The cryptocurrency market entered a sell-off section within the first week of June, seeing a market-wide route with nearly all of cryptocurrencies falling to a 4-year low.

The adorning market situations have additionally affected Bitcoin (BTC) mining profitability adversely, forcing miners to liquidate their BTC holdings.

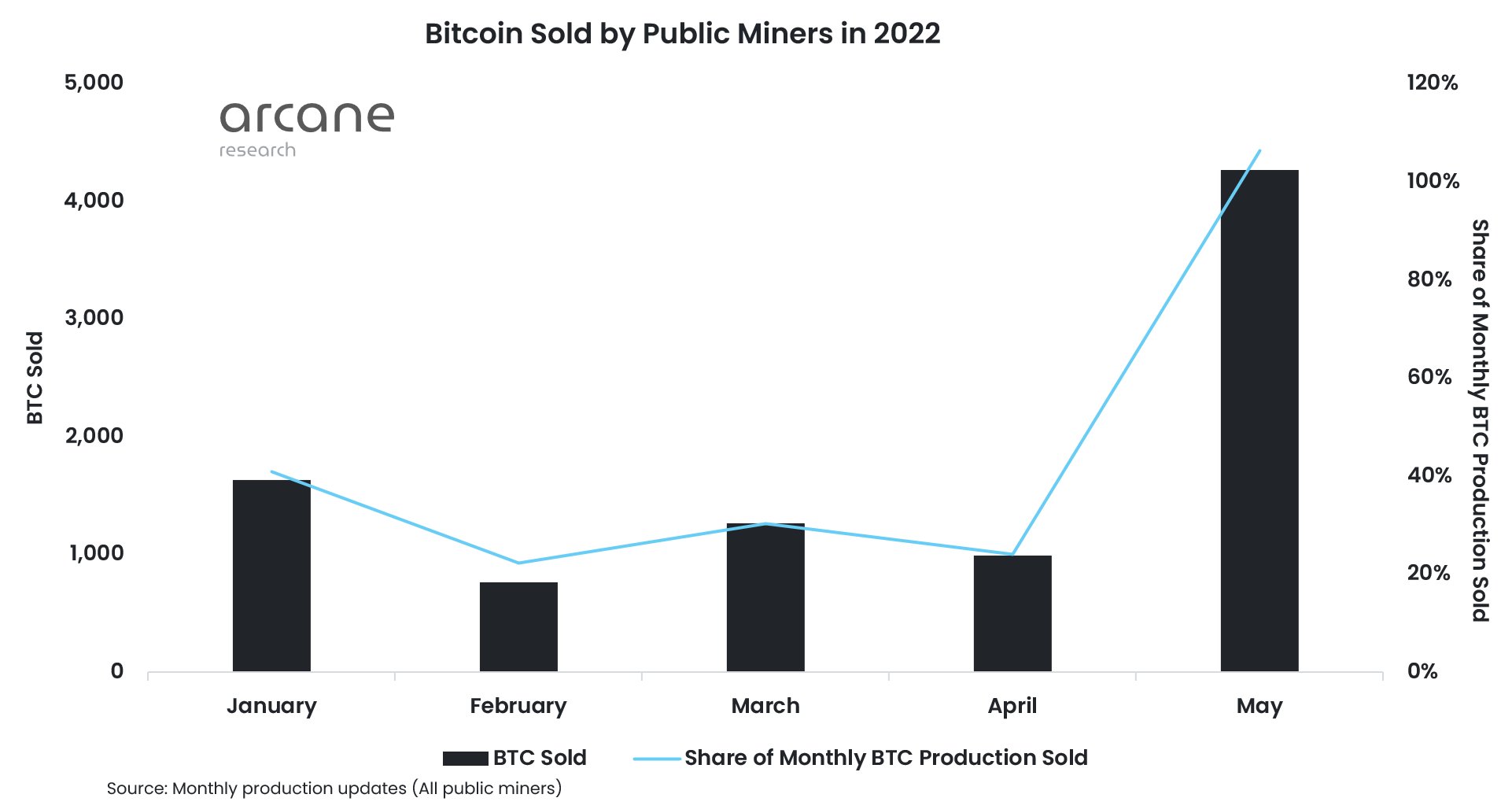

New knowledge from Arcane analysis exhibits that public Bitcoin mining companies bought 100% of their BTC manufacturing in Might in comparison with the same old 20-40% earlier.

Within the first 4 months of 2022, public BTC mining companies bought 30% of their mined manufacturing, which elevated 3X folds in Might and is predicted to rise even additional in June.

Whereas public BTC miners solely make as much as 20% of the overall community hashrate, their conduct typically displays the emotions of personal miners as properly.

Miners collectively maintain 800,000 BTC, making them one of many greatest whales available in the market. Out of those, public miners maintain 46,000 BTC and their promoting spree might push the value additional down.

