Disclaimer: The Business Discuss part options insights by crypto business gamers and isn’t part of the editorial content material of Cryptonews.com.

Making a diversified crypto portfolio is essential, contemplating how risky and speculative this buying and selling business is.

On this regard, a well-diversified portfolio ought to comprise all kinds of crypto property throughout many various area of interest markets. The aim of this information is to discover the finest crypto portfolio allocation for risk-averse traders.

Greatest Crypto Portfolio Allocation Abstract

Holding a diversified portfolio of cryptocurrencies will make sure that traders keep away from turning into over-exposed to a small variety of cash. Which means if one venture does not fairly carry out in addition to anticipated, different cash throughout the diversified portfolio might assist cowl the losses.

Due to this fact, the overarching goal of crypto portfolio allocation is to unfold the danger throughout many various tasks. Firstly, traders ought to make sure that their portfolio allocates funds to established, large-cap cryptocurrencies.

Bitcoin and Ethereum symbolize good choices right here. On the different finish of the size, traders may additionally want to allocate funds to newly launched tasks with a smaller market capitalization. This presents traders the chance to focus on increased good points.

Examples right here embody the likes of Tamadoge – a newly launched P2E crypto gaming ecosystem that lately raised $19 million in presale funding. One other angle to take is to diversify into different crypto asset markets totally, similar to related shares and even curiosity accounts.

Finally, the important thing takeaway is that the extra high-quality property there are in a portfolio, the extra risk-averse it’s in the long term. Simply bear in mind, even allocating a small quantity of capital to higher-risk tasks can work out favorable long-term, offering the portfolio is well-diversified.

Greatest Cryptocurrencies to Add to Your Portfolio

As famous above, one of the best crypto portfolio allocation methods will make sure that a portfolio is diversified throughout many several types of digital property.

On this part, we provide some perception into how a well-diversified portfolio would possibly allocate its funds.

1. Tamadoge – Newly Launched P2E and Metaverse Venture

A well-diversified portfolio will usually maintain each small and large-cap cash. Relating to the previous, Tamadoge may very well be value contemplating for these wishing to allocate funds to a high-growth venture. Based in 2022, Tamadoge is constructing a metaverse gaming platform that permits gamers to win real-world rewards.

The sport focuses on a digital Tamadoge pet, which must be minted by way of the Ethereum blockchain. The randomization course of supported by sensible contract know-how signifies that every Tamadoge pet is exclusive from the subsequent. The rareness of every pet shall be decided by the NFT’s traits.

Gamers might want to practice and feed their digital pet to make sure that it continues to extend its power and broader capabilities. For instance, Tamadoge pets can enter battles with different gamers, with the winner rewarded in TAMA tokens. It can even be potential to mint new Tamadoge pets by breeding NFTs.

The staff at Tamadoge goals to supply their gaming platform alongside immersive experiences. Along with metaverse encounters, Tamadoge gamers may even have the ability to get pleasure from augmented actuality options by way of a cellular gaming app. Tamadoge lately accomplished the most effective crypto presales lately – elevating over $19 million in beneath two months.

