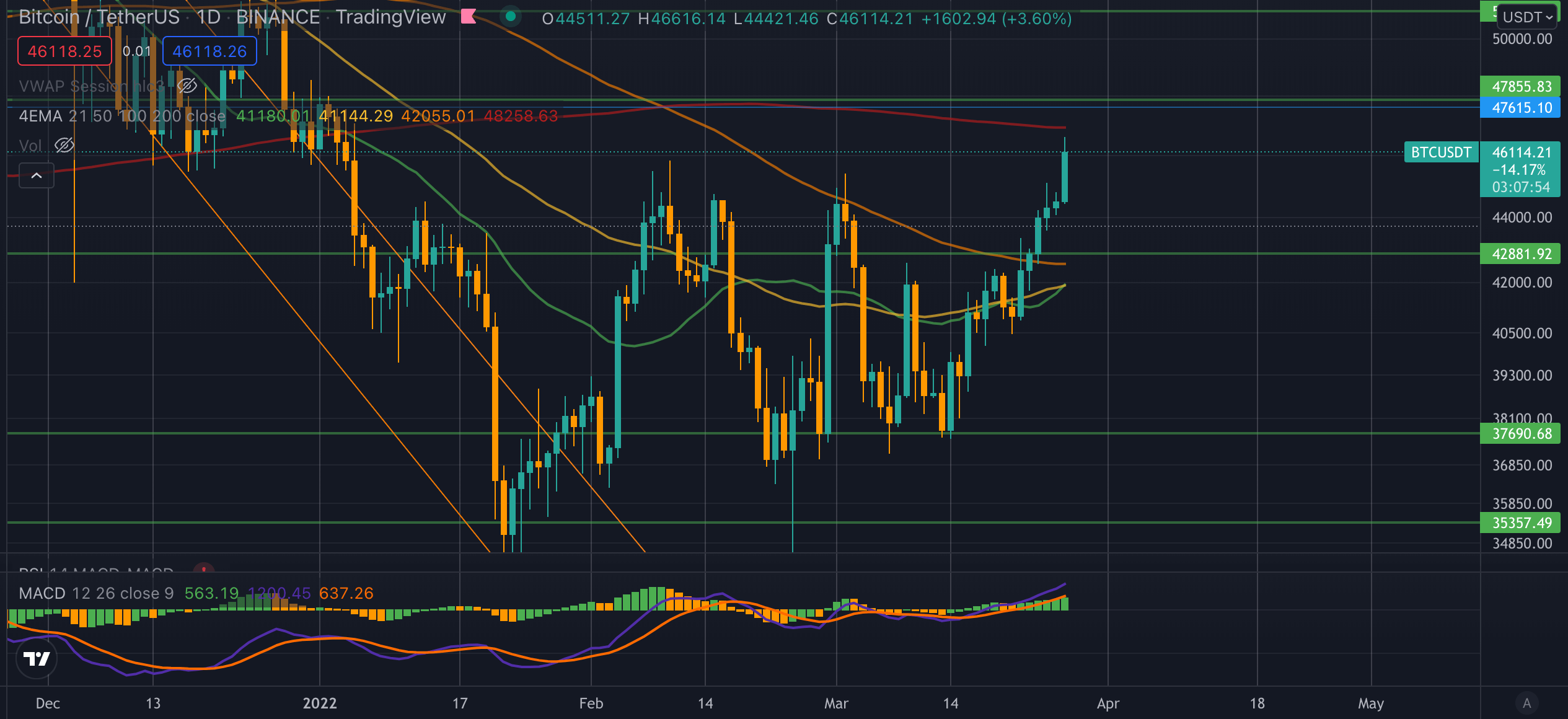

Bitcoin has simply pumped to its highest stage since January 4 to create a weekly shut above $45,500 for the primary time in 2022. The transfer is a bullish signal as BTC breaks the $44,500 resistance that has seen a rejection thrice already this 12 months.

The breakout probably validates the falling wedge sample that might be seen on the day by day chart as we now have seen repeated increased lows all 12 months. Nevertheless, whereas technical evaluation can provide notable short-term buying and selling alerts, they don’t seem to be at all times dependable indicators for long-term investing. There isn’t any precise science to technical evaluation. To get an entire image of why Bitcoin could also be breaking out, we have to take a look at the broader socio-economic setting.

The 12 months has seen sturdy information for crypto, which has been in headlines worldwide, from donations to assist Ukraine within the face of Russian aggression to constructive sentiment from the E.U. and U.S. legislators.

Many believed we now have moved out of the period of crypto prospecting and right into a interval of crypto adoption and blockchain infiltration into the mainstream. Whereas Bitcoin should be down 30% from all-time highs, it has weathered 2022 properly with comparatively low volatility by its personal requirements. Its correlation to the S&P500 not too long ago hit a 17 month excessive, showcasing simply how secure it has been.