D-Keine/iStock by way of Getty Photographs

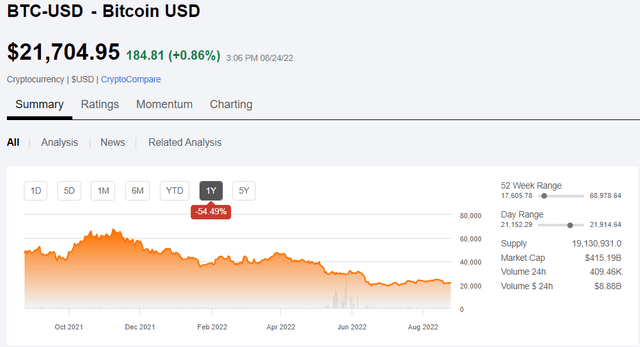

As I’m certain you already know, Bitcoin (BTC-USD) has dropped to lower than 1/3 of its peak worth.

SA

The related query is whether or not there will likely be a restoration, or if that is the start of the top.

These of us who work within the broader inventory market discuss with market drops as cyclical, implying that there’s a sure inevitability to an eventual restoration. Crypto purveyors whether or not that be the currencies or ancillary companies have adopted related language, referring to the unparalleled crash as a downturn, downcycle or the “Crypto Winter”.

After winter inevitably come spring and summer time, they usually need to convey that form of inevitability to a crypto restoration.

I posit that Crypto Extinction could be a extra correct time period.

On this article, I intend to make use of reasoning to point out 2 issues:

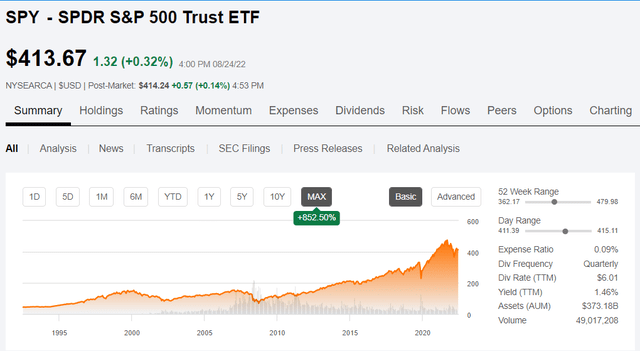

- Why the S&P 500 will all the time get well (barring excessive circumstances)

- Why we consider the crypto downturn is everlasting

I feel analyzing the explanations the broader inventory market has all the time recovered from crashes will assist illuminate the flimsiness of the belief that crypto may have an identical cyclical restoration.

Why the broader inventory market all the time recovers

Allow us to start with the factual commentary. The inventory market has crashed dozens of occasions over its multi century historical past, nevertheless it has all the time come again to achieve new highs.

Each market crash there are doomsayers suggesting this time is totally different. This would be the finish of the up marketplace for causes XYZ. In each case, these doomsayers have been confirmed mistaken because the inventory market proceeds to hit new highs in not too lengthy of a time span.

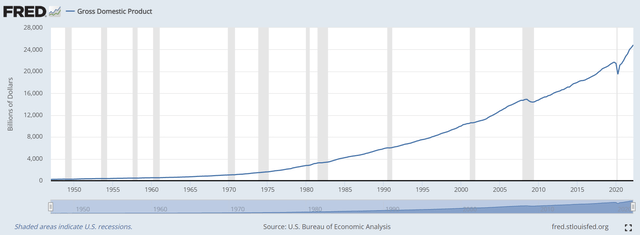

There may be an underlying mechanism that makes the restoration so dependable and seemingly inevitable – the regular upward march of U.S. GDP.

FRED

Particular person corporations can and do fail. Even complete sectors can change into out of date, however the economic system is a giant and various mechanism. As some corporations wrestle, others are rising. As total GDP grows, the market does and will go up.

Because the economic system grows, the earnings energy of the businesses comprising the inventory market will increase, which in flip causes their market costs to go up.

So, when funding professionals converse of market downturns as if they’re simply cyclical in nature and {that a} restoration is nearly inevitable, that isn’t hubris. That isn’t salesmanship. That could be a researched understanding of the perdurability of the underlying financial mechanisms.

Why Crypto purveyors attempt to persuade you it’s cyclical

I, after all, can not know the intent of others. I can solely study financial incentive. Those that personal crypto are economically incented to encourage others the costs will go up as a result of it will increase the worth of their portfolio.

Those that carry out crypto associated companies are incented to say crypto will get well as a result of when Bitcoin is greater the transaction quantity is greater and the charge earnings is greater.

Coinbase (COIN) is one such purveyor of crypto companies. CEO Brian Armstrong stated in an interview on CNBC:

“the downturn will not be uncommon, as Coinbase has been by way of 4 down cycles in 10 years”

He additionally stated.

“Hopefully it (the downturn) will likely be 12-18 months with a pleasant restoration”

That is roughly par for the course by way of how crypto insiders describe the “downturn”

Brian Armstrong’s sentiment might be completely real. I can not know his inside ideas, however I do suppose it’s price noting that COIN’s enterprise is reliant upon a crypto rebound, and thus he kind of has no alternative however to be bullish publicly.