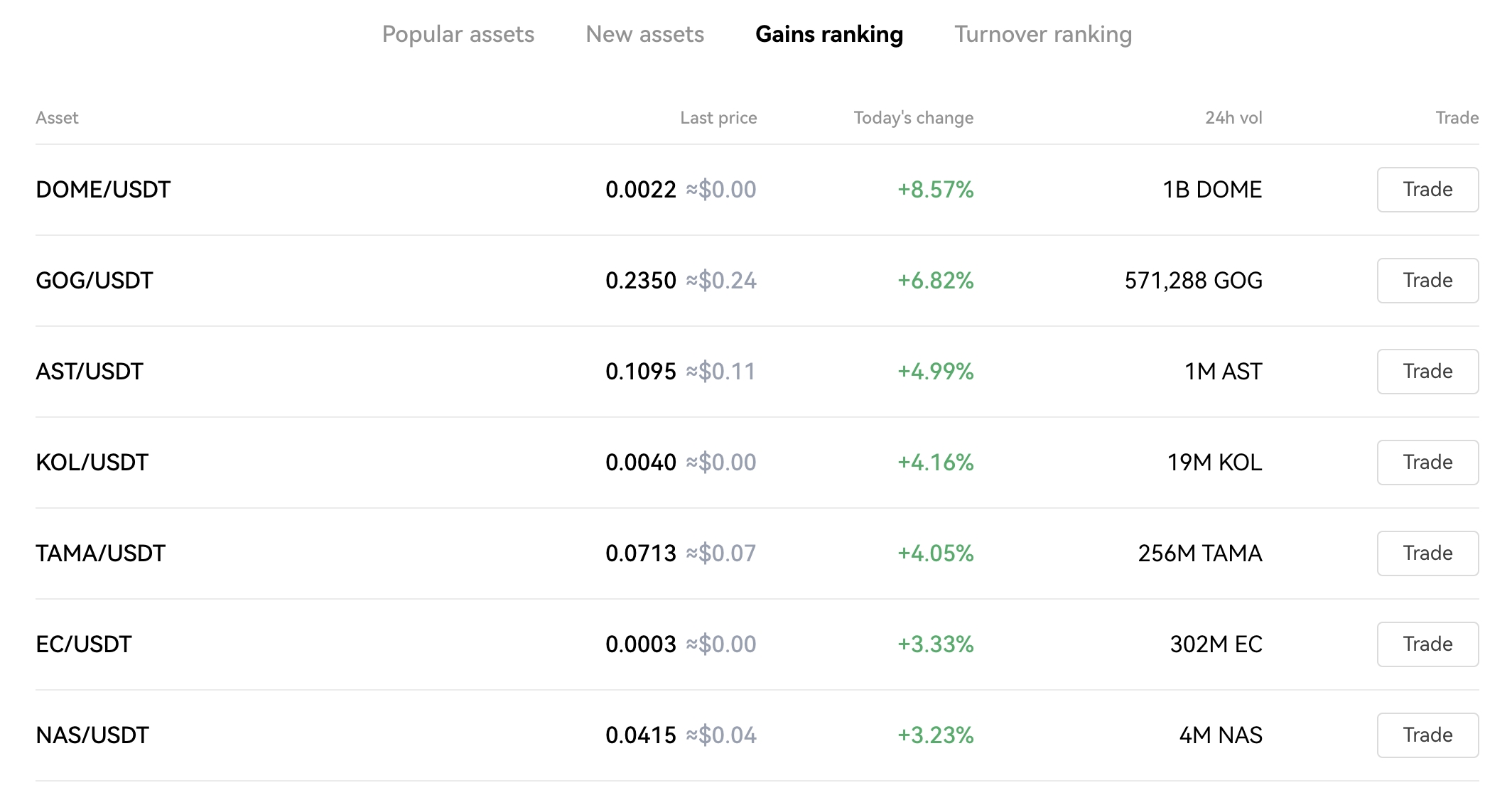

Not solely that, however these wishing to purchase Tamadoge tokens can now accomplish that by way of the tier-one crypto alternate – OKX. Which means the venture will entice huge sums of liquidity throughout each its centralized and decentralized alternate platforms. Along with being one of many prime trending crypto tasks out there proper now, Tamadoge continues to be a low-cap coin.

As of writing, for instance, CoinMarketCap notes that Tamadoge carries a market capitalization of beneath $70 million. Much more curiously, nevertheless, is that Tamadoge is without doubt one of the quickest rising crypto property, despite the fact that the broader business is in a bear market. As an example, since itemizing on CoinMarketCap, TAMA has elevated by greater than 315%.

Which means when making an attempt to execute one of the best crypto portfolio allocation potential, solely a small portion of the funding capital wants to enter high-growth tasks like Tamadoge. For portfolio stability, the improved risk-reward profile may be countered by larger-cap cash.

