The most important information within the cryptoverse for Sept. 2 consists of CZ saying that Binance isn’t included in China, Cardano’s Vasil improve scheduled for Sept. 22 and U.S. regulators proposing amendments for giant hedge fund reporting.

CryptoSlate High Tales

CZ denies claims that Binance is in ‘the pocket of the Chinese language authorities’

Changpeng ‘CZ’ Zhao has responded to allegations about Binance and the Chinese language authorities. He defined that the crypto trade was by no means included in China and that the place of his delivery and his ethnicity shouldn’t be a “scarlet letter.”

“Binance was by no means included in China. Nor will we function like a Chinese language firm culturally. We now have subsidiaries in lots of international locations… However we don’t have any authorized entities in China, and we should not have plans to.”

CZ additionally responded to allegations about about an alleged secret Chinese language agent named “Guangying Chen.” He stated Chen is a back-office supervisor and never the proprietor nor a Chinese language authorities agent.

Cardano’s Vasil improve will occur on Sept. 22

Cardano’s mum or dad firm Enter Output(IOHK) has confirmed the tentative date for the Vasil improve to be Sept. 22.

The Vasil improve will improve Cardano’s community capability and decrease its transaction prices. The improve is predicted to be seamless and never intervene with customers or break block manufacturing course of.

Digital on line casino Stake.com going through $400M lawsuit filed by former associate

Christopher Freeman, a former associate in Stake.com is suing the on line casino platform for being reduce out of the corporate.

Within the early days of the startup, Freeman owned 20% of the corporate however 6% was reduce off his share to distribute to different crew members. He’s searching for $400 million as compensation for punitive damages.

Terra LUNA Basic continues astonishing come again with 2,400% positive aspects over the past 7 days

The two,400% positive aspects of Terra’s LUNC over the past 7 days may be traced to new options launched by the builders.

LUNC gives a excessive staking reward of as much as 2.6% and it’s anticipated to succeed in a excessive of 37% per 12 months.

Token burn mechanisms have additionally helped the value spike. Greater than 3 billion tokens have been burnt since its relaunch.

SEC, CFTC proposes amendments for giant hedge fund crypto reporting

US regulators are working to supply a framework for hedge funds to report their crypto publicity.

The regulators stated investments in digital property have develop into extra widespread, and there’s a rising want to assemble extra info on the publicity of funds to crypto. They additionally referred to as on the crypto neighborhood to hunt readability on the perfect time period to make use of for cryptocurrencies, both “crypto asset” or “digital asset.”

Celsius expects to obtain a $70M mortgage compensation to fund operations past November

A forecast of money circulate for Celsius over the following three months revealed that the corporate expects to report an influx of $70 million from the compensation of a USD-denominated mortgage.

The additional money will fund Celsius’ enterprise operations and restructuring plans until November, and nonetheless go away the corporate with a surplus of about $42 million.

Analysis Spotlight

On-chain metrics counsel extra ache forward for long-term Bitcoin holders

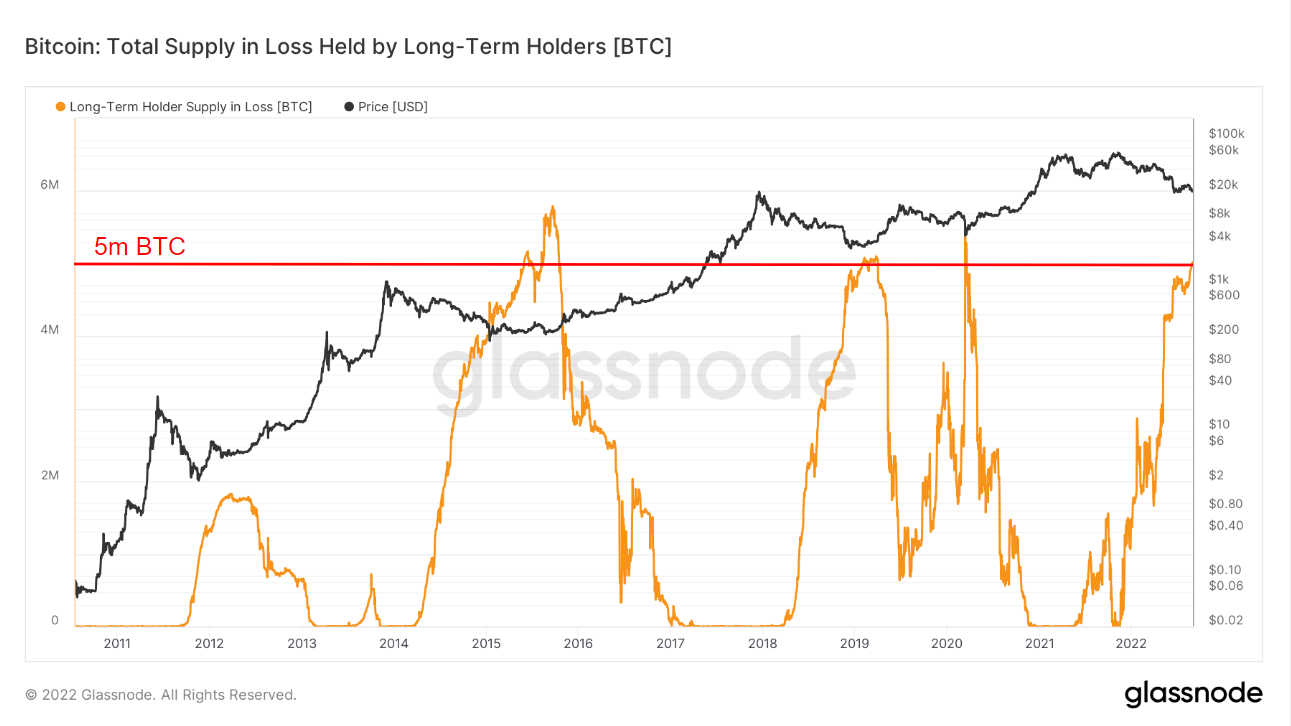

CryptoSlate analyzed three key on-chain metrics which all counsel that the market backside isn’t but in. Take an instance from the evaluation utilizing the Bitcoin whole provide for Lengthy-Time period Holders (LTH) metrics.

At any time when the overall provide exceeds 5 million tokens, BTC worth reverts to the uptrend. In the meanwhile, BTC’s present provide is but to interrupt the brink indicating that Bitcoin holders are in loss and should endure additional worth decline.

Information from across the Cryptoverse

IMF plans platform for cross-border CBDC transactions

The IMF hinted in its September bulletin that it’s seeking to construct a digital platform that may facilitate cross-border CBDC transactions.

The platform will enable private and non-private sectors to write down sensible contract codes with the aptitude to implement settlement options that go well with the customers’ wants.

Bybit celebrates 10M with 0 charges supply

Bybit has introduced gives to have a good time its 10 million customers milestone.

Customers buying and selling on the platform will obtain its zero charges supply on all spot buying and selling pairs, efficient Sept.6. Customers additionally get to earn as much as 12% APY for staking by way of Bybit Financial savings.

Crypto Market

Bitcoin was down -0.55% on the day, buying and selling at $19,972, whereas Ethereum was buying and selling at $1,578, reflecting a lower of 0n improve of -0.47%