- Glassnode launched a report detailing Bitcoin’s efficiency in the course of the bear market and the potential for a get away from present ranges.

- The report highlights that Bitcoin is performing equally to the way it did in different bear markets and may have extra time to reply and transfer.

- The profitability of long-term holders can also be at 60%, however a subset of long-term holders are seeing capitulations.

The crypto market is trying rather more optimistic because it heads into the brand new yr, with Bitcoin holding regular above the $20,000 stage. Different crypto property have additionally been doing nicely, most notably Dogecoin (DOGE), however the market’s greatest asset is the place all eyes are on. The crypto market had been in a rut for a lot of months, with volatility additionally hitting lows.

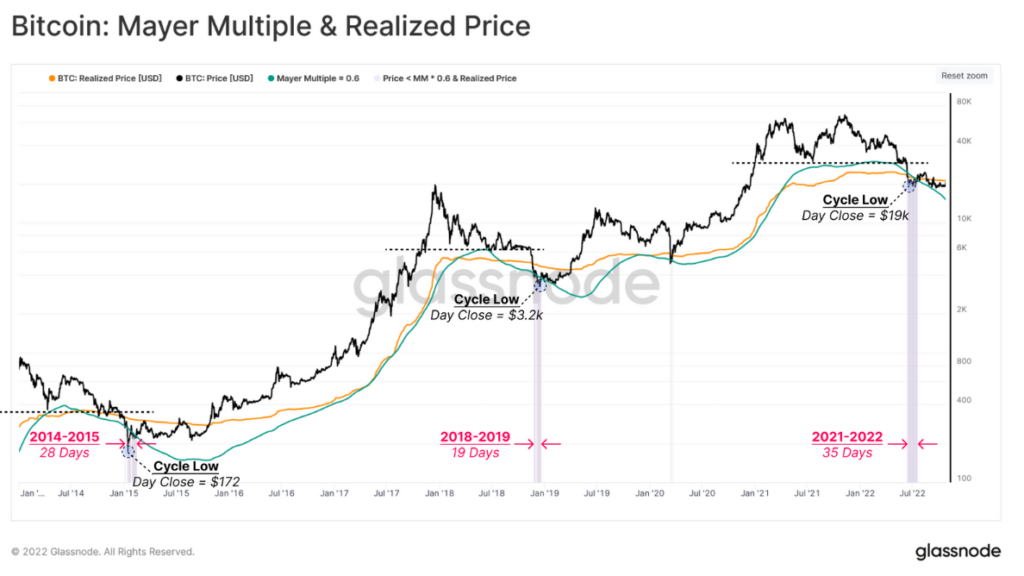

Nonetheless, latest actions point out that the market could also be heading out of its stagnant state and into a possible bullish interval. Glassnode reported that Bitcoin’s latest worth historical past is one that ought to create some tentative optimism. The corporate makes use of Bitcoin’s realized worth and the Mayer A number of to gauge the place of the cryptocurrency.

Glassnode beforehand described the underside discovery section of the market, saying that this begins when the worth falls via the first bear market flooring. It notes that the worth has traditionally discovered itself between the realized worth and the Mayer A number of decrease band. The latter is the ratio between the worth and the 200-day easy transferring common, which is utilized in analyses in conventional finance.

The report states that after the underside formation has been recognized, the following step is discovering the potential worth fluctuation vary. As per Glassnode’s knowledge, the perfect worth ranges for the underside formation are the realized worth of $21,000 and the balanced worth of $16,500. Nonetheless, it’s fast to notice some caveats,

“In comparison with historic priority, the worth has traded inside this vary for ~3 months, compared to prior cycles which lasted between 5.5 and 10 months. This implies length could stay a lacking element from our present cycle.”

Lengthy-Time period BTC Holders Profitability at 60%

The Glassnode report additionally discusses the provision profitability of long-term holders. This determine is at 60%, whereas the whole % provide in revenue is at 57%. At this level, for this to point {that a} restoration is on the horizon, Bitcoin spot costs must attain $21,700.

Nonetheless, Glassnode does level out {that a} subset of long-term holders see capitulations. It says that the typical long-term holder who has endured full cycles of volatility has underperformed in comparison with the broader market.

In conclusion, Glassnode stories that the 2022 flooring lacks a level of length, which signifies that it might require a further section of redistribution to check buyers. Glassnode basically highlights that Bitcoin is appearing because it did in different bear markets, however that point and maybe a brand new inflow of buyers might push the asset ahead.