Purchase Tamadoge on OKX CEX

Purchase Tamadoge on OKX DEX

2. Bitcoin – Greatest Crypto Asset for Threat-Averse Portfolio Allocation

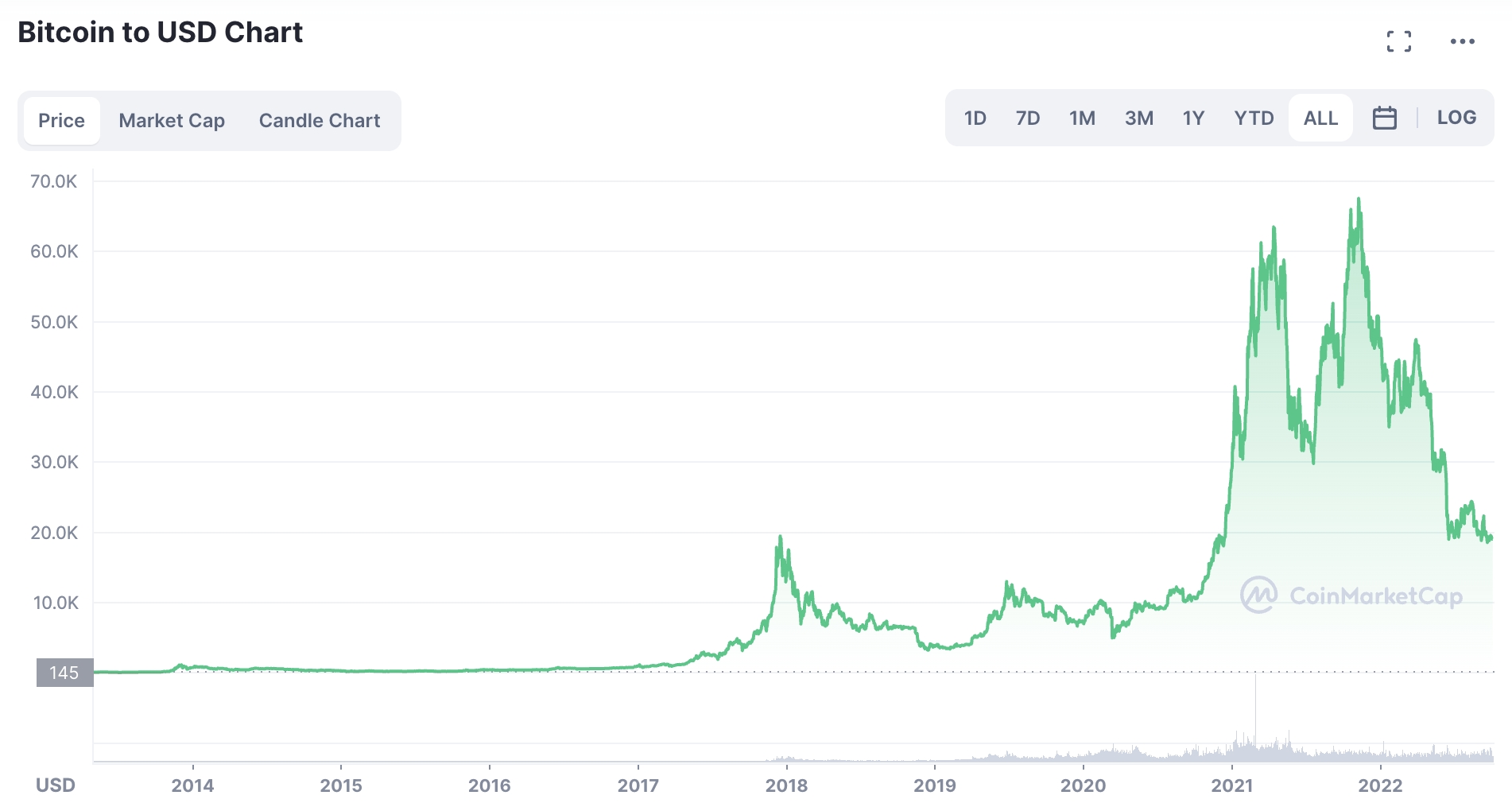

On the exact opposite spectrum of Tamadoge is Bitcoin – the most important and most dear crypto asset on this house. Crucially, though Bitcoin will arguably develop at a slower tempo compared to one of the best altcoins out there, the de-facto cryptocurrency presents some much-needed portfolio stability – not less than in the long run.

