Mining

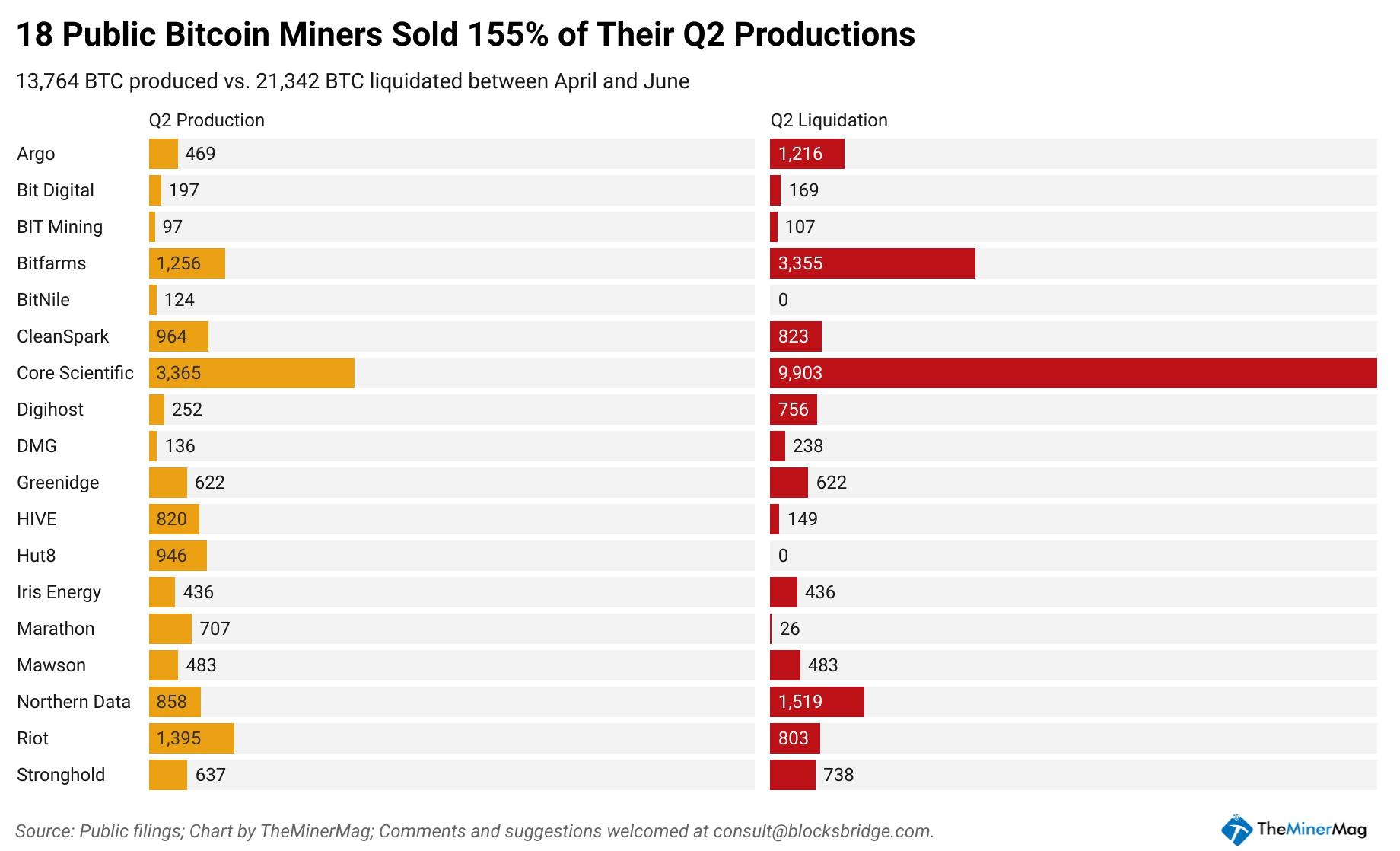

The second quarter of 2022 was a troublesome one for public bitcoin (BTC) miners, as 18 of them bought BTC 21,342, in keeping with a current report launched by crypto consultancy BlocksBridge Consulting.

