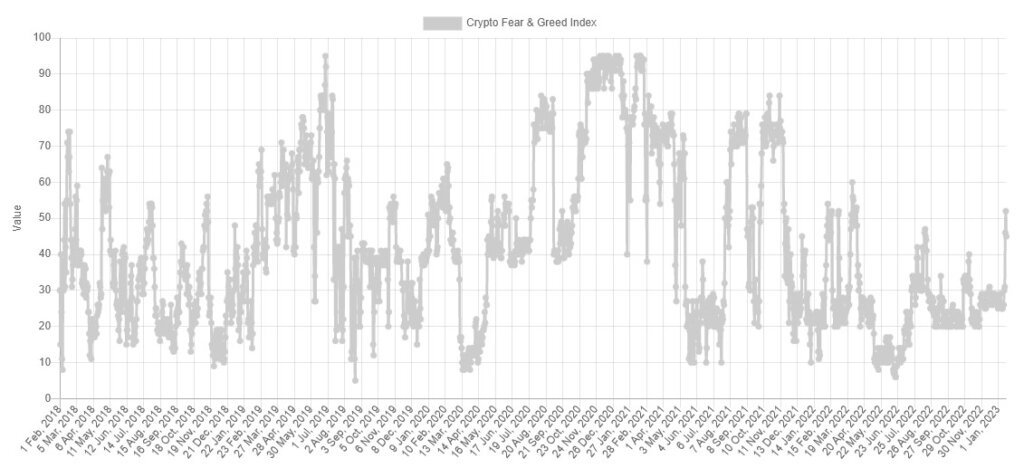

For the primary time since April 2022, the Bitcoin Worry & Greed Index (FGI) has moved out of the ‘worry’ zone and into ‘impartial.’

Over the weekend, Bitcoin reached a rating of 52 on the index as Bitcoin pushed over $21,000.

As of press time, the rating has retraced barely to the underside finish of the ‘worry’ scale at a ranking of 45. The index began the yr within the ‘excessive worry’ zone, indicating that bearish sentiment had management of the market at the beginning of January.

Nonetheless, as Bitcoin rallied from the $15,600 to $17,200 vary held all through November and December, the FGI moved away from excessive worry.

Bitcoin went into free fall following the collapse of FTX. Nonetheless, it seems to have recovered to pre-FTX-collapse ranges inside the previous week. The highest cryptocurrency by market cap was vary sure for roughly 63 days earlier than breaking resistance to interrupt again above $20,000.

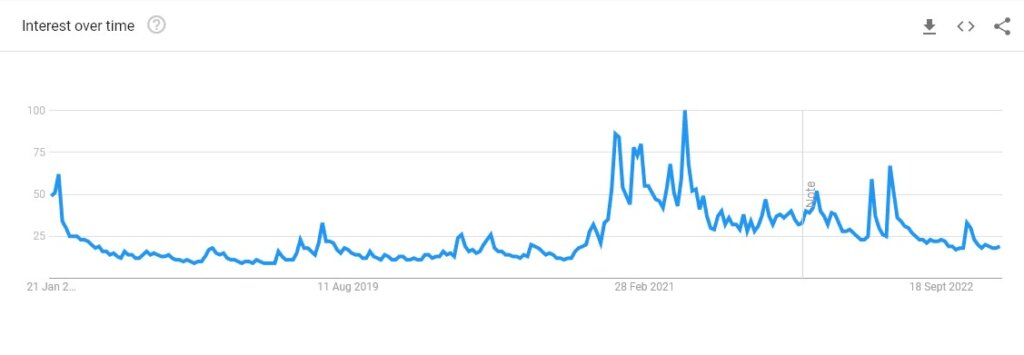

Moreover, whereas the FGI could have moved away from ‘worry,’ different world metrics haven’t proven an analogous bullish pattern. For instance, Google search visitors for the time period ‘Bitcoin’ remains to be at its lowest since December 2020.

Curiosity by area exhibits El Salvador as probably the most fascinated by Bitcoin by some margin, with Nigeria following behind earlier than a big hole earlier than European international locations reminiscent of Netherlands, Switzerland, and Austria.

Bitcoin is authorized tender in El Salvador, whereas Nigeria makes use of BTC for peer-to-peer funds.

Nigeria not too long ago acknowledged crypto as an asset class alongside its CBDC, the e-Naira. Nonetheless, Paxful CEO Ray Youssef attributed the rise in Bitcoin’s reputation to Nigeria’s youth tradition by stating:

“Nigeria is completely different, the youth had been all about it, they had been like carry within the Bitcoin, screw the whole lot else let’s do that.”

Apart from these outlier nations, curiosity in Bitcoin has undoubtedly waned throughout the bear market, and the latest rally has not led to a substantial enhance in Bitcoin searches globally.

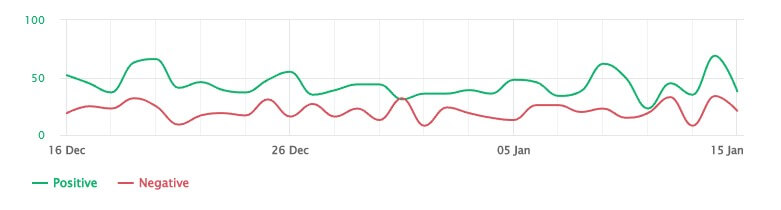

Moreover, a evaluate of sentiment evaluation for standard movies, information, and blogs associated to Bitcoin confirmed a peak in optimistic sentiment on Jan. 15. Nonetheless, there was no obvious enhance in both optimistic or detrimental views over the previous 30 days.

Wanting on the historic FGI information, it’s clear that Bitcoin has damaged the downward trendline which began in November 2021. Nonetheless, different breakouts had been supported by elevated curiosity in Bitcoin, which isn’t evident as of press time.

Potential detrimental catalysts stay on the forefront of buyers’ minds as Digital Forex Group has didn’t publicly positive up its enterprise. Consequently, the danger of additional ache out there stays excessive, with many pointing to the latest worth motion as indicative of a bull entice.

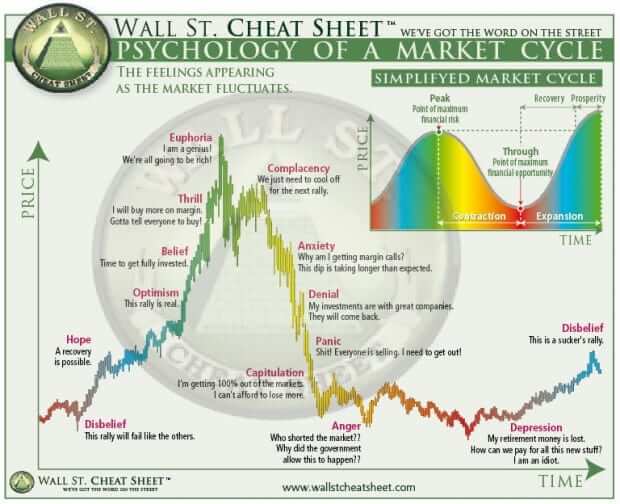

Nonetheless, Alistair Milne, chief funding officer at Altana Digital Forex, shared a popular graph that depicts the everyday investor mentality at every stage of a worth cycle. Within the picture proven under, the ultimate stage of a bear market is described as ‘disbelief.’

Following the ‘disbelief’ part, the market strikes again into the bull territory.

Such photographs are removed from 100% correct as there isn’t any crystal ball to foretell Bitcoin’s worth. Nonetheless, with falling inflation and little over one yr till the subsequent Bitcoin halving, there may be lastly some purpose to carry out hope of a faster-than-expected return to the bull cycle.