Binance Pool added Ravencoin [RVN] to its checklist of supported tokens, as per the most recent announcement made on 23 November. Binance Pool shall be charging 1% charges for its RVN pool.

It was solely in October that the cryptocurrency alternate launched a funding pool value $500 million. This was to lend to distressed mining corporations amid a disaster within the crypto market.

ETH miners transfer to the likes of Ravencoin

As crypto platforms are transferring from PoW to PoS resulting from vitality issues, the change has since confirmed to be a problem for the mining group.

As soon as Ethereum went from PoW to PoS mechanism following the Merge, numerous ETH miners took to mining tokens. These included Ravencoin [RVN], Ethereum Traditional [ETC], and Beam [BEAM].

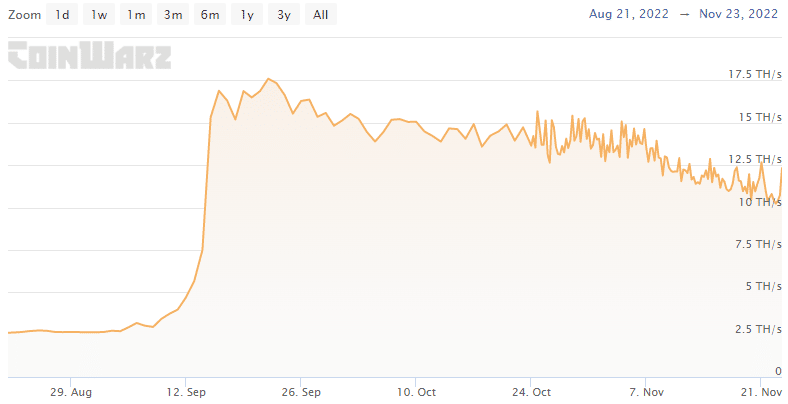

Because the ETH Merge, the hashrate of RVN grew from 2.93 TH/s to 11.93 TH/s at press time. This confirmed a fourfold development over this era.

Supply: Coinwartz

Lending assist amid trade woes

Binance, nevertheless, wasn’t the one crypto agency to launch a lending fund in current instances. Jihan Wu, the billionaire founding father of crypto mining rig maker Bitmain, additionally set up a fund value $250 million in September. The fund shall be used to purchase belongings from distressed bitcoin miners.

The identical month, DeFi software Maple Finance additionally started a lending pool value $300 million. The fund shall be used to lend to mid-size bitcoin miners throughout North America and Australia.

Crypto mining companies around the globe have been struggling amid a bearish market development. The mining trade has been stricken by a path of bankruptcies resulting from rising vitality prices, hashrate issue, and falling token costs.

Compute North, one of many world’s largest operators of crypto-mining knowledge facilities, filed for Chapter 11 chapter safety in September 2022. The mining agency owed $500 million to roughly 200 collectors.

Texas-based mining agency Core Scientific’s October filing with the SEC revealed that it could run out of money earlier than the tip of 2022. Moreover, Colorado-based mining agency Riot Blockchain Inc.’s income fell by over 17% throughout Q3 this yr as revealed in its current SEC submitting.

Australian mining agency Iris Power additionally defaulted on a mortgage value $107.8 million as per its newest SEC filing. Subsequently, it unplugged its tools used as collateral, shedding part of its mining capability.

If the crypto market additional dips, a disaster for the mining trade may be anticipated. It’s because mining manufacturing stands immediately proportional to Bitcoin worth.