Bitcoin and Ethereum miners noticed a steep decline in income through the month of Could as costs of each cryptocurrencies fell to new native lows.

Could proved to be one of many worst months for Bitcoin miners in 2022. In keeping with Be[In]Crypto analysis, BTC miners had been in a position to generate roughly $906.19 million in income through the fifth month of the 12 months.

Supply: Bitcoin Miner Income Chart by YCharts

Bitcoin miners’ income for Could was down $253.81 million from April 2022’s worth of round $1.16 billion.

The overall profitability of Bitcoin over the previous 12 months was down by 37% since Could 2021, which noticed $1.45 billion in income recorded.

The one-day excessive for Could 2022 was 11% under the very best day excessive in April. The one-day excessive for April was $46.01 million, based on information from YCharts. The one-day excessive for Could was within the area of $40.53 million and this was 32% decrease than the very best day excessive of $60.16 million in January 2022.

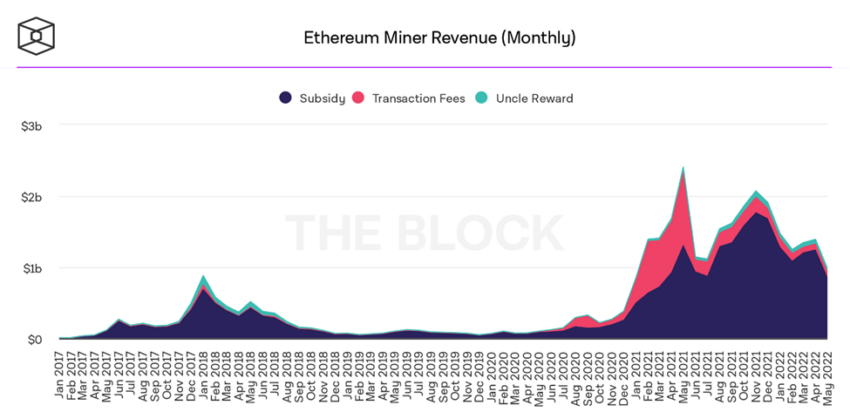

Ethereum outpaces Bitcoin mining income for the fifth consecutive month

Whereas Bitcoin miners managed $906.19 million in Could income, Ethereum miners generated round $1.01 billion.

Like Bitcoin, Ethereum’s income decreased by 27% from April. April 2022 noticed Ethereum mining convey forth whole income of $1.39 billion. Ethereum mining additionally noticed a year-over-year month-to-month decline in Could. Could 2021 noticed roughly $2.4 billion in income generated, whereas 2022’s determine dipped by 57%.

Supply: Ethereum Miner Income Chart by the Block Crypto

Miners nonetheless revenue extra from Ethereum in Could 2022

Regardless of the market crash of Could 2022, Bitcoin stays the biggest cryptocurrency by market capitalization. With that mentioned, miners continued to learn extra from Ethereum than Bitcoin.

Earlier than Ethereum miners’ income surpassed Bitcoin in Could, ETH outpaced BTC by $260 million in January, $190 million in February, $130 million in March, and greater than $230 million in April.

What brought on the crash in mining income?

To grasp the crash in mining income, we should always focus on how mining income is calculated. We calculate miners’ income by multiplying the worth of a coin (BTC or ETH) by the overall variety of cash earned in a given interval.

Sinking cryptocurrency costs brought on by the market crash of Could will be credited as the first trigger for waning mining revenues.

Ethereum mining income decreased from April 2022 due to buying and selling within the vary of $2,000 to $3,000 within the first 11 days of Could. The final 20 days noticed ETH buying and selling extra within the vary of $1,700 to $2,000.

In April 2022, Ethereum traded within the vary of $3,000 to $4,000 per coin for almost all of days. Total, ETH opened at $2,730 on Could 1, and closed Could 31, at $1,942. This equated to a 28% decline in Ethereum’s opening and shutting value in Could.

Supply: ETH/USD Chart by TradingView

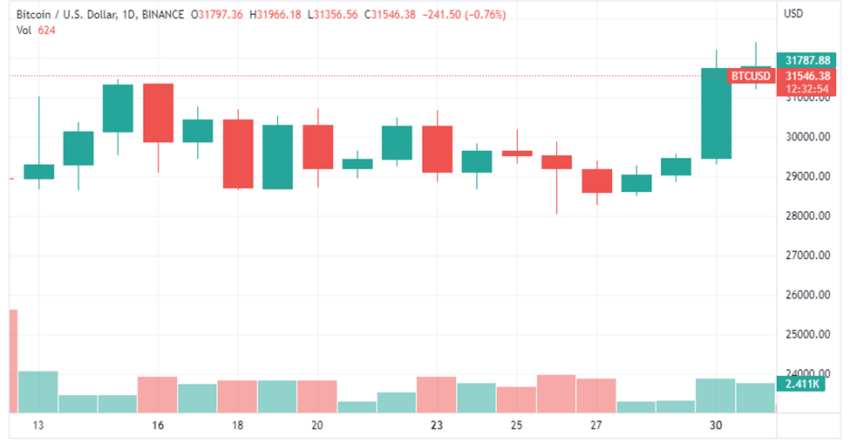

Alternatively, Bitcoin spent the primary 9 days of Could buying and selling within the vary of $30,000 to $40,000. Within the final 22 days, BTC traded extra within the value vary of $25,000 to $32,000. In April 2022, Bitcoin spent nearly all of its days buying and selling between $37,000 and $44,000. Total, BTC opened at $37,713 on Could 1 and closed at $31,792 on Could 31. There was a 15% drop in BTCs opening and shutting value in Could.

Supply: BTC/USD Chart by TradingView