Fed minutes from the Nov. 2022 Federal Open Markets Committee Assembly reveal that the majority Fed officers see charge hikes softening quickly.

Nonetheless, some officers famous that the terminal charge, i.e., the speed at which inflation is anticipated to achieve the Fed’s goal of round 2%, was larger than beforehand anticipated.

Fed minutes trigger main indexes and crypto to rally

After the minutes had been launched, the S&P 500 inched 0.4% larger. Treasury yields dropped, and the Dow Jones Industrial Common rose 0.2%. The Nasdaq spiked 0.7%.

“Wanting by the Minutes there may be nothing terribly shocking with officers suggesting that slowing the tempo of proper hikes would enable the Fed to higher assess progress in direction of its objectives ‘given the unsure lags’ related to financial coverage,” stated Michael Reinking, an NYSE market strategist.

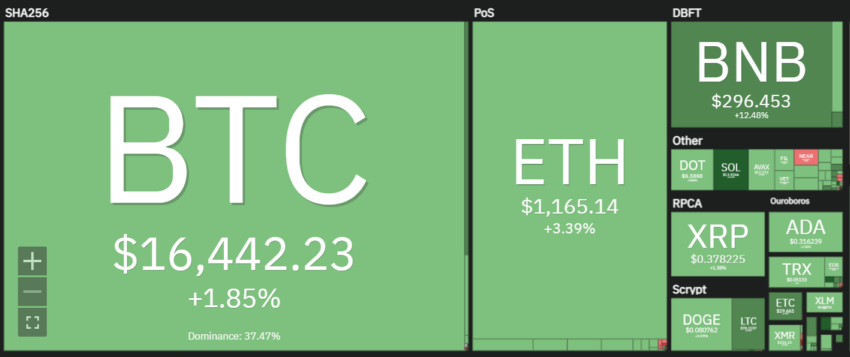

Bitcoin responded positively to the information, up nearly 3% to round $16,700 within the final 24 hours, with Ethereum surging 4.75% to alternate fingers at $1,177.52.

High-10 memecoin Doge rose 4.8% to $0.082, whereas BNB went up by 13.2%.

Although Fed minutes are usually outdated, as inventory markets have already absorbed the result of the earlier assembly, they reveal the Fed’s outlook on the U.S. economic system and supply perception into the financial institution’s future actions.

Fed officers decry the unsure ‘lag’ in financial response

The minutes come on the again of U.S. employment information launched on Nov. 19, 2022, revealing indicators of a slowdown in hiring. The week ended Nov. 19, 2022, noticed 240,000 unemployment claims, above estimates of 225,000. This comes as tech and crypto-related layoffs flood the information, stabilizing the stability between job provide and demand.

A decrease month-on-month core Shopper Value Index in Oct. 2022 in comparison with Sep. 2022 additionally confirmed indicators of cooling inflation. Nonetheless, assembly individuals nonetheless really feel it’s too excessive and predicted that lower-than-expected GDP development would assist stability provide and demand.

“With inflation remaining far too excessive and exhibiting few indicators of moderating, individuals noticed {that a} interval of below-trend actual GDP development could be useful in bringing combination provide and combination demand into higher stability, lowering inflationary pressures, and setting the stage for the sustained achievement of the Committee’s aims of most employment and worth stability, ” the report reads.

The committee additionally admitted that regardless of indicators of the Fed’s rate of interest hike coverage affecting costs, it’s nonetheless difficult to foretell the lag between Fed motion and financial response.

Fed minutes roils analyst

Technical analyst Sven Henrich factors out the evident omission of any reference to a 2023 recession within the Fed minutes, slamming the group for being dishonest.

Certainly, the rising unfavorable unfold in treasury yields has been a predictor of earlier recessions. A recession may are available Q1 of 2023, however solely be made official in Q2 or Q3. Earlier this month, the distinction between 10Y and 3M yields was round -0.4%.

“Recession appears increasingly doubtless for the upcoming yr and if the Fed responds accordingly [slower hikes], a recession could grow to be quick and shallow,” stated Jeffrey Roach of LPL Monetary.

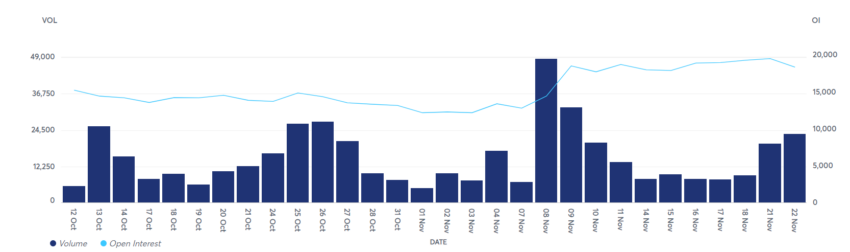

Regardless of the current Bitcoin worth enhance, open curiosity on CME’s Bitcoin futures contracts is surging as Wall Road continues to wager on the decline within the worth of Bitcoin.

Some analysts consider will contact the $10,000 mark earlier than the top of 2022. At press time, the world’s largest crypto had shed earlier positive factors, and is down 0.5% to under $16,500.

For Be[In]Crypto’s newest Bitcoin (BTC) evaluation, click on right here.

Disclaimer

All the data contained on our web site is printed in good religion and for common info functions solely. Any motion the reader takes upon the data discovered on our web site is strictly at their very own threat.