At its peak, when Bitcoin hit an all-time excessive of over $68,000 in November 2021, this digital asset was value greater than $1 trillion. The valuation of Bitcoin has since declined by 70% from its prior peak. Nonetheless, this presents an excellent alternative from a cryptocurrency asset allocation perspective, as Bitcoin may be bought at an enormous low cost.

Somewhat than allocating capital to Bitcoin in a single lump sum, risk-averse traders would possibly as an alternative contemplate a dollar-cost averaging technique. This implies shopping for a small quantity of Bitcoin every week or month at a hard and fast funding stake. In doing so, every buy will entice a unique value worth, which shall be averaged out over time.

One more reason why traders would possibly contemplate allocating a big weighting to Bitcoin is that the crypto asset is restricted in provide. Simply 21 million Bitcoin will ever exist, which makes the cryptocurrency a scarce asset. Furthermore, the circulating provide of Bitcoin is mounted and predictable, with new cash being minted each 10 minutes.

Purchase Bitcoin on eToro

Cryptoassets are extremely risky and unregulated. No client safety. Tax on earnings could apply.

3. Ethereum – Largest Sensible Contract Blockchain With Hundreds of ERC-20 Tokens

Behind Bitcoin, Ethereum is the second-largest crypto asset on this house. And due to this fact, that is one other venture to contemplate when evaluating one of the best crypto portfolio allocation technique. As of writing, Ethereum carries a market capitalization of over $150 billion. Nonetheless, similar to Bitcoin, the worth of Ethereum has declined significantly for the reason that bull market peaked in late 2021.

The truth is, when in comparison with Ethereum’s all-time excessive of virtually $5,000, the crypto asset is buying and selling at a reduction of 70%. This as soon as once more presents a lovely entry worth when investing in Ethereum. By way of longevity, though there are different rivals within the sensible contract area, Ethereum is the de-facto blockchain community on this regard.

For example this level, there are lots of hundreds of altcoins constructed on prime of the Ethereum blockchain – in any other case referred to as ERC-20 tokens. It is because Ethereum is a trusted community that’s famend for its safety and effectivity. That is particularly the case now that Ethereum has accomplished its much-anticipated ‘merge’ to proof-of-stake.

This may profit Ethereum and ERC-20 tokens enormously, as transaction charges at the moment are decrease and speeds are a lot quicker. Furthermore, Ethereum is now extra scalable, which can doubtlessly entice much more tasks to its ERC-20 framework. Most of the finest upcoming ICOs are Ethereum-based too, which presents much more demand for its decentralized sensible contract companies.

Purchase Ethereum on eToro

Cryptoassets are extremely risky and unregulated. No client safety. Tax on earnings could apply.

4. Battle Infinity – Excessive-Development Play-to-Earn and NFT Gaming Platform

With the portfolio now solidified with large-cap tasks like Bitcoin and Ethereum, traders can contemplate allocating some funds to a different high-growth coin. Another choice that we like is Battle Infinity, which is without doubt one of the finest penny cryptocurrencies out there proper now. Battle Infinity is constructing a decentralized gaming platform together with a P2E rewards system.

Which means by enjoying Battle Infinity video games, gamers can generate free crypto tokens – paid in IBAT. The primary sport to launch is the IBAT Premier League – which is a globally-accessible fantasy sports activities event. Gamers can decide a ‘dream staff’ from their favourite sport and earn rewards by accumulating factors.

Factors are decided by the real-world efficiency of every sports activities participant from throughout the chosen staff. This presents an expertise that connects the digital and real-world worlds into one ecosystem. Gamers even have the chance to earn one of the best NFTs throughout the Battle Infinity metaverse, which may then be traded on the IBAT market.

Gamers may also commerce their IBAT tokens for different crypto property on the Binance Sensible Chain, by way of the Battle Infinity DEX. Greater than $5 million value of IBAT was bought in presale funding – with the laborious cap being reached in simply 24 days. These trying to purchase Battle Infinity tokens for optimum portfolio range can accomplish that on PancakeSwap or LBank.