Per the report, this was 660% of what they bought within the first quarter of this yr and about 150% of their manufacturing within the April-June 2022 interval.

Supply: BlocksBridge Consulting

The most recent information obtained by the agency means that bitcoin manufacturing prices, in addition to normal and curiosity bills elevated within the second quarter of this yr.

In accordance with the consultancy,

“Q2 numbers from eight public miners who’ve launched full monetary statements up to now present that their common cots of manufacturing, normal and curiosity bills per every bitcoin mined spiked by 22% in Q2 vs Q1. They symbolize ~10% of the community hashrate.”

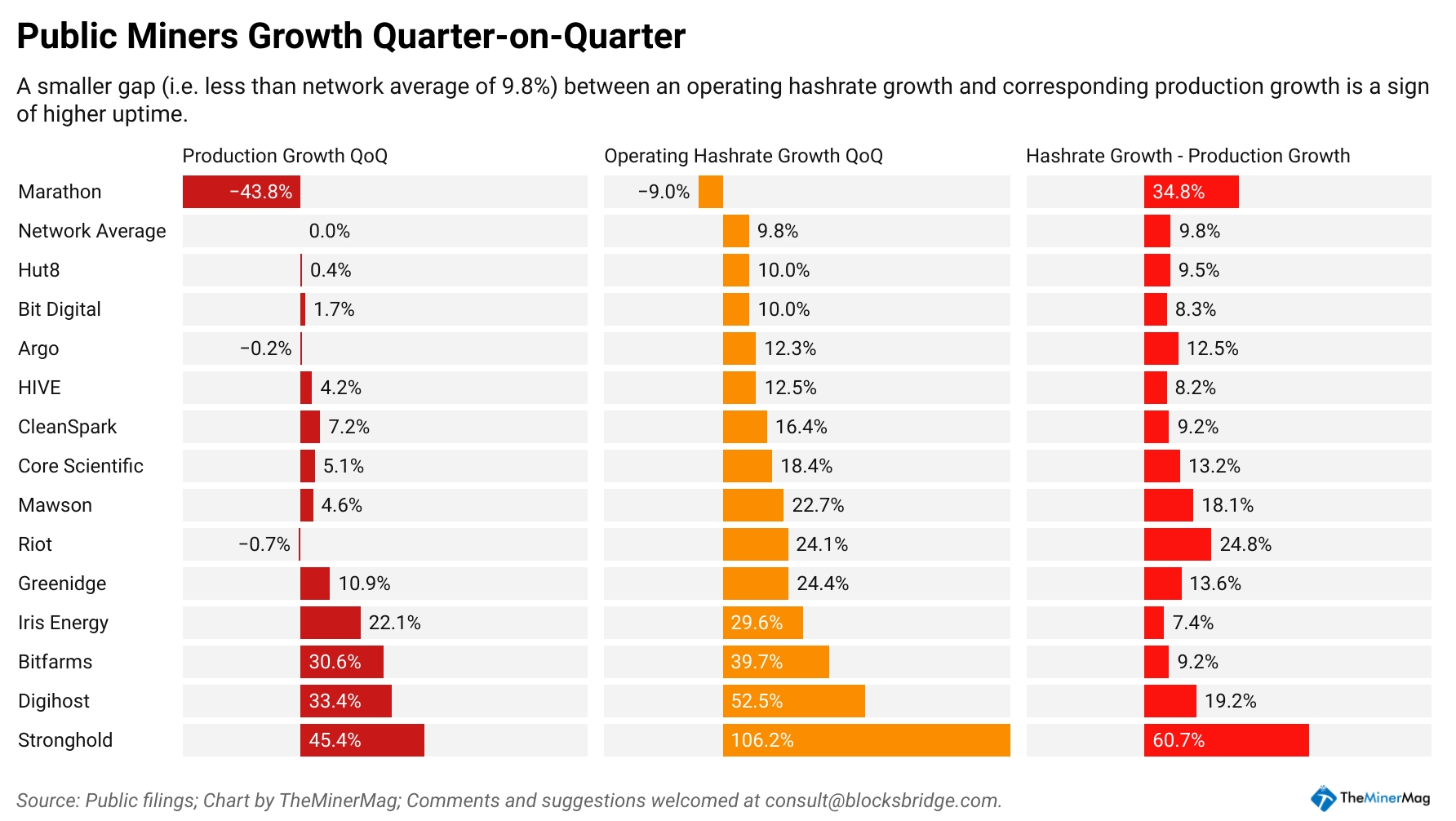

The report acknowledges that, on the intense aspect, virtually each public mining firm managed to outgrow the community’s hashrate rise within the second quarter, that’s, the April-June 2022 interval.

“However QoQ [quorter-on-quarter] manufacturing development lagged rather a lot behind the working hashrate development. Why? Not everybody was in a position to keep a superb uptime,” BlocksBridge stated.

Supply: BlocksBridge Consulting

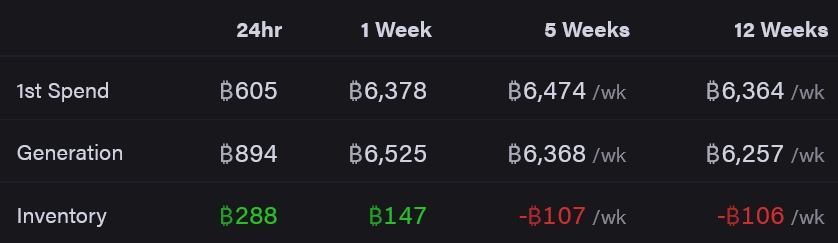

In accordance to ByteTree information, miners have spent extra of their newly generated BTC, in comparison with what they’ve held over the previous 12 weeks. Nonetheless, this pattern has modified up to now seven days.

Supply: terminal.bytetree.com

In the meantime, Bitcoin mining problem, or the measure of how arduous it’s to compete for mining rewards, elevated on August 18 by 0.77%, at present standing at 28.57 T. This was its third in a collection of smaller will increase, with the issue inching in direction of its Could all-time excessive of 31.25 T.

Final week, Bitfinex Analysts stated in a remark shared with Cryptonews.com that,

