Key Takeaways

- Crypto and world monetary markets are bracing for a busy week forward of the following FOMC assembly, main earnings stories, and the Q2 GDP report.

- Bitcoin and Ethereum trended down early Monday and look poised for volatility over the following few days.

- The highest two crypto property are at present sitting on important assist.

Share this text

Uncertainty is mounting round Bitcoin and Ethereum forward of this week’s Federal Open Market Committee. Moreover, upcoming earnings stories from America’s 5 largest tech firms and different stories might affect crypto costs over the following few days.

Bitcoin and Ethereum Brace for Volatility

Volatility has struck the cryptocurrency market as hypothesis mounts round a collection of extremely anticipated conferences this week.

Of explicit significance to crypto market contributors is the following Federal Open Market Committee, which is scheduled to happen on Wednesday, July 27. The Fed is broadly anticipated to implement one other 75 foundation factors rate of interest hike in a bid to curb U.S. inflation, which final month hit a 40-year excessive of 9.1%. A price hike might incentivize some crypto traders to promote of their holdings and take income as excessive curiosity environments are inclined to negatively affect risk-on property.

The U.S. gross home product for the second quarter of the yr can also be on account of print this Thursday, which might spark additional fears round the potential of a U.S. recession. The economic system shrank by 1.6% within the first quarter, and it’s anticipated that this week’s studying will present a development of 0.5% within the second quarter. Nonetheless, if the expansion is slower than anticipated or one other retraction is printed, it might be seen as one other signal that the U.S. has entered a recession.

Moreover, earnings stories from Apple, Microsoft, Alphabet, Amazon, and Meta might give a sign of the well being of the U.S. economic system, doubtlessly resulting in volatility in world and crypto markets.

Forward of one of many busiest weeks of the summer season for crypto, Bitcoin dropped 3.7% early Monday. The main cryptocurrency declined from a excessive of $22,580, hitting a low of $21,750. Though it has rebounded in the previous few hours to hit $22,050 at press time, its subsequent transfer stays unclear.

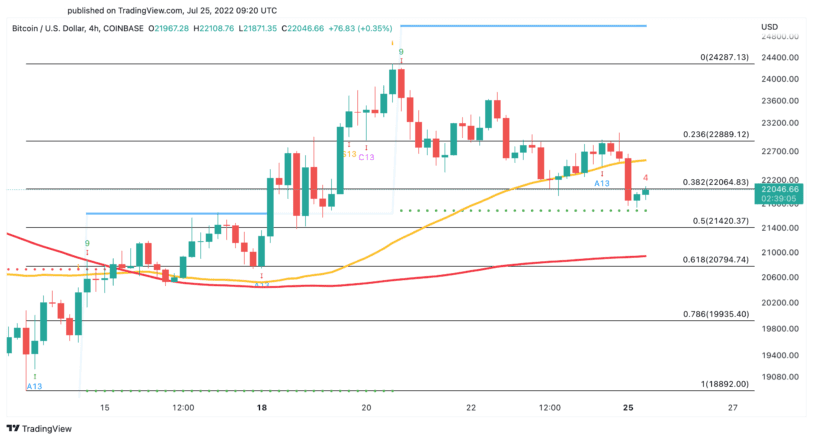

On the four-hour chart, Bitcoin’s latest exercise is pointing to a vital worth level. The Tom DeMark (TD) Sequential indicator’s assist trendline at $21,700 wants to carry to keep away from additional losses. If Bitcoin fails to carry this stage, it might endure a downswing towards the 200-hour shifting common at round $20,800.

Bitcoin would possible should slice by the 50-hour shifting common at $22,700 to have an opportunity of printing increased highs. Overcoming this important resistance stage may give it the power to retest its July 20 excessive at $24,290.

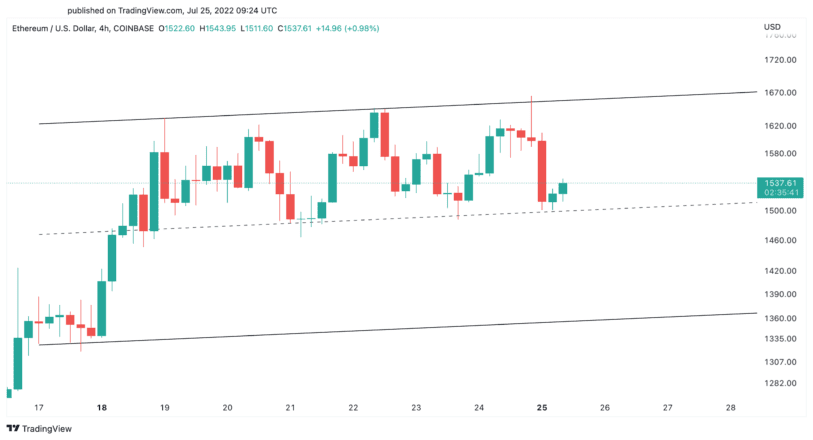

Ethereum has additionally kicked off the week within the crimson, dropping over 100 factors in market worth. The sudden downswing pushed ETH to the decrease boundary of a parallel channel at $1,500, the place costs have been consolidating for the previous week. This significant assist space should maintain to keep away from triggering a retracement to $1,360.

Based mostly on the latest worth motion, Ethereum seems to be prefer it might want to print a four-hour candlestick shut above $1,670 to advance additional. If it succeeds, it could have higher likelihood of a breakout towards $1,850.

Disclosure: On the time of writing, the creator of this function owned BTC and ETH.

For extra key market traits, subscribe to our YouTube channel and get weekly updates from our lead bitcoin analyst Nathan Batchelor.