Go to Battle Infinity

5. Uniswap – Put money into the Way forward for Decentralized Finance

The perfect crypto portfolio allocation methods may even look to dedicate capital to rising tendencies and markets. On the forefront of that is decentralized finance, which presents conventional monetary companies to shoppers with out requiring traders to undergo a third-party middleman. Uniswap is a frontrunner on this house, with the venture specializing in Ethereum-based tokens.

On Uniswap, traders can swap one ERC-20 token for one more while not having to create an account or present any delicate KYC paperwork. As a substitute, traders merely want to attach an Ethereum-compatible pockets to the Uniswap ecosystem and swap the 2 tokens in actual time. Uniswap is ready to facilitate this by way of an automatic market marker (AMM) protocol.

In essentially the most primary of phrases, this removes the necessity for conventional order books. As a substitute of requiring a vendor to be current within the transaction, the AMM system at Uniswap depends on liquidity swimming pools. Every pair may have equal quantities of each tokens, which ensures that Uniswap can supply its buying and selling companies in a decentralized method – 24/7.

Moreover, liquidity swimming pools may be funded by anybody, which allows traders to generate passive earnings on their idle tokens. Uniswap is due to this fact the most effective yield farming crypto platforms for passive traders. One of many best methods so as to add UNI tokens to a portfolio is to speculate by way of the regulated and low-cost dealer – eToro.

Purchase Uniswap on eToro

Cryptoassets are extremely risky and unregulated. No client safety. Tax on earnings could apply.

Constructing a Diversified Crypto Portfolio – Balancing Strategies

There isn’t any one-size-fits-all technique that may be taken when evaluating one of the best crypto portfolio allocation. The rationale for that is that every investor may have their very own monetary targets and danger urge for food.

Nonetheless, there are a variety of core methods that may be undertaken when constructing a balanced crypto portfolio, which we talk about in additional element within the sections under.

Portfolio Weighting

An ideal start line is to evaluate the weighting of the crypto portfolio. The ‘weighting’ merely refers back to the proportion breakdown of every crypto funding sort. A well-balanced portfolio must be closely weighted to large-cap and established tasks.

- Whereas the precise weighting will in the end be decided by the investor, risk-averse merchants would possibly contemplate allocating 70% of their crypto portfolio to Bitcoin and Ethereum.

- The argument right here is that each tasks have solidified their standing on this house, and subsequently, symbolize two of one of the best long-term crypto property.

- On this state of affairs, this would depart 30% of the portfolio on small and medium-cap tasks.

Though risker when in comparison with Bitcoin and Ethereum, smaller-cap tasks which have lately entered the crypto house can present above-average good points. As we famous earlier, for instance, Tamadoge tokens have grown by greater than 315% in only one week of buying and selling.

Compared, Bitcoin has elevated by 1.40% throughout the identical timeframe, whereas Ethereum has declined by 1.24%.

In idea, this could imply that whereas 70% of the portfolio has remained stagnant over the prior week, if 30% was allotted to high-growth tasks like Tamadoge – the investor would nonetheless be sizeable good points.

Diversification of Every Area of interest Market

Every crypto venture out there will look to focus on a selected area of interest – such because the metaverse, NFT gaming, sensible contracts, or interbank funds.

The very fact is, nevertheless, that inside every area of interest, there are lots of crypto property competing for his or her share of the respective market.

Let’s take sensible contracts as a main instance:

- We talked about earlier that Ethereum dominates this house significantly – with hundreds of ERC-20 tokens constructed on its community.

- Nonetheless, there are lots of different sensible contract blockchains out there – a few of which supply quicker, cheaper, and extra scalable transactions.

- Due to this fact, the most effective crypto portfolio allocation methods on this regard could be to diversify the funding funds throughout a number of sensible contract tasks.

- Whereas Ethereum is perhaps closely weighted, the portfolio might additionally allocate capital to the likes of Solana, Cardano, and Neo.

This technique may also be deployed when investing in higher-growth tasks. As an example, along with Tamadoge and Battle Infinity, traders would possibly allocate funds to a collection of different crypto presales.

