Ethereum took an extra step again in complete transactions in February as Binance Sensible Chain noticed a 378% enhance in transactions over the primary good contracts-backed blockchain community.

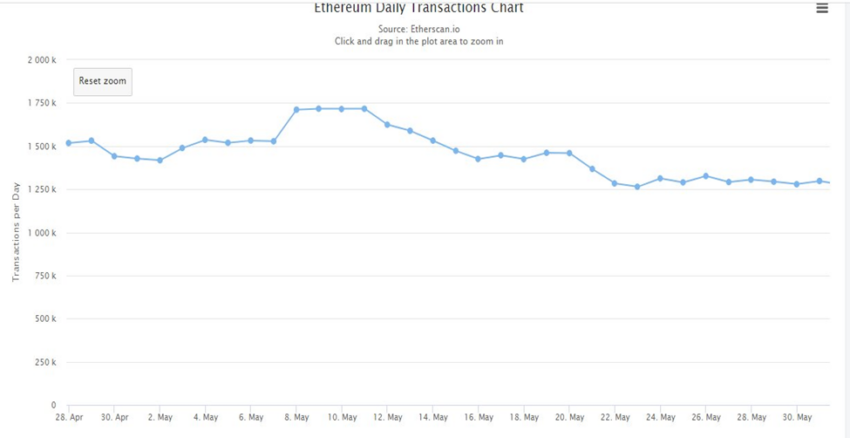

Final month proved to be a tricky month for the Ethereum blockchain. The most important chain by way of complete worth locked (TVL) managed to document roughly 32,739,456 transactions throughout February, based on Be[In]Crypto Analysis.

To readers that have no idea a lot concerning the blockchain know-how area, this determine is spectacular when in comparison with the whole transaction counts of different chains. With that stated, Ethereum took a success by way of transaction counts for February.

The entire transactions counts by the top of January 2022 was 36,851,128. Which means that roughly 4,111,672 was wiped off January’s determine in February, an 11% lower in complete transactions within the area of 28 days.

Supply: Etherscan

Ethereum transaction rely decreased from 2021

The entire transaction rely for Ethereum over the previous 12 months was down by 7% since February 2021, which noticed 35,758,516 in complete transaction counts recorded.

Supply: Etherscan

Except for this, Ethereum reached its peak in Might 2021. This was a time when the native coin of the Ethereum ecosystem (ETH) surpassed $4,000 for the primary time and reached new milestones. This was buoyed by the rising utilization of decentralized protocols and functions (dApps) on the Ethereum blockchain as many customers took benefit of decentralized lending, exchanges, and yield aggregation protocols. This mirrored positively within the complete transaction rely for Ethereum.

Whole transaction rely on Might 31, 2021, stood at 45,055,042. This was a 26% enhance from February 2021.

Supply: Etherscan

In January 2022, the single-day excessive in transactions for Ethereum was 1,283,346. The only-day excessive in transactions on Ethereum in February 2022 was a 4% enhance than the best-day excessive within the first month of 2022. The only-day excessive for February 2022 was 1,343,869.