Associated: Bitcoin worth faucets 5-day highs as Shiba Inu leads altcoin positive factors

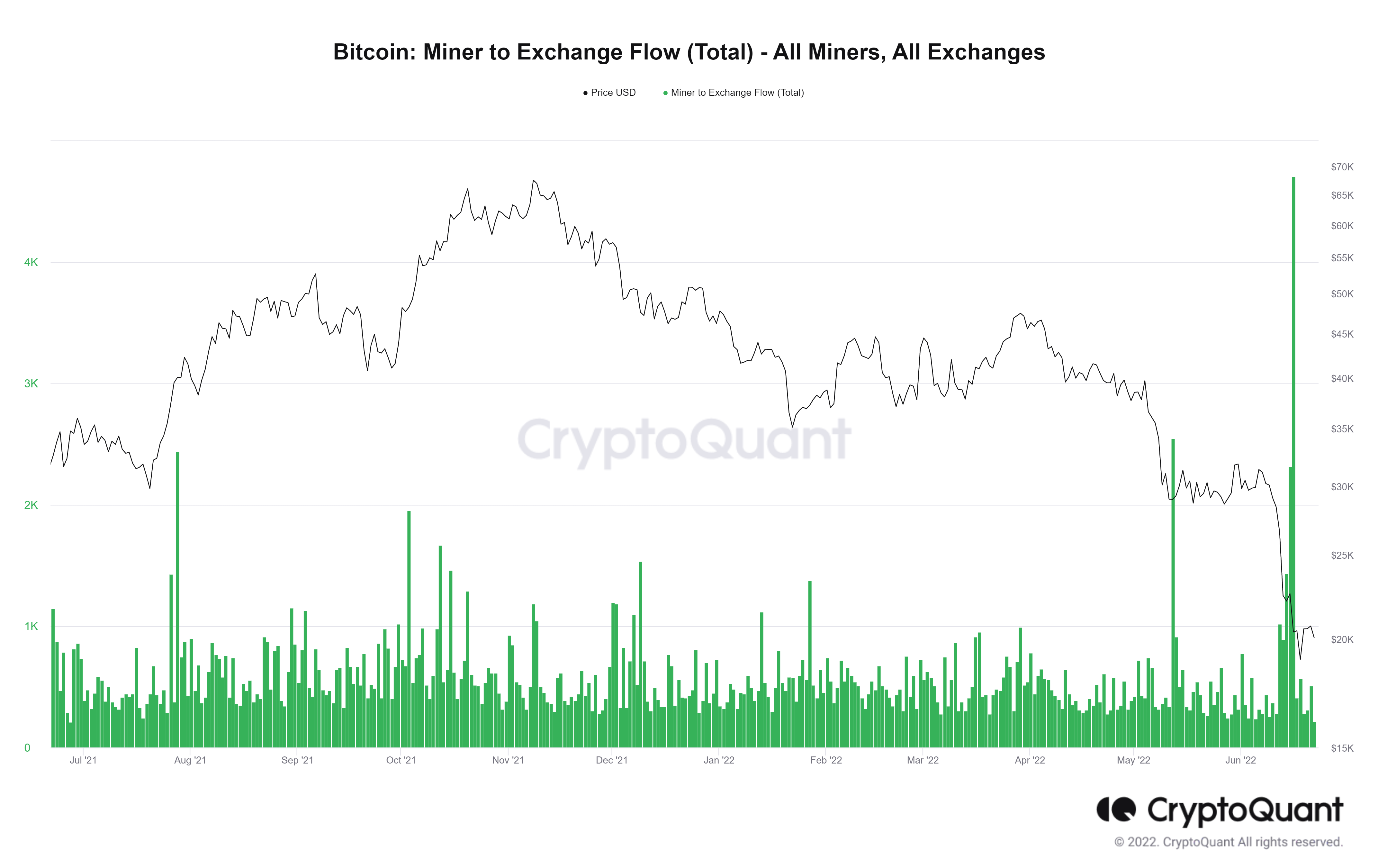

The situation has solely worsened in June with the Bitcoin worth falling beneath the 2017 excessive of $20,000 and recording a brand new 4-year low of $17,783. Miner’s to alternate circulation, an information metric that exhibits the quantity of BTC despatched by miners onto exchanges has reached a brand new excessive in June, reaching a degree not seen since January 2021.

As Cointelegraph reported earlier, BTC miner’s to alternate circulation ratio has hit a brand new 7-month excessive when BTC worth tanked beneath $21,000. The decline within the worth of BTC has additionally made many mining machines unprofitable, forcing miners to depart the crypto market.

Bitcoin hash worth is a mining metric that represents the miner income on a per terahash foundation. It’s the common worth — in fiat forex — of the each day rewards a miner will get per every terahash calculation (USD/TH/s per day), which has fallen to a brand new 1.5-year low.

Bitcoin Hash Ribbon, an indicator that tries to establish durations the place BTC miners are in misery and could also be capitulating, has crossed, indicating many miners are unplugging their machines because of lack of profitability.

At a time of BTC worth decline and miner disaster, many consider it’s a sturdy worth backside sign as properly, particularly when miners begin giving up.

⚠️Hash Ribbon Indicator: $BTC miners are capitulating⚠️

This misery sign occurred 9 days in the past, probably indicating that the value backside is close to!

“When miners hand over, it’s probably probably the most highly effective Bitcoin purchase sign ever” -@caprioleio #BTC #Cryptocrash #cryptocurrency pic.twitter.com/SWJjzUEICB

— El Baranito ₿ (@ElBaranito) June 18, 2022

BTC slumped beneath $21,000 once more and was buying and selling simply above $20,000 at press time, seeing a 6% decline over the previous 24 hours.