Mining

Bitcoin miners are discovering it now not worthwhile to mine BTC. Rising vitality costs, inflation, and a looming recession have put many of those corporations beneath duress.

Mining Bitcoin has turn into an more and more troublesome activity as crypto miners can now not afford it. Because of this, the hashrate of the community is predicted to drop as a result of miners merely can’t make a revenue, not to mention get better the prices.

In the previous few months, a number of Bitcoin miners have skilled a number of monetary stressors. This consists of Core Scientific, Argo, Compute North, and Iris Power.

In the meantime, Luxxfolio provided an operations replace lately that spoke in regards to the strain the mining trade was going through. The miner highlighted that it was unprofitable, although it had lowered its debt and moved to lower-cost immersive mining. Most notably, it mentioned that if it didn’t discover a accomplice or buy for its mining operation in New Mexico, it must contemplate completely shutting down operations.

Iris Power can also be beneath a excessive stage of duress. Its monetary replace additionally revealed a dire state, saying,

“Sure gear (i.e., Bitcoin miners) owned by the particular function automobiles at the moment produce inadequate money move to service their respective debt financing obligations, and have a present market worth effectively under the principal quantity of the related loans. Restructuring discussions with the lender stay ongoing.”

These circumstances are consultant of what the bigger mining trade goes by means of. What buyers are involved about is the discount within the hashrate.

BTC Hash Charge Might Endure

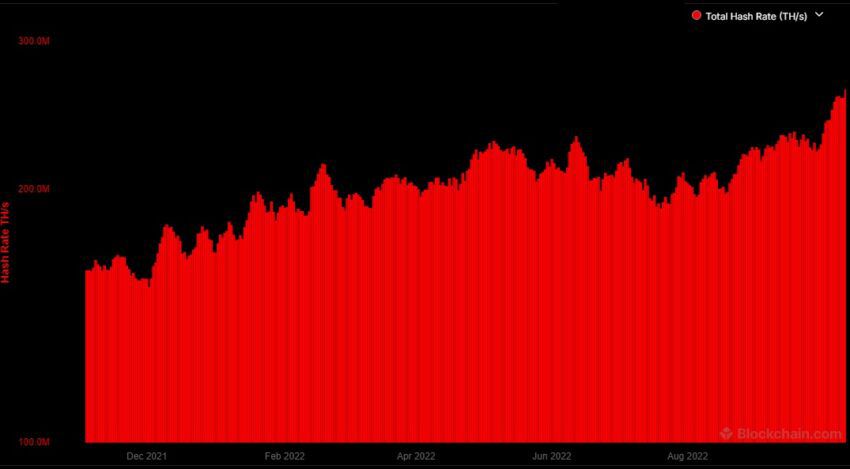

The problem and hashrate each hit all-time highs in October. This was seen as excellent news, as the next hashrate means a safer community. Nevertheless, the scenario has modified rapidly.

BTC hashrate: Blockchain.com

With Bitcoin mining not being worthwhile sufficient anymore, there might be extra shutdowns on the horizon. It at the moment prices about $19,300 to mine 1 BTC, and within the present financial setting, that’s unfeasible.

Power costs have additionally gone up in 2022, and this has additionally contributed drastically to the mining trade’s slowdown. Inflation and an upcoming world recession are additionally enjoying an element.

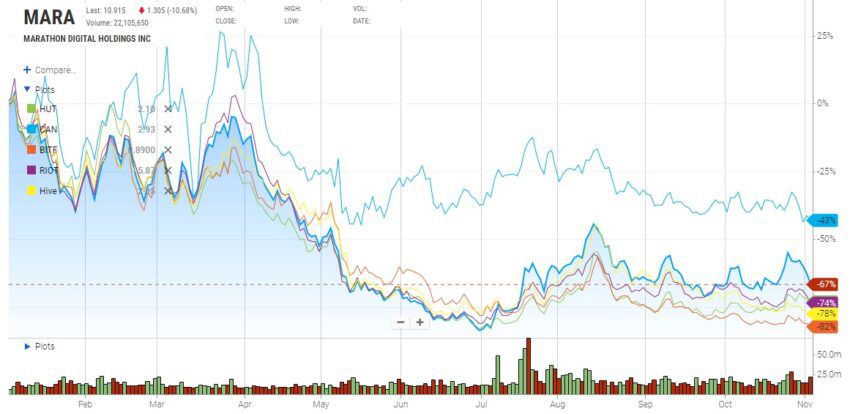

Bitcoin mining shares seeing large drops

Bitcoin mining shares in contrast (YTD): Nasdaq

In the meantime, the shares of Bitcoin mining corporations are taking a robust hit. Hut8 is down 73% year-to-date (YTD), whereas Canaan is down 44%. Different massive drops embrace Bitfarms at 82%, Riot Blockchain at 73%, and Hive at 77% YTD. The identical is the case with the Argo blockchain, which is down by a whopping 90%.

Plummeting inventory costs throughout the sector clearly present how the bear market is impacting massive Bitcoin miners.