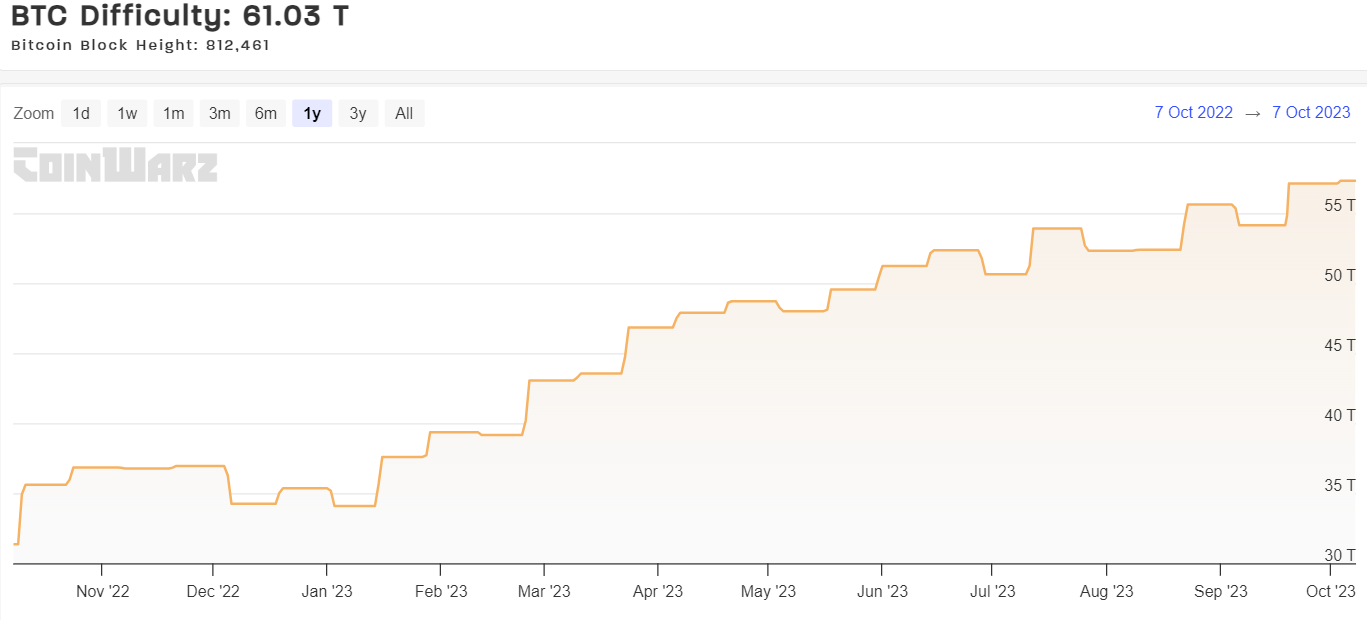

Bitcoin’s mining issue stage has hit a brand new excessive after one other surge on Monday, rising by 6.47% and making it much more difficult for Bitcoin miners to uncover blocks.

In response to knowledge from CoinWarz, after the newest replace, Bitcoin’s mining issue—the estimated variety of hashes required to mine a block—is now at 61.03 trillion.

That is the third consecutive improve in Bitcoin mining issue, which has virtually doubled since October final yr.

Bitcoin’s mining issue is readjusted each 2,016 blocks, or roughly each two weeks, because the community determines whether or not the actions of miners for the interval resulted within the diminished or elevated time to discover a new block.

This adjustment interval permits the community to guage whether or not miners have been capable of finding new blocks quicker or slower than the goal time of 10 minutes per block.

The mining issue is elevated if blocks are being mined too quick and decreased if it takes longer than 10 minutes to mine a block.

A rise in mining issue signifies that miners must allocate extra computational energy to efficiently mine a block, and signifies a rising variety of miners are becoming a member of the community, as mining turns into extra computationally intensive.

Bitcoin halving and mining

Some consultants imagine the spike in exercise may be attributed to the upcoming Bitcoin halving, which is now about 6.5 months away.

“This flurry of mining exercise could possibly be about maximizing returns earlier than the Bitcoin halving subsequent yr,” Jeff Mei, COO of the crypto trade BTSE, instructed Decrypt. “After that time, the rewards for mining Bitcoin will half, because the title suggests. So it’s doable we’re seeing miners squeeze all the worth they will earlier than that time.”

Mauricio Di Bartolomeo, co-founder and CSO at crypto lender Ledn, additionally believes that the subsequent Bitcoin halving shall be a “enormous deal” for miners.

“There’s going to be a rush of miners coming on-line between now and Might, each miner goes to attempt to squeeze each final drop of their tools from the 6.25 per block payout price, as a result of from 6.25 BTC/block it’s going to drop to three.125 BTC/block,” Di Bartolomeo instructed Decrypt. “So people who have machines pending to be linked, shall be dashing to get them on the grid to gather to the upper payout price whereas they nonetheless can.”

In response to him, this may lead to a run-up in issue up till the halving, nonetheless, as soon as the halving happens, “that vast rush to attach new miners will stop as a result of these connecting from that time onwards shall be making considerably much less returns.”

Different causes, based on Mei from BTSE, is also a mirrored image of miners’ elevated fears of an upcoming and dramatic rise in power costs, which might have a significant impression on their profitability.

“With regional tensions flaring up throughout a number of flashpoints, miners could possibly be anticipating oil costs and power typically to turn into much less reasonably priced,” Mei instructed Decrypt.

Edited by Liam Kelly.