Take into account Different Asset Courses When Gaining Publicity to Crypto

There’s typically a false impression that the one technique to achieve publicity to cryptocurrencies is to purchase particular person cash. Whereas that is typically seen as the simplest manner of investing in crypto, different choices exist. And crucially, this presents an extra technique to create a well-balanced and diversified portfolio.

Let’s take Coinbase as a main instance. This huge crypto alternate is a publicly traded inventory on the NASDAQ. As Coinbase is a pure-play crypto inventory, because of this its worth is intently related to the broader market. Extra importantly, from an funding perspective, Coinbase presents publicity to the broader business while not having to select and select appropriate crypto tasks.

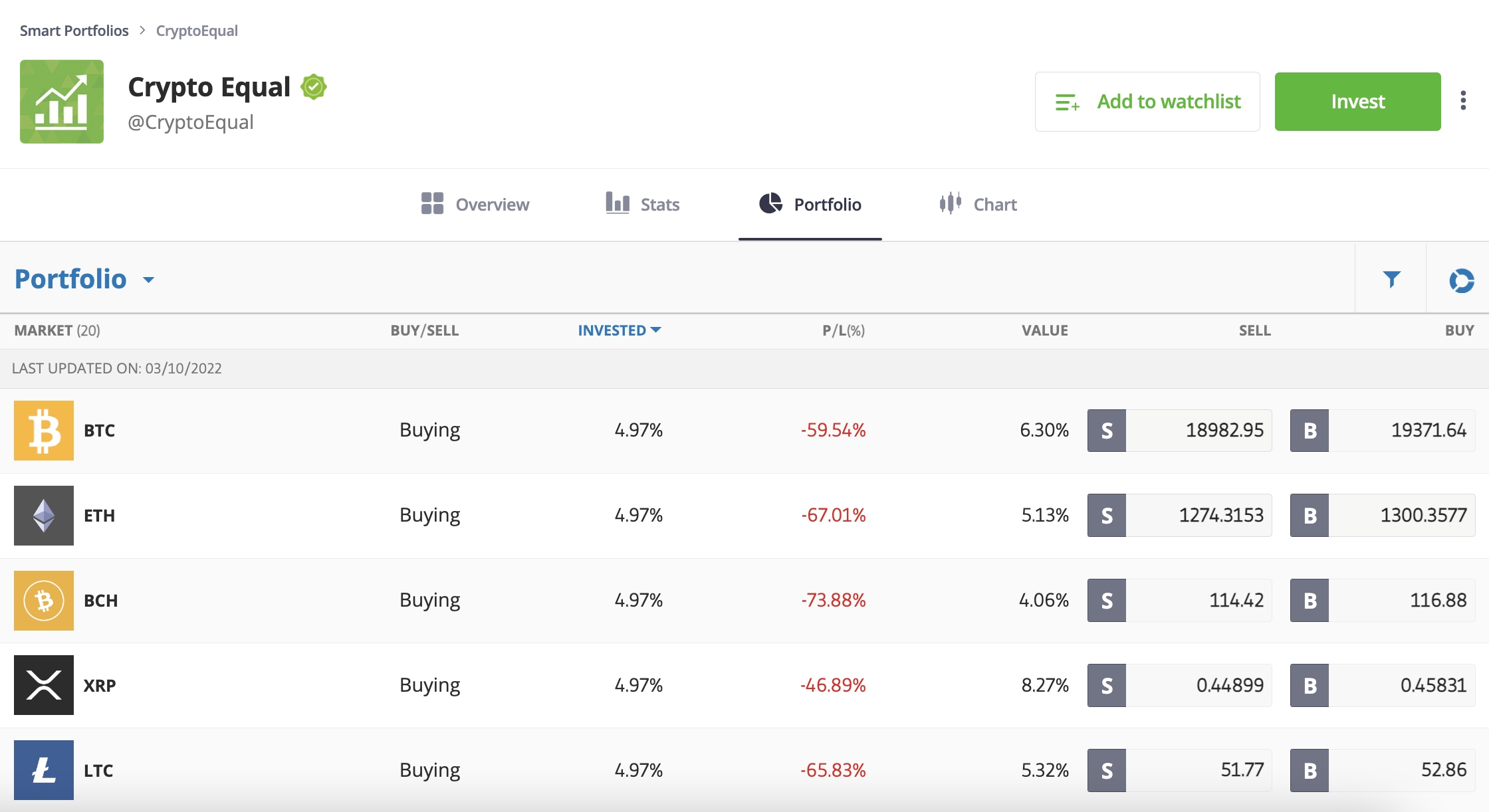

Another choice to contemplate on this regard is an eToro Sensible Portfolio. There are a number of to select from and every Sensible Portfolio is professionally managed by eToro. The ‘CryptoEqual’ Sensible Portfolio, for example, presents diversified entry to twenty cryptocurrencies at equal weights of just below 5%.

Which means eToro will usually rebalance the portfolio on behalf of its traders to make sure that it continues to align with the broader crypto market. Moreover, not solely is the minimal funding an affordable $500, however the eToro crypto portfolio administration service doesn’t entice any further charges.

Keep away from Being Overexposed to Crypto

Moreover, additionally it is necessary to do not forget that to actually change into a risk-averse investor, portfolios ought to by no means be 100% uncovered to crypto.

Quite the opposite, it’s smart to contemplate investing in different asset lessons totally, similar to shares, ETFs, or valuable metals.

In doing so, when the broader crypto market is bearish – like it’s proper now, different property throughout the portfolio would possibly counter these losses.

For instance, oil shares and index funds have generated phenomenal leads to 2022 as a result of ever-rising power costs.

Why it’s Essential to Have a Properly-Balanced CryptoPortfolio

It may be tempting to go ‘all-in’ on a crypto asset that provides a lovely upside potential. Nonetheless, traders ought to do not forget that this market is vastly speculative. Many, if not most, cryptocurrencies on this house don’t supply any long-term utility.