Binance Sensible Chain continues to surpass Ethereum in complete transactions

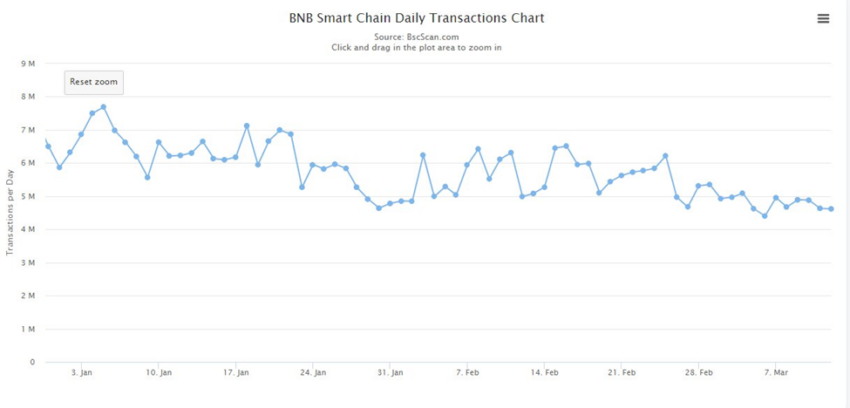

Though Ethereum managed to document 32 million transactions in February, Binance Sensible Chain managed to document roughly 156,512,579 (156 million). After being affected by a bearish engulfing within the early days of the month, Russia’s invasion of Ukraine in the direction of the top of February deepened the bearish cycle. Binance Sensible Chain noticed complete transactions lower by 18% from January 2022.

Supply: BscScan

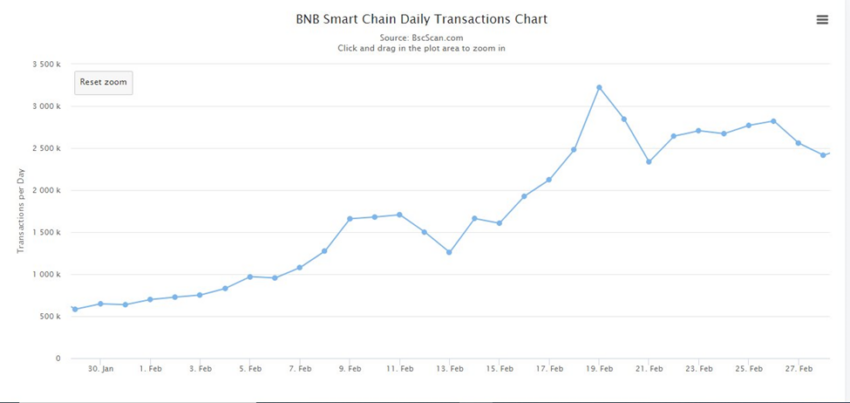

January 2022 noticed Binance Sensible Chain convey forth complete transaction counts of roughly 192,096,842 (192 million). In sharp distinction to Ethereum’s falling year-over-year transactions in February, Binance Sensible Chain noticed a year-on-year month-to-month enhance for February.

February 2021 noticed the recording of 51,983,356 (51 million) transactions, with 2022’s determine rising by 201%.

Supply: BSCScan

As of March 2022, Ethereum stays the most important by way of complete worth locked, and Binance Sensible Chain is third by way of TVL. The 2 chains have essentially the most vibrant ecosystems within the area right this moment with main decentralized functions akin to Uniswap (UNI) and PancakeSwap (CAKE) respectively. Nonetheless, regardless of Ethereum’s place by way of TVL, Binance Sensible Chain stays the clear favourite by way of person exercise which has been mirrored in complete transaction counts.

Earlier than the decline in complete transactions in February, January 2022 noticed Binance Sensible Chain transactions outpace Ethereum by 421%. Along with this, BSC surpassed Ethereum by 45% in February 2021, with Binance Sensible Chain being the clear favourite in February 2022, with 378% extra transactions than Ethereum.

