Key Takeaways

- Bitcoin dropped 11.6% following Monday’s open.

- On the identical time, Ethereum took an 18% nosedive.

- Each cryptocurrencies now sit at essential help ranges.

Share this text

The whole cryptocurrency market cap has fallen under $1 trillion for the primary time since January 2021 as Bitcoin, Ethereum, and most main cryptocurrencies drop in tandem.

Bitcoin and Ethereum Look Oversold

Bitcoin and Ethereum seem to have resumed their downtrends after shedding very important help areas.

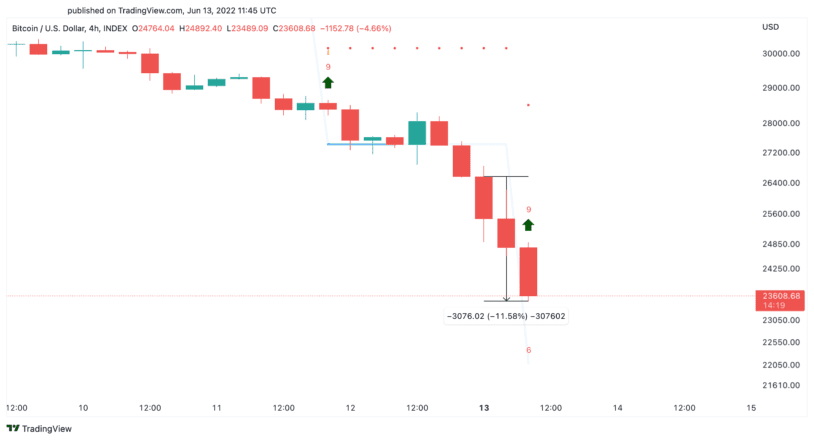

Bitcoin has seen its worth drop by almost 11.6% following Monday’s open. BTC went from $26,565 to hit a low of $23,426, shedding greater than 3,000 factors in market worth. The current bout of promoting has put Bitcoin in oversold territory, opening up the potential for a rebound.

The Tom DeMark (TD) Sequential indicator at the moment presents a purchase sign on Bitcoin’s four-hour chart. The bullish formation is indicative of a one to 4 candlesticks upswing. A spike in shopping for strain on the present worth ranges might assist validate this bullish formation.

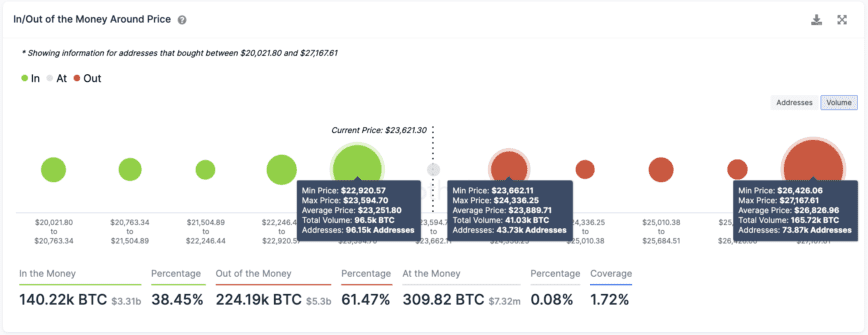

On-chain information exhibits that roughly 96,000 addresses have beforehand bought almost 100,000 BTC between $22,920 and $23,600. If Bitcoin can maintain above this degree, the TD’s outlook may very well be confirmed and result in a rebound towards $27,000. Nonetheless, the pioneer cryptocurrency should reclaim $24,000 first as help to entice market individuals into opening new lengthy positions.

It’s price noting that shedding the $22,920 to $23,600 help flooring might end in a downswing to $20,000 as there seem like no different outstanding areas of demand beneath it.

Ethereum additionally kicked off the week in a unfavorable posture, dropping almost 18% since Monday’s open. The downtrend seems to have accelerated shortly after ETH broke out of a descending triangle sample on the four-hour chart. The current fall has introduced ETH all the way down to the 29.4% goal introduced by the bearish technical formation.

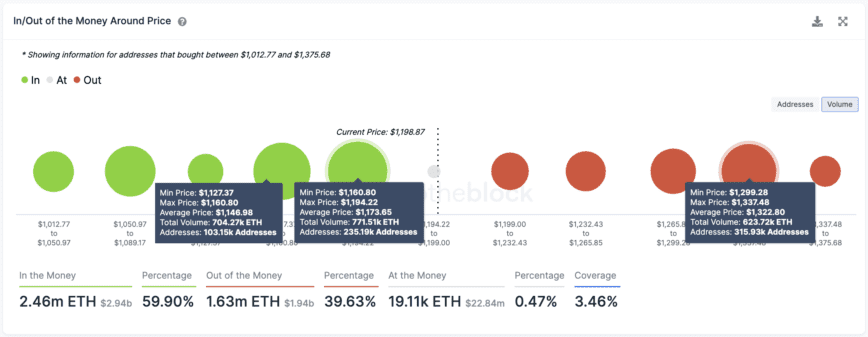

Transaction historical past exhibits that the realm between $1,130 and $1,190 represents a major help flooring for Ethereum. Right here, roughly 340,000 addresses have beforehand bought 1.44 million ETH. If costs can maintain above this demand zone, a rebound towards $1,330 might materialize.

The power of the downward transfer means that regardless of the significance of the $1,130 to $1,190 help, it is important to attend for affirmation earlier than anticipating a possible rebound. Dropping this help might end in a downswing to $1,000 and even $900.

It’s nonetheless not clear whether or not Bitcoin and Ethereum can acquire the power wanted to rebound. The macroeconomic setting stays bearish given the looming uncertainty within the international monetary markets. Could’s CPI information revealed that U.S. inflation is at 8.6%, hitting a 41-year excessive and considerably exceeding economists’ expectations.

Disclosure: On the time of writing, the writer of this piece owned BTC and ETH.

For extra key market developments, subscribe to our YouTube channel and get weekly updates from our lead bitcoin analyst Nathan Batchelor.