Information from Santiment reveals each Bitcoin and Ethereum at the moment lack the buying and selling volumes to justify their market caps.

Bitcoin And Ethereum NVT Ratios Are Each Bearish Proper Now

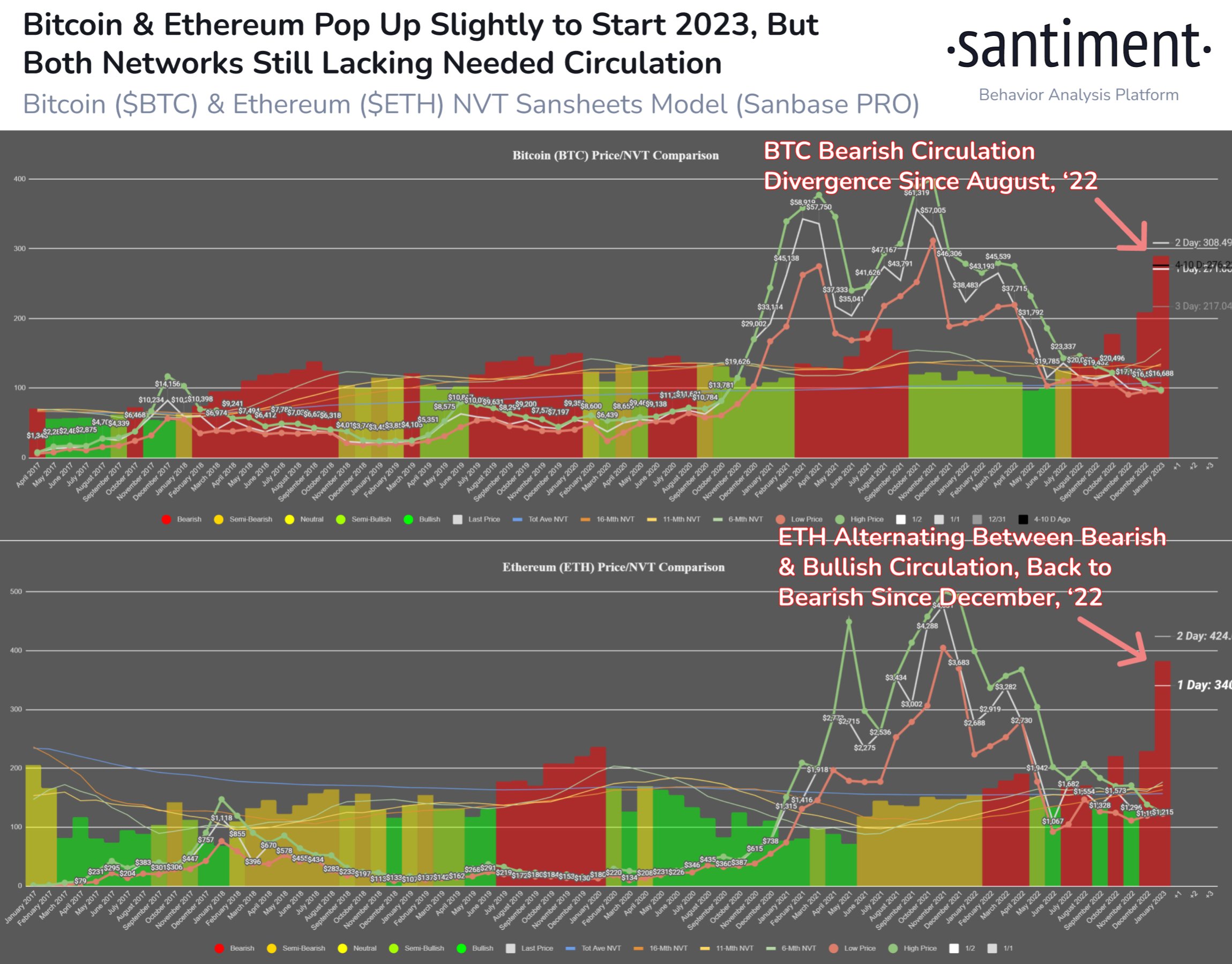

Based on the on-chain analytics agency Santiment, each the bitcoin and ethereum networks might want to see a pickup in exercise this 12 months. The related indicator right here is the “Community Worth to Transaction” (NVT) ratio, which measures the ratio between the market cap of any crypto and its transaction exercise.

Often, the buying and selling quantity is taken into account because the transaction exercise of a coin, however Santiment’s NVT ratio works otherwise. As a substitute of dividing the market cap by the volumes, this model of the metric makes use of the “each day circulation,” a measure of the overall variety of distinctive cash which have seen some motion prior to now day.

The benefit of the circulation indicator is that transactions, the place the identical cash bounce by a number of wallets, are solely counted as soon as in the direction of the measurement, whereas the conventional buying and selling quantity metric would have counted them as many occasions as they have been transferred. This helps remove duplicate transactions and offers a extra correct concept concerning the market exercise.

Now, what the NVT ratio tells us is how the market cap of Bitcoin or Ethereum at the moment compares in opposition to the exercise on the respective networks. Excessive values of the metric recommend the volumes are a lot decrease than the cap proper now, and therefore the coin could also be overvalued in the meanwhile. However, low values recommend the worth could also be undervalued.

Now, here’s a chart that reveals the place the NVT ratio has been valuing Bitcoin and Ethereum throughout the previous few years:

The worth of the metric appears to have been bearish for each the cash just lately | Supply: Santiment

Because the above graph reveals, the NVT ratio has been bearish for Bitcoin since August 2022. Which means in the previous few months, the circulation on the BTC community has remained fairly low when in comparison with the market cap of the crypto.

For Ethereum, the indicator’s worth had been switching between bearish and bullish all through 2022, however the coin appears to have ended the 12 months being overvalued because the circulation was bearish in December.

If the cryptos proceed to be overvalued in line with the NVT, then a correction could also be imminent for them. “The circulation fee of each networks want to choose up in 2023, and this week shall be telling as non-holiday days start,” explains Santiment.

BTC Value

On the time of writing, Bitcoin’s worth floats round $16,700, down 1% within the final week.

Seems like BTC has surged within the final couple of days | Supply: BTCUSD on TradingView

Featured picture from mana5280 on Unsplash.com, charts from TradingView.com, Santiment.web