Key Takeaways

- Bitcoin is about to shut its ninth consecutive crimson candle on the weekly chart.

- BTC has misplaced greater than 22,800 factors in market worth over this era.

- Now, all of it relies on whether or not BTC can maintain above $29,000.

Share this text

Bitcoin seems to be buying and selling at a make-or-break level as its future relies on its capability to carry the $29,000 help stage.

Bitcoin Appears Oversold However Lacks Assist

The pioneer cryptocurrency is in a steep downtrend because it struggles to search out help.

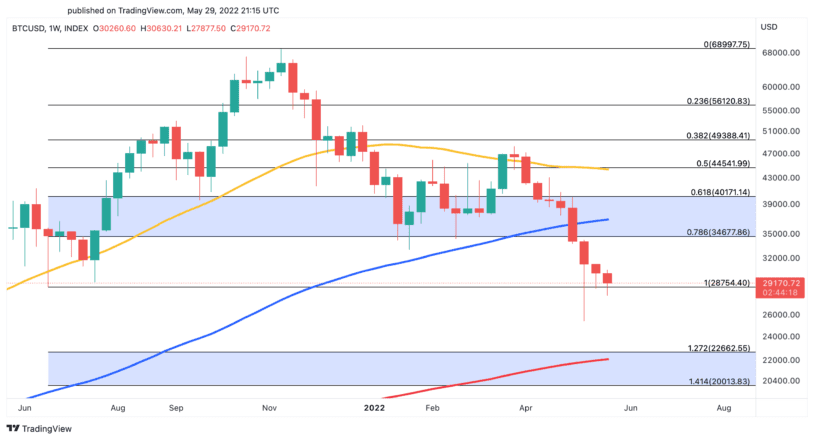

Bitcoin is about to make a brand new report by closing its ninth consecutive crimson candle on the weekly chart. The flagship cryptocurrency has shed greater than 22,800 factors in market worth since Mar. 28, going from a excessive of $48,222 to a low of $25,365. BTC nonetheless appears weak regardless of the numerous losses incurred.

The harm to traders’ confidence introduced on by Terra’s LUNA and UST loss of life spiral has been too nice to beat. Though Terraform Labs efficiently airdropped new LUNA tokens to earlier LUNA and UST holders, it has performed little to enhance market sentiment. The Fear and Greed Index is at its lowest ranges whereas buying and selling volumes throughout the board proceed to dry up.

Certainly, Bitcoin seems to be in a precarious place with traders exhibiting little curiosity. $29,000 has held as help for 9 weeks, but when BTC had been to lose such an important foothold, a 22% downswing towards the 200-week transferring common at round $22,300 would seemingly materialize.

The magnitude of the losses that Bitcoin has incurred during the last 9 weeks makes it cheap to recommend that it has reached oversold situations. If this had been the case, BTC must regain $31,000 as help as quickly as potential to be able to lure traders again into the market. Overcoming such a tough hurdle may generate a spike in shopping for strain that might ship costs towards $34,700.

Disclosure: On the time of writing, the writer of this characteristic owned BTC and ETH.

For extra key market developments, subscribe to our YouTube channel and get weekly updates from our lead bitcoin analyst Nathan Batchelor.