On-chain analyst Willy Woo says Bitcoin (BTC) is seeing traditionally unparalleled spot market demand regardless of the underwhelming value motion that has unfolded over the past a number of weeks.

The favored analyst tells his a million Twitter followers that institutional capital is pouring into Bitcoin whereas BTC’s value motion emulates late 2020, simply earlier than crypto markets went on huge rallies.

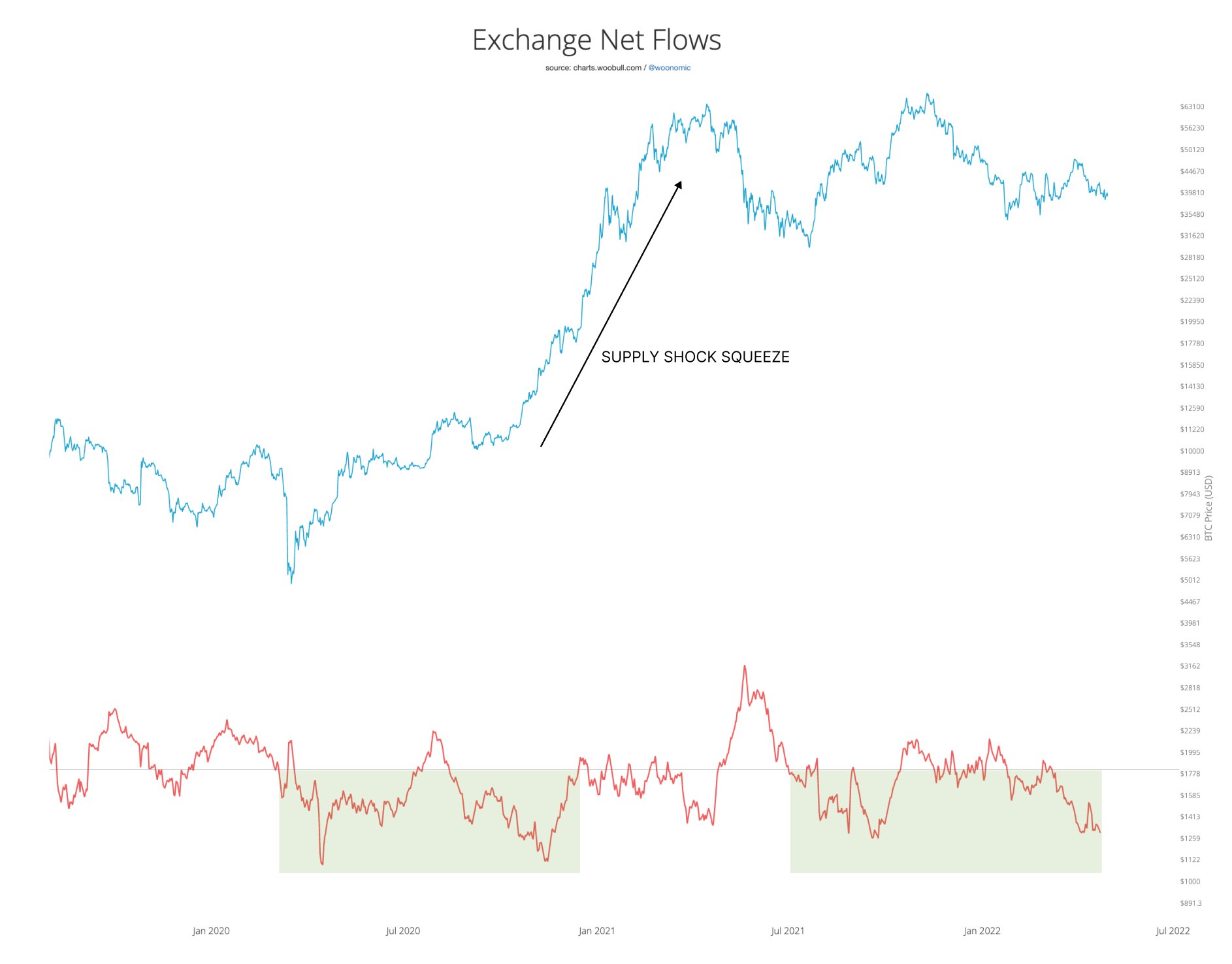

“Bitcoin value is sideways as a result of Wall St is promoting futures contract in a macro risk-off commerce. In the meantime, institutional cash is scooping spot BTC at peak charges and transferring to chilly storage.

It’s occasions like these I bear in mind the This fall 2020 provide shock squeeze.”

In response to Woo, buyers could already be BTC as a reputable safe-haven asset class given Bitcoin’s potential to avoid an entire collapse within the face of a steep inventory market correction.

“BTC value holding up properly whereas equities tank and USD Index moons is testomony to the unprecedented spot shopping for taking place proper now.

In different phrases: buyers already see BTC as a secure haven. It’s going to take time for value to mirror. Look forward to the futures sells to expire of ammo.”

Within the quick time period, Woo says Bitcoin faces headwinds from macroeconomic components. Nonetheless, he notes that the USD greenback index (DXY) is at a vital resistance stage, which might end in a rejection that might support Bitcoin and different belongings in igniting rallies.

Woo additionally factors out to veteran commodities dealer Peter Brandt that the TD (Tom DeMark) sequential, an indicator that makes an attempt to establish turning factors in traits, has flashed a serious bearish reversal sign for DXY.

When the TD sequential information 9 consecutive candles above the closure of the 4 prior candles, it prints a TD9 sign. Woo says the DXY has formally flashed a TD9, which might have massive implications for Bitcoin and different belongings within the close to future.

TD9 reversal on the month-to-month and weekly candles. Will probably be attention-grabbing to see what occurs subsequent week.

— Willy Woo (@woonomic) April 28, 2022

At time of writing, Bitcoin is buying and selling at $38,117.

Examine Worth Motion

Do not Miss a Beat – Subscribe to get crypto e-mail alerts delivered on to your inbox

Observe us on Twitter, Facebook and Telegram

Surf The Every day Hodl Combine

Disclaimer: Opinions expressed at The Every day Hodl usually are not funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital belongings. Please be suggested that your transfers and trades are at your personal threat, and any loses you might incur are your accountability. The Every day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital belongings, neither is The Every day Hodl an funding advisor. Please notice that The Every day Hodl participates in online marketing.

Featured Picture: Shutterstock/SergZSV.ZP/Gorodenkoff