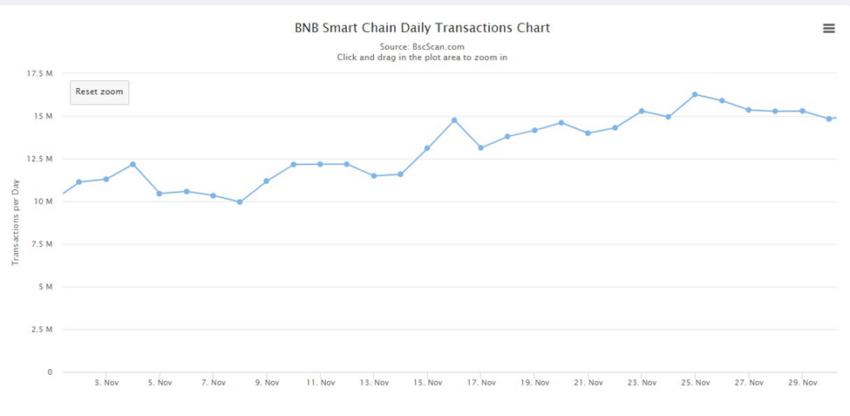

What’s extra, Binance Sensible Chain reached an all-time excessive in complete month-to-month transactions in November 2021 and managed to document roughly 391,847,392 (391 million). With a watch on Ethereum’s aforementioned month-to-month excessive in Might 2021, BSC nonetheless maintained its dominance over Ethereum by way of all-time highs by a staggering 769%.

Supply: BSCScan

What precipitated the autumn in transactions?

Lowering transaction counts which led to reducing volumes on the decentralized functions of Binance Sensible Chain and Ethereum are largely chargeable for the decline.

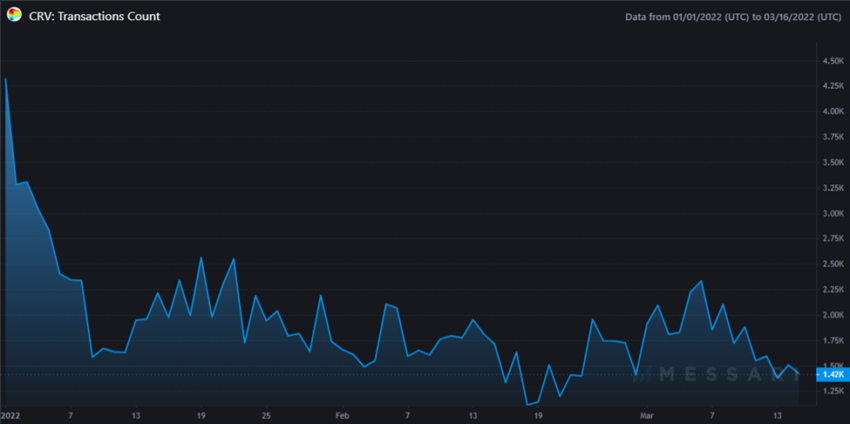

The most important dApp by way of complete worth locked, Curve (CRV) runs on the Ethereum blockchain. The entire transaction rely for CRV in February 2022 was roughly 45,468. This was a 34% lower from January 2022’s determine of 69,281, based on Be[In]Crypto Analysis.

Except for this, Curve’s complete transaction rely noticed a year-over-year lower of 21% from February 2021’s determine of 58,051.

Supply: Messari

One of the vibrant areas in crypto within the final 12 months is non-fungible tokens (NFTs). A lower in complete transaction counts impacted NFT Market OpenSea which runs totally on Ethereum. A discount in complete transactions noticed OpenSea plunge by 27% in quantity from January 2022’s determine of $4.95 billion to February 2022’s quantity of $3.57 billion.

Alternatively, Binance Sensible Chain additionally noticed reducing transaction counts largely because of the reducing utilization of its prime dApp, PancakeSwap. Finally, the autumn in transaction rely noticed the decentralized change lower in quantity from $25.25 billion in January to $15.73 billion, a 37% lower within the area of 28 days.

Supply: Nomics

Sadly, the decline in complete transaction counts has been mirrored within the worth of their respective native property, ETH and BNB.

ETH opened Jan. 1, 2022, at $3,683.05 and elevated by 5% to succeed in a yearly excessive of $3,876.79 on Jan. 4. ETH is at the moment buying and selling at a worth that’s 27% beneath its yearly excessive recorded in January and has been buying and selling within the area of $2,308.91 and $3,185.52 inside the previous 30 days.

BNB opened on Jan. 1, 2022, at $511.91 and elevated by 4% to succeed in a yearly excessive of $533.37 on Jan. 2. BNB is buying and selling at a worth that’s 27% beneath the yearly excessive recorded within the early days of the 12 months. BNB continues to commerce within the vary of $324.48 and $433.43 inside the previous 30 days.