Mining

Bitcoin ASIC miners — machines optimized for the only real function of mining Bitcoin — are presently promoting at bottom-of-the-barrel costs not seen since 2020 and 2021, in what’s being considered as one other signal of a deepened crypto bear market.

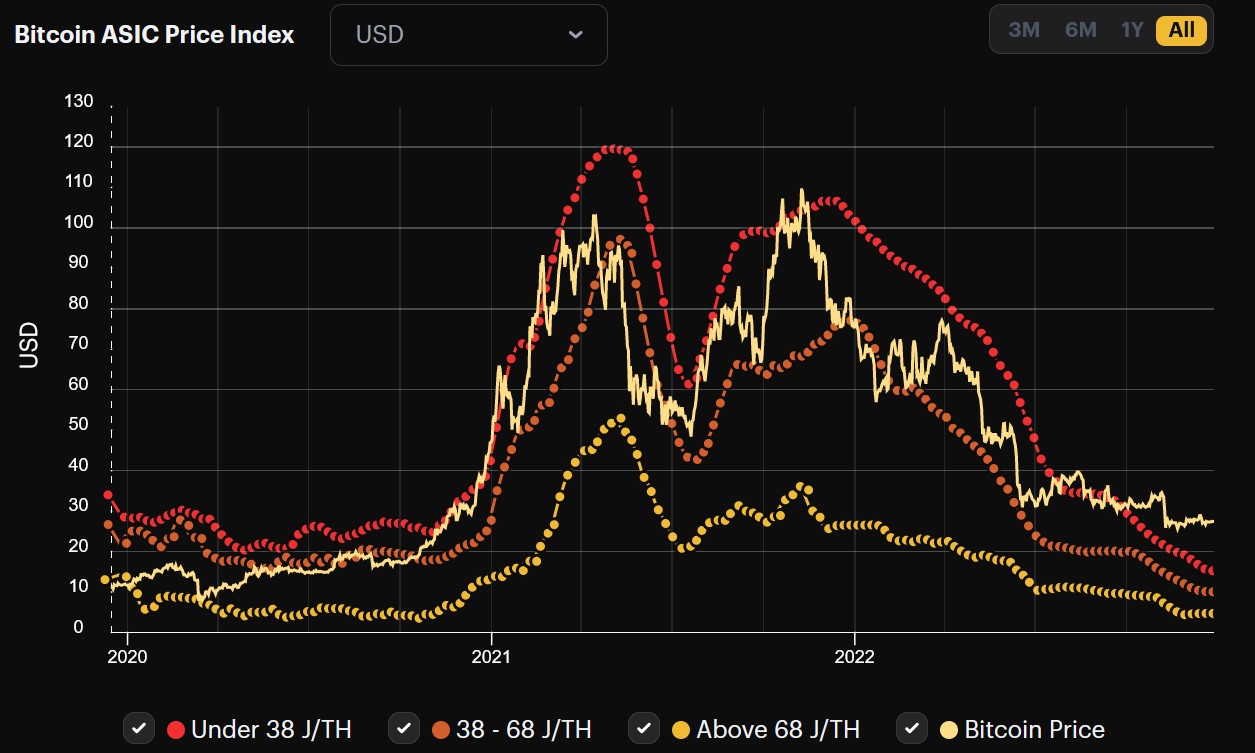

Based on the most recent knowledge from Hashrate Index, probably the most environment friendly ASIC miners, these producing at the very least one terahash per 38 joules of power, have seen their costs fall 86.82% from Could. 7, 2021 peak of $119.25 per terahash all the way down to $15.71 as of Dec. 25.

Miners in these class embody Bitmain’s Antminer S19 and MicroBTC’s Whatsminer M30s.

The identical assertion holds true for the mid-tier machines, with costs now averaged out at $10.23 after falling an enormous 89.36% from its peak value of $96.24 on Could. 7, 2021.

Nonetheless, the least environment friendly machines, ones that require greater than 68 Joules per TH, at the moment are priced at $4.72, a 91% drop from its peak value of $52.85. The final time it was priced close to this was round Nov. 5, 2020.

Bitcoin ASIC Miner Value Index for machines with various ranges of effectivity. Supply: Hashrate Index.

The autumn in costs has largely been attributed to massive Bitcoin mining corporations which have struggled to stay worthwhile all through the bear market, with many both submitting for Chapter 11 chapter, taking up debt, or promoting their BTC holdings and gear so as to keep afloat.

Among the many companies to have finished that embody Core Scientific, Marathon Digital, Riot Blockchain, Bitfarms and Argo Blockchain.

Associated: Bitcoin miner outflow ratio hits 6-month excessive in new menace to BTC value

However the steep value fall has been met with some eager consumers. Amongst these embody many Russian-based mining services like BitRiver who’re capable of capitalize on comparatively low electrical energy prices, with some up-to-date {hardware} able to mining one Bitcoin (BTC) at about $0.07 per kilowatt-hour within the energy-rich nation.

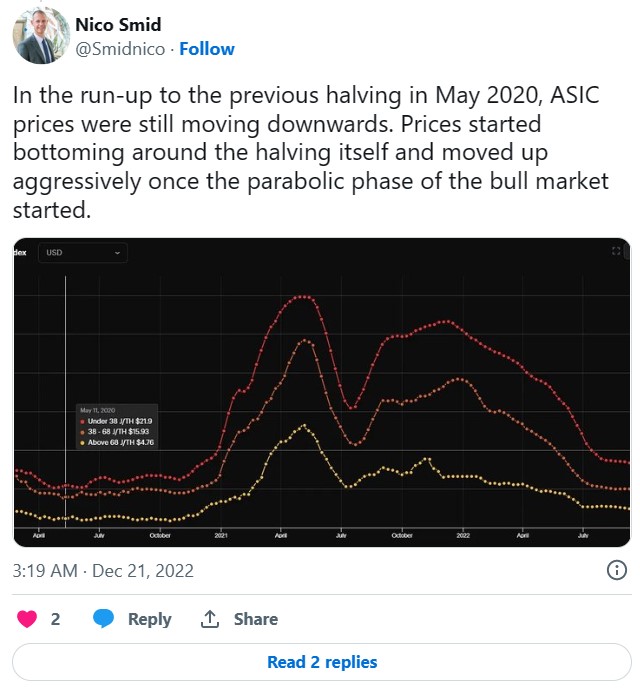

Whereas it’s arduous to foretell what value course ASIC miners will head towards subsequent, Nico Smid of Digital Mining Options identified in a Dec. 21 tweet that ASIC miner costs bottomed at Bitcoin’s final halving cycle in Could. 11, 2020 and moved up aggressively shortly after — one thing which may play out in Bitcoin’s subsequent halving cycle which is anticipated to happen on Apr. 20, 2024.

Supply: Twitter