Extensively adopted on-chain analyst Will Clemente says Bitcoin (BTC) purchase orders on crypto trade Coinbase are paying homage to BTC’s backside in March 2020.

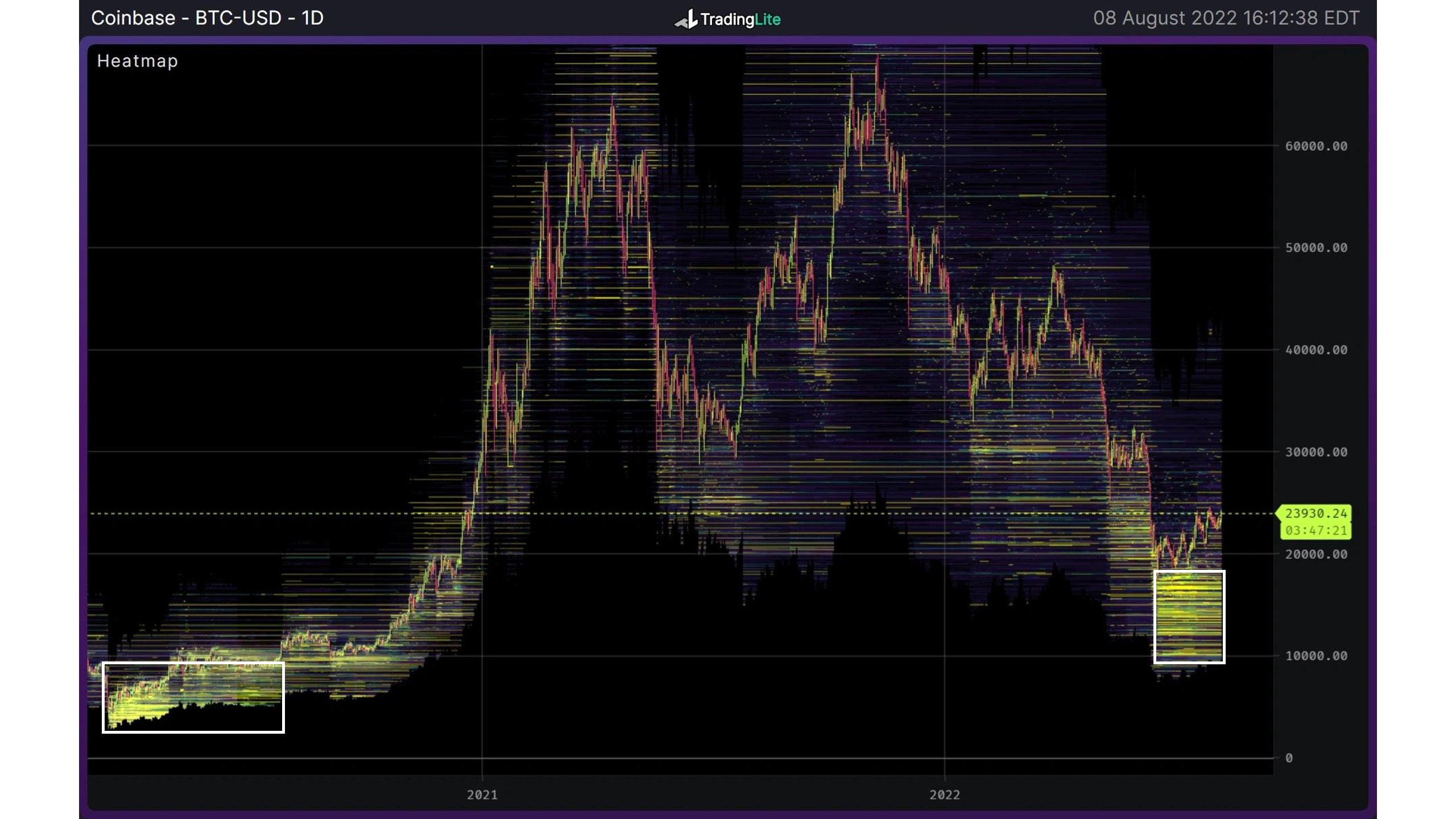

Clemente tells his 657,400 Twitter followers that BTC bulls on Coinbase have positioned thick purchase orders from $17,000 and under.

In response to the on-chain analyst, the eagerness of market contributors to catch BTC at decrease costs bodes nicely for the king crypto.

“Bids within the Bitcoin orderbook on Coinbase are stacked down from $17,000 and under. Lots of people are hoping to purchase BTC decrease. The final time the orderbook was this skewed to the bid-side was the grind up from the March 2020 lows.”

In March 2020, Bitcoin crashed to round $3,700 earlier than launching a large rally that propelled BTC to $64,000 a couple of 12 months later.

