Key Takeaways

- Bitcoin and Ethereum have declined by greater than 8% over the previous 48 hours.

- One technical indicator means that each belongings may quickly rebound.

- Nonetheless, the excessive optimism ranges amongst merchants suggests {that a} quick squeeze could possibly be approaching.

Share this text

Bitcoin and Ethereum have reached very important assist ranges, gathering sufficient liquidity for a possible rebound. Nonetheless, from a long-term perspective, a long-squeeze seems to be underway.

Bitcoin, Ethereum on Shaky Floor

Bitcoin and Ethereum may quickly rebound, however the degree of optimism amongst merchants may spell hassle.

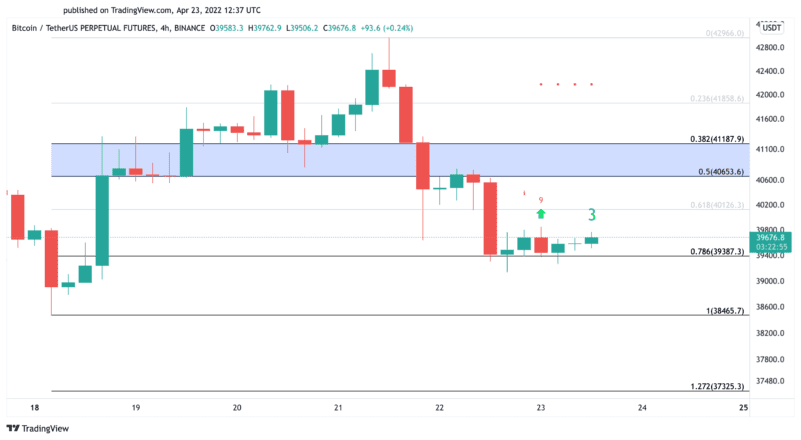

Bitcoin has misplaced greater than 4,000 factors in market worth over the previous 48 hours. The rejection from the $43,000 resistance degree on Apr. 21 led to the current correction. Nonetheless, it seems that Bitcoin could possibly be making ready to bounce off the assist degree.

The Tom DeMark (TD) Sequential indicator has offered a purchase sign on Bitcoin’s four-hour chart. The bullish formation developed as a pink 9 candlestick, which is indicative of a one to 4 candlesticks upswing. A spike in shopping for stress across the present worth ranges may assist validate the optimistic outlook, leading to an upswing to $40,650 and even $41,200.

It’s price noting that Bitcoin should maintain $39,400 as assist so the bullish thesis may be validated. Failing to carry above this very important assist degree may end in a steeper correction as the next very important demand zones sit at $38,500 and $37,300.

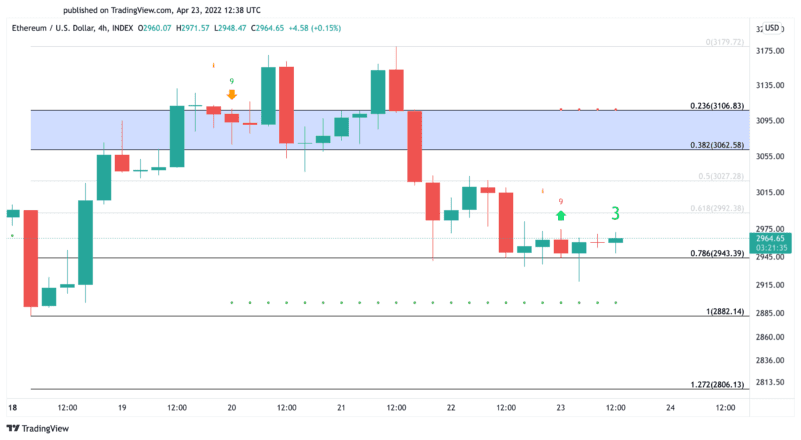

Ethereum additionally seems to be gathering momentum for a bullish impulse after retracing by greater than 8% prior to now 48 hours. So long as the asset continues to commerce above $2,950, it has an opportunity of rebounding. The TD Sequential indicator helps the optimistic outlook and has offered a purchase sign on Ethereum’s four-hour chart.

If purchase orders enhance across the present worth ranges, Ethereum may acquire over 150 factors in market worth. A decisive shut above $3,100 may result in additional beneficial properties whereas shedding $2,950 as assist may see the asset fall to $2,880.

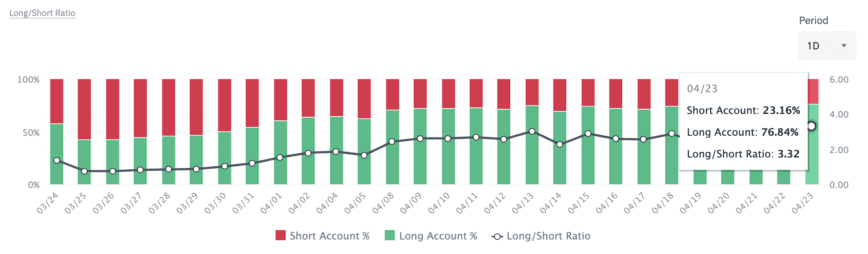

Though the technicals level to a rebound within the short-term future, present optimism ranges may be seen as a warning sign.

On Binance, roughly 77% of all accounts with an open place in Bitcoin are lengthy. The BTCUSDT Lengthy/Brief Ratio has risen to a 3.32 ratio as of Apr. 23. Most merchants on the main alternate predict costs to proceed rising, which may create the right circumstances for an extended squeeze.

Disclosure: On the time of writing, the creator of this piece owned ETH and BTC.