On-chain information reveals the variety of energetic Bitcoin addresses have remained at a low worth for some time now, suggesting there isn’t a lot demand for the crypto at present.

Bitcoin Energetic Addresses Have Continued To Transfer Sideways Just lately

As identified by an analyst in a CryptoQuant post, the BTC community exercise has been low in current days, implying there isn’t sufficient demand for a bull rally simply but.

The “variety of energetic addresses” is an indicator that measures the entire quantity of addresses on the Bitcoin blockchain which have been participating in some exercise, whether or not that be sending or receiving.

When the worth of this metric is excessive, it means the community is observing loads of exercise proper now. Such a pattern reveals the overall curiosity across the crypto is excessive amongst merchants at present.

However, low values of the indicator can recommend the chain isn’t viewing a lot buying and selling exercise in the mean time.

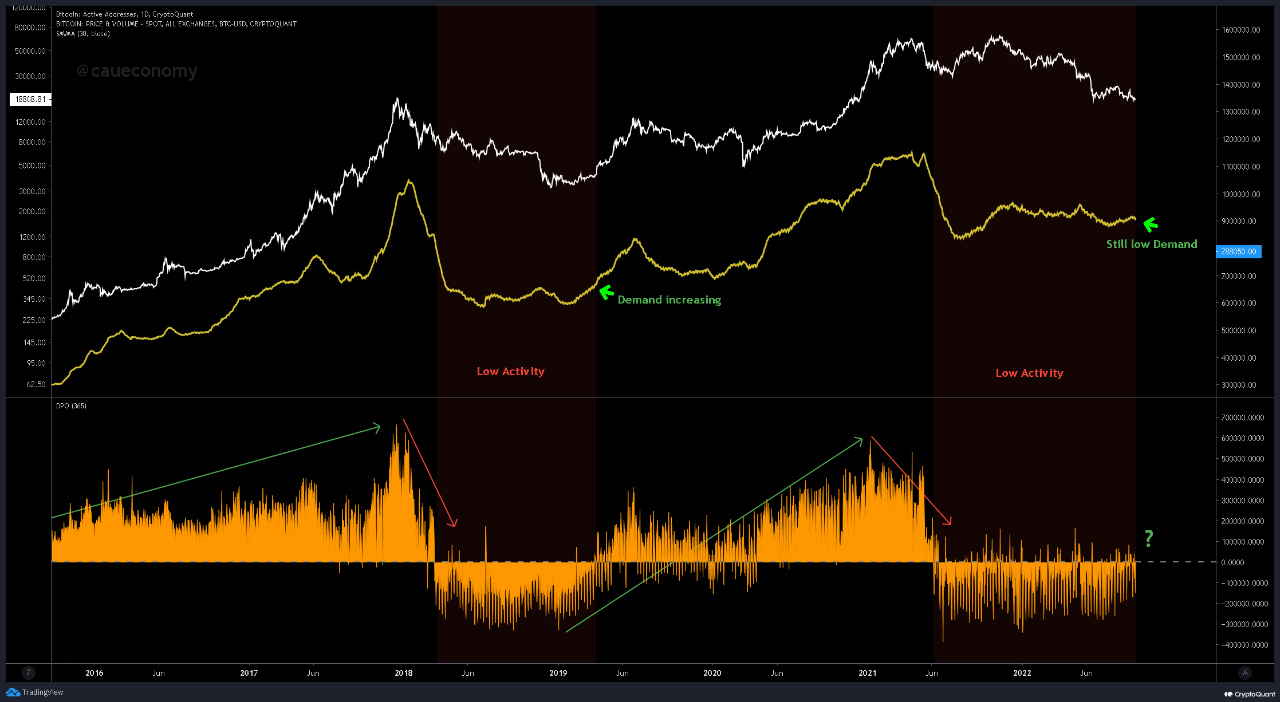

Now, here’s a chart that reveals the pattern within the Bitcoin energetic addresses over the previous few years:

Seems to be like the worth of the metric has been fairly stagnant in current months | Supply: CryptoQuant

As you may see within the above graph, the quant from the put up has highlighted the related intervals of pattern for the Bitcoin energetic addresses.

Traditionally, bear markets have noticed low and stagnating values of the indicator. The explanation behind it’s that giant declines within the value often scare away newcomers and short-term merchants from the crypto, thus killing off exercise on the community.

Within the instances main as much as bull runs, the market has typically seen a gradual buildup of energetic addresses, which finally hit a peak alongside the value. This type of uptrend indicators rising demand for Bitcoin amongst every kind of merchants.

Most just lately, the metric has been caught in sideways motion because the crypto has been in the course of a bear market. There nonetheless hasn’t been, nonetheless, any signal of the variety of energetic addresses going up but.

The analyst explains that this current low demand suggests BTC nonetheless hasn’t constructed up any secure setup for a long-term sustainable rally that may result in a brand new bull market.

BTC Worth

On the time of writing, Bitcoin’s value floats round $18.8k, up 1% up to now week. During the last month, the crypto has misplaced 12% in worth.

The beneath chart reveals the pattern in BTC’s value over the previous 5 days.

Seems to be like the worth of the crypto hasn't proven a lot motion throughout the previous few days | Supply: BTCUSD on TradingView

Featured picture from Hans-Jurgen Mager on Unsplash.com, charts from TradingView.com, CryptoQuant.com