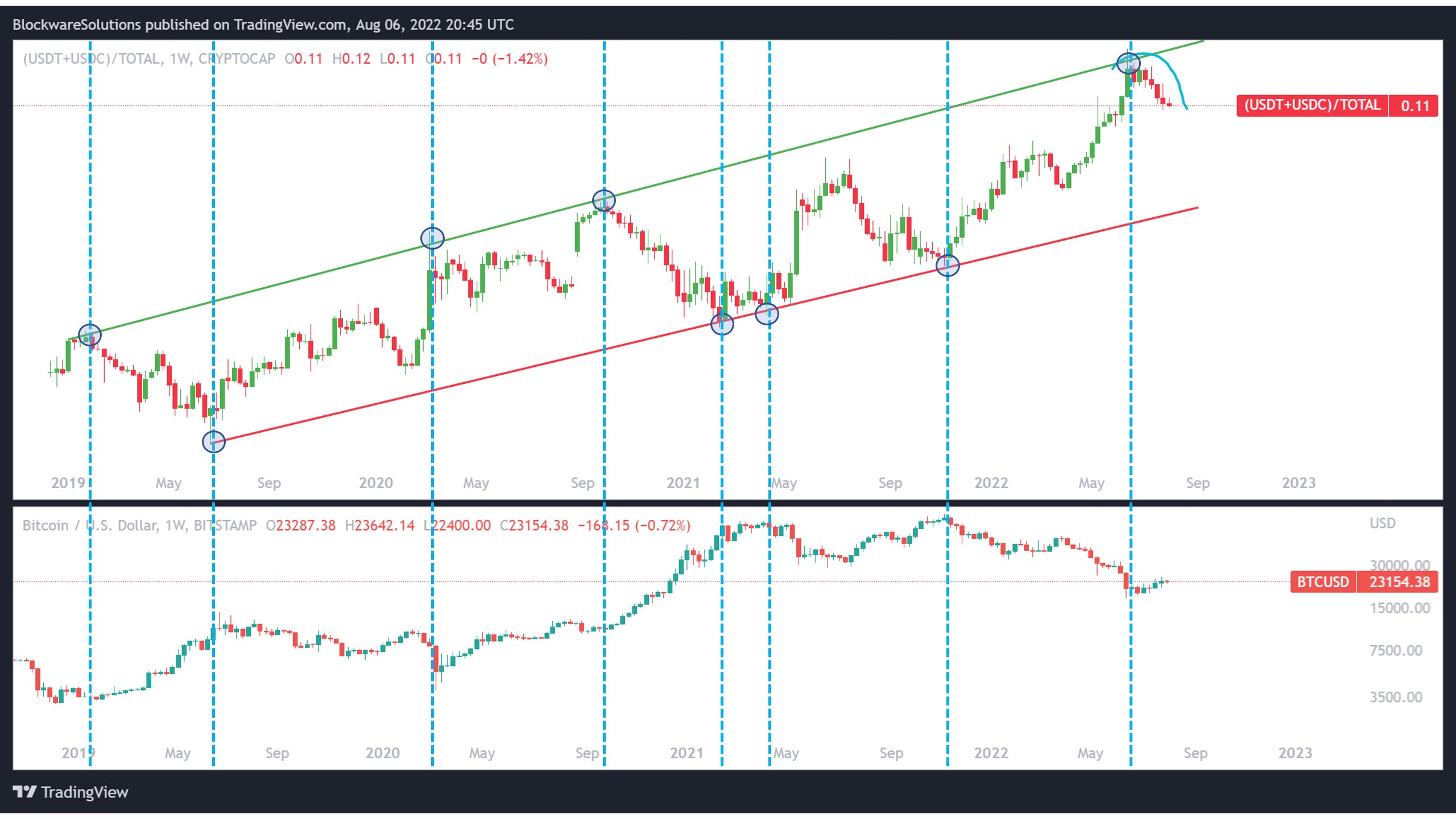

Clemente additionally has his eye on one other metric that has beforehand marked the tops and bottoms of Bitcoin. In response to the on-chain analyst, the ratio between the entire market cap of the 2 largest stablecoins and the entire crypto market cap can also be flashing backside alerts.

“USDC+USDT market cap/whole crypto market cap ratio continues to roll off of the historic bottoming space, respecting the channel bounds… Common thought is that when the ratio is excessive and at channel bounds, massive share of stables [are available] to be deployed relative to crypto market cap. When [ratio is] low, there’s loads of stables which have already been deployed.”

Though on-chain alerts look like favoring BTC bulls, Clemente warns that macroeconomic knowledge scheduled to be launched as we speak might derail Bitcoin’s bounce.

“CPI (client worth index) announcement on Wednesday dictates if this risk-on bear market rally continues within the quick time period.”

The CPI is a extensively tracked measure of the US inflation charge. Says Clemente,

“Inflation rolling over = Fed can take foot off fuel. Inflation persisting greater = Fed has to maintain foot on the fuel.”

The US Federal Reserve has been elevating rates of interest in an effort to fight inflation, a macroeconomic coverage that has saved the crypto markets bearish over the previous months.

At time of writing, Bitcoin is swapping fingers for $22,838, down 3% on the day.

Do not Miss a Beat – Subscribe to get crypto electronic mail alerts delivered on to your inbox

Test Worth Motion

Observe us on Twitter, Facebook and Telegram

Surf The Each day Hodl Combine

Disclaimer: Opinions expressed at The Each day Hodl should not funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your personal danger, and any loses you might incur are your accountability. The Each day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital property, neither is The Each day Hodl an funding advisor. Please word that The Each day Hodl participates in internet online affiliate marketing.

Generated Picture: Stablediffusion