BTC has help at $19k however there are dangers of an additional sell-off. RSR continues with weekly positive factors. TON creeps into the highest 40 cash.

BTC

Bitcoin is 1.65% increased during the last seven days and a few analysts see it as a optimistic as a consequence of shares being decrease. However the 2017 excessive in shares was across the $20,000 stage and we have to see a bounce in BTC right here.

The Chairman of the Commodity Futures Buying and selling Fee (CFTC) Rostin Behnam stated final week that any CFTC regulation might have vital advantages for the crypto business, together with a possible increase within the worth of the likes of Bitcoin.

“Progress would possibly happen if we have now a well-regulated area,” Behnam stated at a college. “Bitcoin would possibly double in worth if there’s a CFTC-regulated market.”

Behnam has been a supporter of readability over crypto rules, which is one thing that many within the crypto business have stated is missing. With no stable framework, institutional traders will proceed to shrink back from the sector. For quite a lot of years, the CFTC and the U.S. Securities and Alternate Fee (SEC) have been making an attempt to be the highest regulator for the crypto business. Each have been reluctant to subject clear steerage however they’ve been given extra authority to take action from a Biden administration order. With a transparent regulatory framework, there could be extra alternatives for institutional traders to enter the market.

“These incumbent establishments within the crypto area see a large alternative for institutional inflows that may solely happen if there’s a regulatory construction round these markets,” Behnam stated.

Non-bank establishments thrive on regulation, they thrive on regulatory certainty, and so they thrive on a stage taking part in area. They usually could say in any other case, they may bicker about the kind of regulation – however what they love most is regulation as a result of they’re the neatest, the quickest, and probably the most well-resourced. With these attributes, they will beat everybody else available in the market.

“We’re appropriated cash by Congress, and it has put us is a place the place we really feel like we’re continuously on edge about how a lot cash we will probably be appropriated,” Behnam stated. “We’re nonetheless feeling the injuries and scars from about 5 – 6 years of flat funding.”

The CFTC’s battle with jurisdiction over crypto markets and a small working price range has impacted its capability to successfully cope with crypto crime, Behnam added.

“We’re solely touching the tip of the iceberg,” Behnam stated. “The 60 or so circumstances introduced, we’ve needed to solely depend on whistleblowers, on buyer complaints, and on ideas coming to us.

“We don’t have the standard surveillance instruments, the market oversight instruments, to watch buying and selling platforms, to supervise broker-dealers or similarly-situated intermediaries … These are the varieties of issues we fall a bit bit quick on, not due to lack of effort however due to an absence of jurisdiction,” he added.

Bitcoin is holding the $19,000 stage however it wants a catalyst to maneuver increased and safe a low. The Monday rally in shares could possibly be useful for the worth of BTC.

RSR

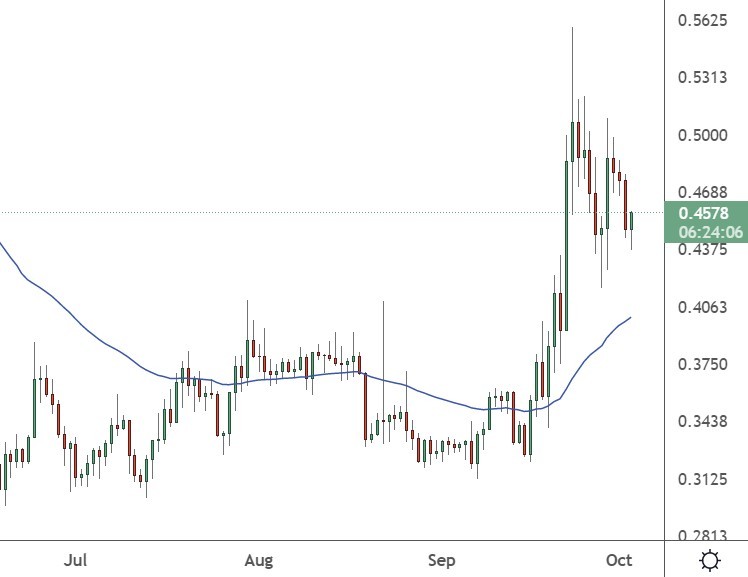

The value of RSR was 26% increased this week because the coin made a second consecutive week of positive factors.

The Reserve Rights cryptocurrency is rallying forward of its mainnet launch which sources have stated is near completion. RSR is the native token of the Reserve Protocol, which is a pool of stablecoins designed to cut back monetary threat via diversification and decentralized governance.

The RSR token is an Ethereum-based ERC token and it’s used for 2 foremost functions within the Reserve Protocol. The token is used for insurance coverage (RTokens) via staking and it’s also used for governance within the Reserve Protocol swimming pools through the proposal and modifications to the pool configurations. In return for offering insurance coverage to RTokens, stakers of RSR obtain a staking reward from the income earned by the RToken that the holders insure. The RSR platform was launched in Could of 2019 after a profitable preliminary coin providing (ICO) on the Huobi platform.

The value of RSR examined the $0.010 stage final week and will appropriate within the quick time period however there’s additionally potential for a low.

TON

The TON blockchain is a brand new venture that has crept quietly into the highest 40 cash.

TON is mineable, however the TON blockchain was by no means a PoW consensus algorithm. The TON blockchain is definitely a consensus algorithm primarily based on PoS which is similar chain that Ethereum has simply turned to.

The TON blockchain is due to this fact a PoS blockchain, and crucial PoS infrastructure is the validator. There are at present greater than 100 validators on the planet, and most are non-public validators. To help within the stability of the TON blockchain, TON holders can stake their TON to validators and earn TON PoS staking rewards as extra earnings.

The present TON APY reward is about 13% and TonStake.com permits customers to stake their TON to validators via a centralized validator service the place they will earn an extra 13% TON after one 12 months as a staking reward via PoS.

TON is a completely decentralized layer-1 blockchain that was designed by Telegram to onboard billions of customers. The venture boasts super-fast transactions, tiny charges, easy-to-use apps, and is environmentally pleasant.

XRP

The value of XRP was 5% decrease this week as hopes for a settlement to the SEC case light.

Final week noticed one other win for Ripple in its case towards the U.S. Securities and Alternate Fee, which sued the crypto agency and its executives in 2020 for the unregistered sale of $1.3 billion value of XRP.

A U.S. District Courtroom choose dominated to launch emails and different correspondence from former SEC Director William Hinman. Hinman had stated in a speech that ETH was not a safety as a result of, like bitcoin, it was “sufficiently decentralized.”

These feedback have grow to be the idea of Ripple’s authorized technique, however the SEC has tried to dam its utilization in courtroom. In a authorized battle that’s approaching the two-year mark, Ripple is in search of to show the SEC has taken an unclear and contradictory method to regulating crypto. The results of the case can have large implications for the cryptocurrency business as a result of different tokens could possibly be classed as securities.

“The ultimate model of Hinman’s speech mentioned an idea that’s central to the Ripple founders’ protection concept – whether or not belongings that perform solely as a method of change in a decentralized community should not a safety, even when they could possibly be packaged and bought as a safety,” Liz Boison of Hogan Lovells, stated.

The value of XRP has dipped to $0.45, however there’s nonetheless potential so as to add to the current positive factors.

Disclaimer: info contained herein is supplied with out contemplating your private circumstances, due to this fact shouldn’t be construed as monetary recommendation, funding advice or a proposal of, or solicitation for, any transactions in cryptocurrencies.