Amidst a resurgence of curiosity within the digital forex house, Bitcoin as soon as once more takes heart stage in world finance, capturing the eye of traders worldwide. After enduring a chronic interval of uncertainty following the 2021 crypto sector collapse, Bitcoin’s current ascent to report highs indicators a exceptional turnaround, bolstered by the introduction of progressive funding autos and renewed retail enthusiasm.

The arrival of exchange-traded funds (ETFs) in the US marks a pivotal second for Bitcoin, bridging the hole between conventional investing and the burgeoning cryptocurrency market. In contrast to earlier iterations, these spot Bitcoin ETFs allow traders to achieve publicity to Bitcoin by means of regulated listings on main U.S. inventory exchanges, catering to the huge U.S. retail investor base.

In simply two months, these U.S. spot Bitcoin funds have attracted over US$8 billion in investments, with BlackRock’s iShares Bitcoin Belief alone amassing a staggering US$788 million in inflows on a single Tuesday. Such fast adoption underscores Bitcoin’s newfound accessibility and its rising enchantment amongst mainstream traders.

Greg Taylor, Chief Funding Officer at Goal Investments, emphasizes Bitcoin’s potential function as a diversifying asset inside conventional funding portfolios. Taylor asserts that Bitcoin’s resilience and resurgence make it an asset class that traders can not afford to miss.

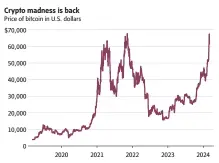

Since its nadir in November 2022, Bitcoin has surged by over 300%, culminating in a report excessive exceeding US$69,000. This exceptional comeback from the depths of the crypto selloff has reignited optimism amongst crypto fans, with bold worth targets now reaching six figures and past, together with projections of US$1 million.

Nonetheless, amidst the exuberance surrounding Bitcoin’s revival, cautionary tales from its tumultuous previous linger. The 2021 crypto increase resulted in a painful reckoning, with the collapse of FTX, a once-prominent crypto trade valued at US$32 billion, leaving traders reeling. In accordance with estimates by the Financial institution for Worldwide Settlements, greater than three-quarters of Bitcoin traders incurred losses throughout this era.

But, a number of elements distinguish the present Bitcoin resurgence from its earlier iteration. Improved regulatory oversight, coupled with the introduction of ETFs, presents traders a regulated avenue to entry Bitcoin with out the complexities of digital wallets. Regardless of these developments, skepticism persists relating to Bitcoin’s underlying legitimacy and potential volatility.

Whereas Bitcoin’s integration into the monetary mainstream signifies a big milestone, its inclusion in funding portfolios requires cautious consideration. Proponents advocate for Bitcoin as a diversifying asset, providing an alternative choice to conventional shares and bonds in portfolio building. As traders navigate this evolving panorama, Bitcoin’s resurgence prompts a basic reevaluation of conventional funding paradigms, highlighting the rising relevance of cryptocurrencies within the fashionable funding ecosystem.