“Bitcoin mining studies point out that there was a notable lower in miner distribution to exchanges in current weeks. This implies that while stress stays within the business; the worst could be behind us. As stress on miners decreases, alongside whales, miners additionally look like taking earnings. They’re mainly compelled into promoting to cowl prices from the extra mining rigs onboarded with their infrastructure as collateral. Over the past 2-weeks, the combination miner steadiness has declined by roughly 4.7k BTC.”

The rising manufacturing prices could possibly be one of many causes behind a lot of current selections made by mining-related corporations.

One in all Japan’s greatest monetary providers suppliers, SBI Holdings introduced it’s shutting down its mining operations in Siberia. The transfer additionally ties again to the sanctions imposed on Russia for its invasion of its western neighbor, Ukraine.

CleanSpark stated that it acknowledged a USD 29.3m internet loss for the three months ended June 30, however it has additionally accomplished the lately introduced acquisition of an energetic bitcoin mining facility within the US simply three days in the past.

In the meantime, Kryptovault AS was compelled by hovering energy costs to maneuver north from southern Norway to the Arctic Circle, the place the ability prices are rather a lot decrease.

Earlier this month, it was additionally unveiled that the development of a bitcoin mining facility close to a Pennsylvania-based nuclear plant was suspended. Taryne Williams, a spokesperson for Talen Power, advised the native each day Customary-Speaker that the development work was suspended “as a consequence of circumstances out of our management.” The assertion could recommend that the choice could possibly be associated to crypto costs tanking up to now months.

At 9:30 UTC on Monday morning, BTC was buying and selling at USD 21,182, down 1% in a day and 13% in per week.

____