The latest downturn, together with a myriad of different components, has put Bitcoin mining firms below stress to remain operational.

In line with Politico, miners have additionally needed to cope with rate of interest rises and rocketing vitality prices, along with costs crashing, which suggests much less demand and tighter revenue margins.

“Rising rates of interest, crashing crypto costs and sky-high vitality prices have thrown the as soon as white-hot trade on ice.”

An extra menace lies within the EU posturing over a Proof-of-Work mining ban, which might be disastrous for the BTC mining trade and its value. Furthermore, as the value of most altcoins follows Bitcoin, the affect, if a ban have been enacted, would doubtless prolong to the whole crypto trade, no matter a token’s particular consensus mechanism.

Regardless of the doom and gloom as Bitcoin was designed, homeostatic mechanisms are kicking in to offset the upheaval of latest instances.

Bitcoin miners really feel the warmth

As a response to the shift, miners sending Bitcoin to exchanges for promoting has been climbing since June 7, in accordance with Reuters. It was additional famous that a number of publically traded mining firms had liquidated greater than their Could token output to deal with the deteriorating market situations.

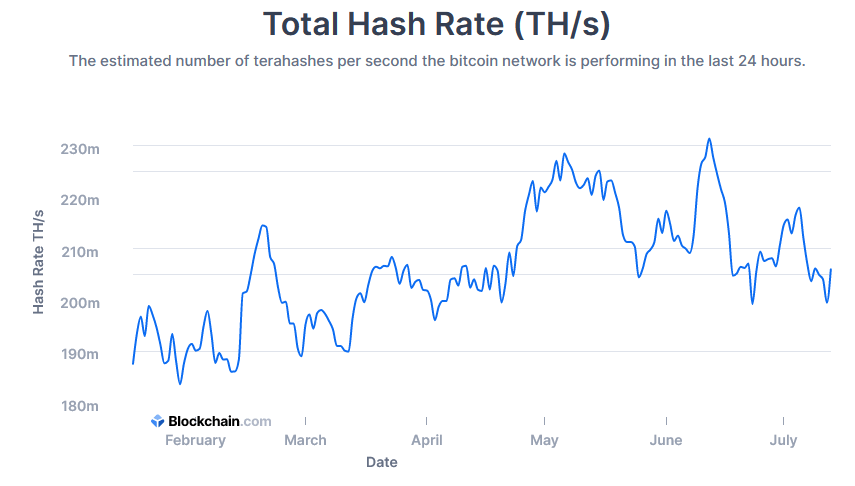

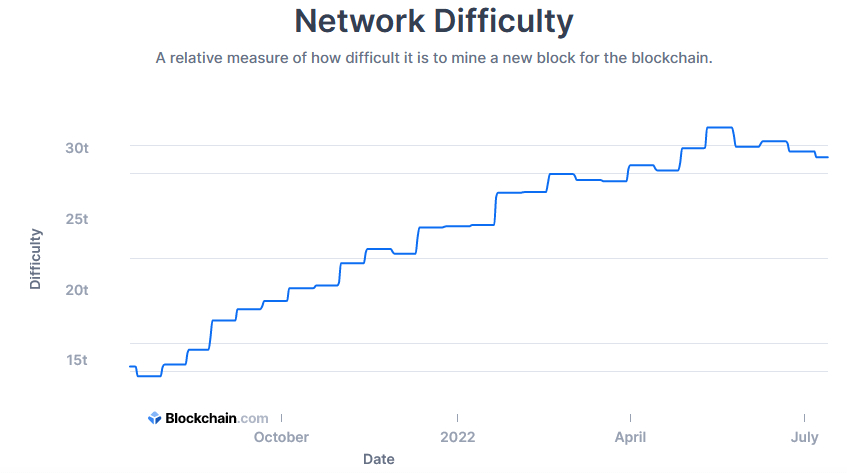

Joe Burnett, an Analyst at mining agency Blockware Options, stated the difficulty had been compounded by spiking hash charges and mining issue over the previous half 12 months, additional incentivizing miners to dump their tokens.

“Over the previous six months, hash charge and mining issue have elevated whereas the value of bitcoin has dropped. These are each negatives for current miners as each work to compress margins.”

Chiming in, Charlie Schumacher, Vice President of Communications at mining agency Marathon Digital, stated it’s as if all the pieces that may go fallacious goes fallacious for the Bitcoin miners.

Mining issue is compensating

Evaluation of the seven-day common Bitcoin hash charge during the last 180 days confirmed a peak of 231m TH/s on June 12. A pointy drop-off adopted this to backside at 199m TH/s lower than two weeks later.

Though the hash charge recovered to prime out at 218m TH/s on July 5, because the June 12 prime, a sequence of decrease highs are forming – suggesting a development in miners leaving the sport.

Evaluation of the one-year mining issue chart confirmed issue topped out at 31.25t for the 2 weeks ending Could 24. A 7% decline since then sees community issue drop to 29.15t at present, forming the beginning of a rounding prime sample.

The above is taking part in out in the price of Bitcoin manufacturing falling. In line with Bloomberg, analysis performed by JPMorgan discovered one BTC now prices $13,000 to supply, falling from $24,000 at first of final month.

With the present value of BTC at $20,100, this could go some strategy to assuaging the stress on miners.