The continuing crypto winter appears to have caught up with Bitcoin miners as they’re now sending a ton of cash to exchanges.

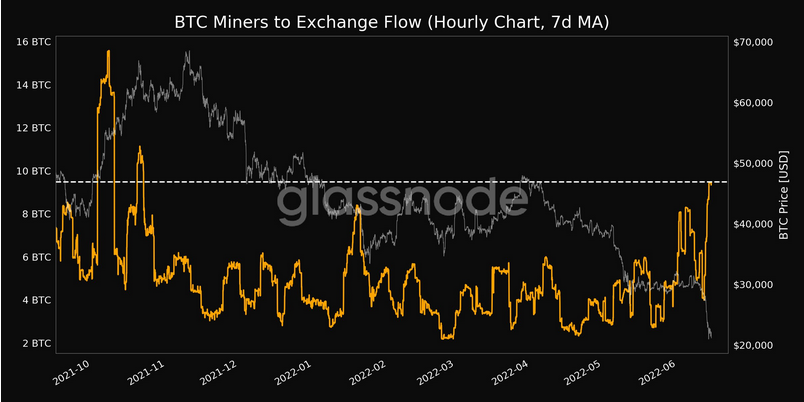

This week, Glassnode’s Bitcoin Miners to Trade Move chart confirmed that the outflow of Bitcoin from miner-held wallets into exchange-held wallets reached a seven-month excessive of 9,476 BTC.

Traditionally, an increase within the variety of cash being despatched to exchanges from miner wallets often depicts that miners are afraid of dropping their hard-earned mining rewards and income and wish to promote. It additionally often alerts the final market sentiment – On this case, sellers nonetheless have a robust grip available on the market.

Miner Profitability On The Decline

This growth comes within the wake of Bitcoin’s mining profitability plummeting by greater than 75% from its all-time highs, with revenues dropping whereas manufacturing price surges.

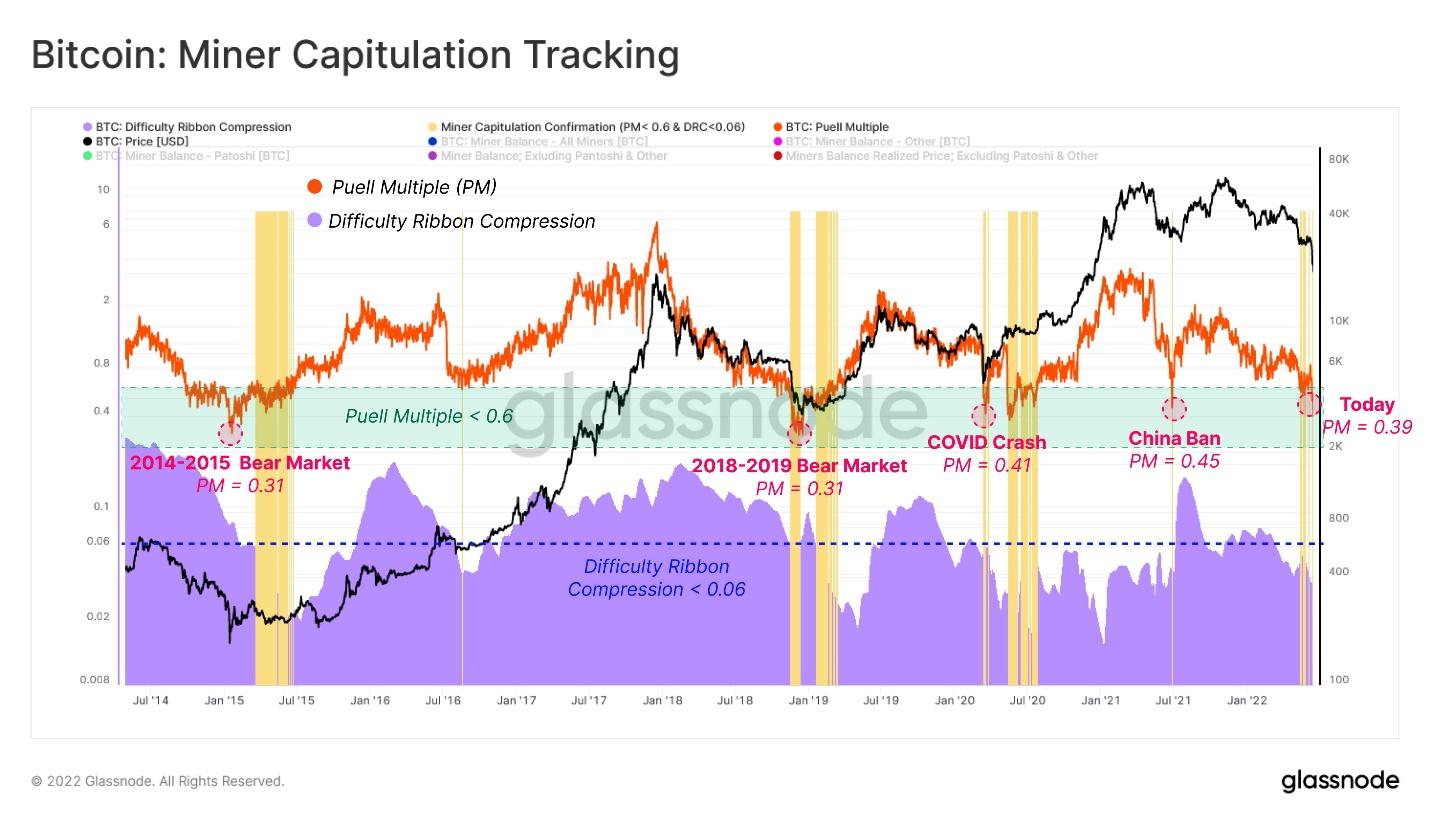

On Friday, Glassnode shared the “Bitcoin Puel A number of Chart”- a metric that quantifies the profitability of the market from the miners’ perspective. Within the phases of a protracted bear market, the Puell A number of plunges to the sub-0.5 zone. This metric is at the moment sitting at 0.39 after coming into the capitulation vary.

Subsequently, that is the bottom stage because the November 2018 crash and signifies miners are at the moment incomes simply 39% of the 1-year common USD earnings. Which means it’s costlier to mine every coin with USD, denominated reward continued to say no and will sign incoming miner capitulation.

Realized Losses Faucet Recent Highs

Elsewhere, BTC’s elevated realized losses proceed to drive the market decrease with the chance of insolvency by key gamers steadily unfolding. Final week, Bitcoin buyers locked within the largest USD-denominated Realized Loss in historical past. This week, the BTC spent on-chain realized web losses of over $4.23B, eclipsing all main sell-offs in 2021 and 2020.

Primarily based on onchain knowledge, long-term holders are at the moment holding the biggest quantity of unrealized losses. This lot can be spending cash with the next however barely worthwhile price foundation in comparison with short-term holders. In previous bear markets, this has signaled the start “of the ultimate wash-out section of all remaining sellers,” earlier than the market finds a remaining backside primarily based on historic knowledge.

That mentioned, after breaking the norm for the primary time in historical past by going under earlier cycles’ all-time excessive, it stays to be seen whether or not BTC will drop 80-90% from November’s peak. As of writing, BTC is buying and selling at $21,397 after a 3% surge previously 24 hours in response to knowledge from CoinGecko.

To date, the coin’s worth has declined by 71% from its all-time excessive of $69,044 with any additional drop threatening to maintain the worth trapped contained in the 2017 territory for the following 8-24 months in response to a latest report by Glassnode.