Key takeaways:

- The variety of Bitcoin addresses holding a number of BTC has hit a brand new all-time excessive of 841,224

- The present ranges between the native low of $26,700 and $32k could be thought-about by some merchants as purchase ranges

- Bitcoin analyst, MagicPoopCannon, suggests a bounce to $35k is possible regardless of indicators of weak point on the $29k value space

- BTC analyst, Timothy Peterson, has forecasted that the subsequent three to 12 months will most likely be an opportune time to load up on Bitcoin

Bitcoin has hit a brand new important milestone by way of holders of a number of BTC. In line with the group at Glassnode, the variety of BTC addresses holding a number of Bitcoin has reached a brand new all-time excessive of 841,224.

The group shared their commentary on Bitcoin by the next Tweet and accompanying chart.

? #Bitcoin $BTC Variety of Addresses Holding 1+ Cash simply reached an ATH of 841,224

View metric:https://t.co/s7tx1xxyz3 pic.twitter.com/e1HkYNBxBF

— glassnode alerts (@glassnodealerts) May 16, 2022

Present Bitcoin Value Vary Between $27,600 and $32k Would possibly Be an Alternative to Purchase

The variety of addresses holding a number of Bitcoin hitting a brand new all-time excessive comes when BTC is buying and selling at $29,400 and between the native low of $26,700 set final week and the $32k resistance stage. This vary additionally comprises a number of vital assist and resistance zones reminiscent of $27,500, $28k, $28,400, $29,300, $30k, $30,500 and $31,400.

Moreover, the 2 corporations of Microstrategy and Tesla, purchased important quantities of Bitcoin at these ranges early final yr.

The 2 causes talked about above trace that Bitcoin merchants and traders most likely view the present BTC value vary as a possible purchase zone.

Bitcoin May Probably Bounce to $35k

With respect to short-term value motion, BTC analyst MagicPoopCannon has forecasted {that a} rally to $35k is feasible. Nonetheless, some weak point lingering round Bitcoin may lead to a retest of $28k or decrease ranges.

The Subsequent 3 to 12 Months Would possibly Be Prime to Load Up on Bitcoin

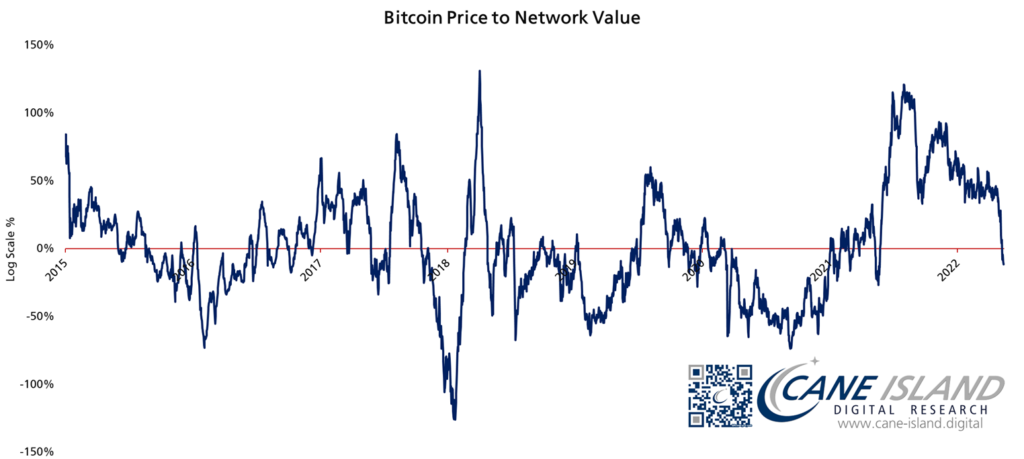

Regarding long-term value motion, Bitcoin analyst Timothy Peterson of Cane Island Different Advisors has identified that BTC is at the moment underpriced and will stay so for the subsequent 12 to 24 months. Nonetheless, he was optimistic that the subsequent three to 12 months could be preferrred for loading up on Bitcoin.

He shared his evaluation of Bitcoin by the following statement and accompanying chart.

How lengthy would #bitcoin keep underpriced? Historical past says 6-12 mo, however that’s in a secular bull market. In a secular bear, possibly 12-24 mo.? No person is aware of but. However because it reverses in 1/2 that point, the prime load-up alternative could be in 3-12 mos from now.