Mining

The present Bitcoin bear market will possible finish this yr, in response to mining knowledge firm Hashrate Index. Different trade insiders, nevertheless, aren’t so certain.

The corporate’s optimistic outlook is welcome information, given the sluggish cryptocurrency market, which has subdued mining earnings.

Nonetheless, Hashrate Index emphasised {that a} full-fledged bull market will possible not kick into gear anytime quickly.

Will the Bitcoin Mining Market Consolidate?

The mining knowledge firm additionally notes that Bitcoin’s hashrate development may gradual in 2023.

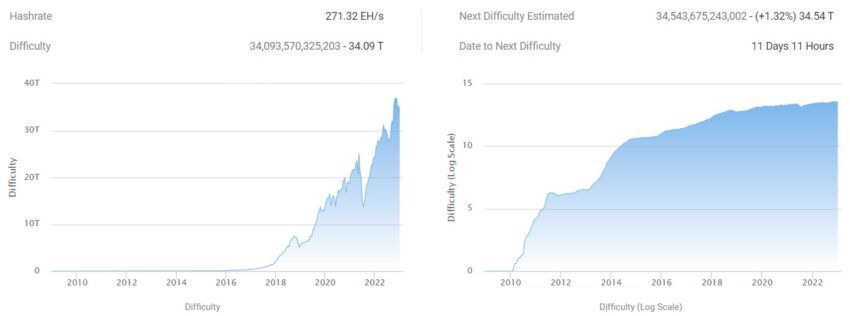

Due to extreme winter storms within the U.S. final week, quite a few miners needed to shut down their gear, inflicting the Bitcoin hashrate to drop by 35% in a single day. After a considerable restoration, the hashrate has recovered to 271.32 EH/s based mostly on knowledge by BTC.com.

Within the newest problem adjustment, BTC problem has fallen by nearly 3.6% resulting from a reducing hashrate.

BTC Hashrate and Issue Chart by BTC.com

That mentioned, Hashrate Index means that there shall be fewer public miners. A prediction that signifies a mining market consolidation. Final month, well-liked American Bitcoin miner Core Scientific introduced that the general public firm has filed for Chapter 11 chapter safety. In the meantime, it not too long ago obtained a $17 million mortgage from BlackRock to maintain it solvent throughout the course of. As well as, the Celsius Community chapter has compelled Core Scientific to show off greater than 37,000 cryptocurrency mining items belonging to the agency.

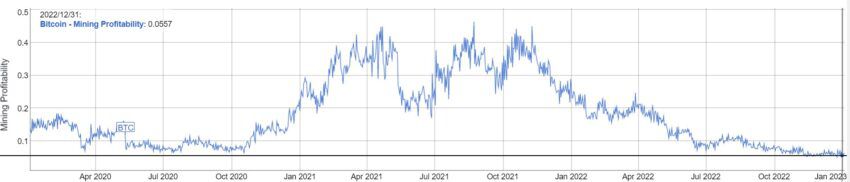

Because of the extended crypto winter and the weak Bitcoin costs, which had been made worse by the FTX chapter, a number of of its friends additionally face bother. BeInCrypto reported in December that BTC profitability plummeted in 2022 resulting from a number of elements. The highest elements are rising electrical energy prices and the collapse of Bitcoin from its report excessive of $69,000 in November 2021. As per knowledge by BitInfoCharts, BTC profitability seems to stay close to its lowest level since 2020.

Bitcoin Mining Profitability Chart by BitInfoCharts

For 1 THash/s, Bitcoin mining profitability was 0.0664 USD/day.

Different King Coin Profitability Predictions

As talked about earlier, electrical energy price is a major deterrent for miners; 2023 predictions embody that the internet hosting prices will lower. Hashrate Index notes that in 2023, minimizing prices shall be essential. With that, ASIC costs will possible plummet, as per the corporate. And miners may need assistance to acquire sufficient up-time.

Regardless of the troubles, the info firm anticipates that miners will attempt to enhance their stability sheets. Particularly when the cumulative debt of publicly traded Bitcoin mining corporations has surpassed $4 billion, in response to analysis from Hashrate Index. Within the newest, Stronghold Digital Mining declared its intention to transform notes into fairness to carry down $17.9 million in excellent debt.

On the identical time, miners may resort to extra derivatives, per the corporate.

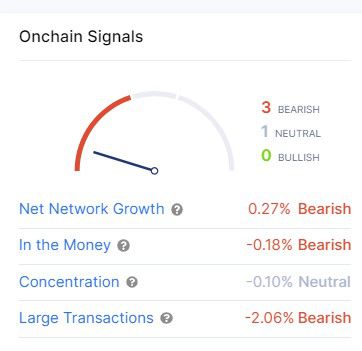

Nonetheless, in the case of on-chain knowledge, king coin stays principally bearish at press time—together with the momentum of enormous transactions. Based on IntoTheBlock, 50% of holders stay out of cash, with 5% breaking even at present value ranges.

BTC is presently hovering in a 24-hour vary of $16,625 and $16,929.

Bitcoin On-Chain Indicators IntoTheBlock

Lastly, Hashrate Index predicts that regulators will proceed to deal with Bitcoin mining. With the U.S. Congress resuming for 2023 on Jan. 3, the main focus stays on crypto laws.

At first of 2023, The Federal Reserve, the Federal Deposit Insurance coverage Company (FDIC), and the Workplace of the Comptroller of the Foreign money (OCC) issued a joint assertion highlighting the ‘dangers’ related to crypto-assets.