I disagree with the of language getting used to explain the autumn of crypto on 2 counts:

- It fails to seize the magnitude of carnage

- It assumes it’s down for cyclical causes and can rebound

The crypto crash is way worse than even the extreme crashes of the broader market. The 2000 web bubble burst, the good monetary disaster and COVID had been the three largest drops in fashionable inventory market historical past.

None of them are near the magnitude of the drop in crypto.

SA

Coinbase is the most important alternate, and it’s down 80%. Bitcoin is the most important and most secure cryptocurrency, but it’s down over 66% from its highs. Most of the different cash are already extinct. Most of the different exchanges and servicers are declaring chapter.

That is absolute carnage, but the purveyors are calling it a cyclical downdraft.

A cyclical downdraft is what occurred to the broader market within the first half of 2022. The foremost indices had been down 10%, 15% or possibly 20% relying on which index you have a look at.

That could be a cyclical downdraft. Crypto 60%-80% down is a catastrophe.

Why Crypto’s declines should not cyclical

As crypto members are fast to level out, cryptocurrencies have been by way of downcycles earlier than and recovered. So this time ought to be no totally different, proper?

Effectively, because it seems, the earlier recoveries had been the results of enlargement of potential investor base by way of accessibility.

Cryptocurrencies themselves shouldn’t have fundamentals as a result of they don’t produce earnings or actually have a pathway to producing earnings, however the securities by which individuals personal them do have fundamentals within the type of the availability and demand of the securities/cash.

Any time one will increase the client pool for a safety, even when only a small share of the brand new potential traders find yourself shopping for, it has a constructive influence on the value of the inventory or on this case, coin. Bitcoin and different cryptos concurrently hit peak purchaser pool and peak adoption as a share of stated purchaser pool. That, I consider, made the highs seen final yr the all-time peak and I don’t suppose it’s believable to return there as a result of that degree of hype can’t be replicated.

Excellent storm of hype and entry

When bitcoin first began out, it was solely accessible to probably the most tech-savvy individuals and was largely simply held by the miners. Its meteoric worth rise was the results of continuous enlargement to the pool of traders by way of accessibility.

Crypto is now held by individuals who till very just lately didn’t even have funding accounts. One can commerce crypto on their telephone with just some clicks. Accessibility has reached some extent of ubiquity such that I do not see a approach for there to be no extra good points by way of elevated investor pool. Hype hit a excessive when billions of {dollars} had been being spent by crypto purveyors, filling up an enormous share of advert house throughout the web, TV and even billboards. I don’t suppose one can throw extra advert {dollars} on the house than LeBron James promoting crypto in a Superbowl advert.

The hype was not only a product of promoting, but in addition a momentum pushed phenomenon. Folks love bragging, and the large crypto good points offered a possibility to brag. I had a robust feeling crypto was nearing its peak after I began to overhear health club bros telling one another about their sick Ethereum good points (ETH-USD).

Bragging is simply part of human nature. It’s evolutionarily bred into us as a approach of accelerating social standing. I like bragging too, which is why I’m going to inform you I wrote a brief thesis on Shiba Inu when it was at greater than double at present’s worth and a brief thesis on Coinbase when it was practically triple at present’s worth.

After the crypto collapse, nonetheless, I consider that hype prepare is lifeless. Bragging about crypto good points has been changed by reluctant admissions of former possession, akin to the best way that one would admit to having executed some silly issues again in faculty.

Maybe one space of remaining enlargement to the investor pool is larger establishments equivalent to BlackRock getting concerned. That would certainly be a supply of incremental demand, however I do not see it as prone to outweigh all of the headwinds from decreased hype.

As such, the investor pool enlargement mechanism that induced earlier crypto rebounds off lows seems weak.

I don’t see any substitute mechanisms that might result in a restoration. In contrast to the S&P, crypto doesn’t have earnings to tug it again up. See, when the S&P will get low-cost, the earnings yield will get greater, main to larger dividends and extra retained capital to additional develop these earnings and dividends.

Thus, the cheapness of the S&P causes the investments to get more and more enticing, thereby pulling costs again up.

Crypto doesn’t get low-cost on valuation because it drops. It doesn’t have earnings to tug it again up. I see no purpose that it’s going to not merely go to zero. Whereas I’m assured the crypto extinction has begun, I’m additionally fallible, so let us take a look at the dangers to shorting Bitcoin.

Dangers to shorting BTC

One of many challenges of shorting normally is that to make it work you not solely must be proper, however the pathway issues. For instance, even when I’m appropriate about BTC ultimately going to zero, if it had been to rebound to say $100K per coin earlier than then it’d trigger important monetary stress and drive brief sellers to cowl.

Thus, to revenue on a brief, one must not solely be proper concerning the vacation spot, but in addition be capable to deal with the vicissitudes of the pathway. As such, it could be sensible to maintain brief positions slightly small.

This pathway threat is probably better with Bitcoin than it might be with a traditional inventory as a result of it’s a momentum pushed story, which implies it could possibly have big strikes over brief durations of time.