As a substitute, traders will purchase tokens merely with the view of constructing short-term good points. Whereas this technique can work for some traders, most will find yourself burning by way of their capital in the long term.

For instance, many top-trending crypto property have since dropped greater than 90% from the all-time highs that have been achieved throughout the latest bull market. Whether or not or not these crypto property will recuperate sooner or later stays to be seen.

This as soon as once more highlights the significance of making a well-balanced and diversified portfolio. With that stated, investing in low-cap tasks and crypto presales can nonetheless symbolize a viable funding technique.

It is simply that traders ought to consider carefully about how a lot of their portfolio to allocate to every venture. One other issue to keep in mind is that there at the moment are greater than 21,000 cryptocurrencies listed on CoinMarketCap.

There’s solely a lot liquidity to go round, that means that not all tasks will witness notable progress – if in any respect. However, by investing in numerous tasks with a smart quantity of capital, this presents one of the best crypto portfolio allocation technique in the long term.

The way to Diversify Your Cryptocurrency Portfolio

Making a diversified and well-balanced cryptocurrency portfolio could be a daunting job for learners.

On this part, we provide a step-by-step overview of the best way to proceed.

Step 1: Assess Funding Capital

Step one for traders to take is to guage how a lot capital they’ll allocate to their crypto portfolio.

This must be an quantity that the investor is snug dropping, owing to the speculative and risky nature of crypto property.

Step 2: Create DCA Technique

As soon as the scale of the funding capital has been assessed, the subsequent step is to create a dollar-cost averaging (DCA) technique. Which means as an alternative of investing your entire capital in a single lump sum, the investor will break up every crypto asset buy over an prolonged time frame.

- For instance, as an instance that the investor has $5,000 that they want to allocate to their portfolio

- An instance of a smart DCA technique could be to separate the $5,000 capital over 10 month-to-month investments of $500

Which means the investor will common out the price worth of every crypto asset that they purchase.

Step 3: Decide Portfolio Weight

Earlier than assessing one of the best crypto to purchase, traders ought to first consider their portfolio weighting. This must be decided by the monetary targets and danger urge for food of the investor.

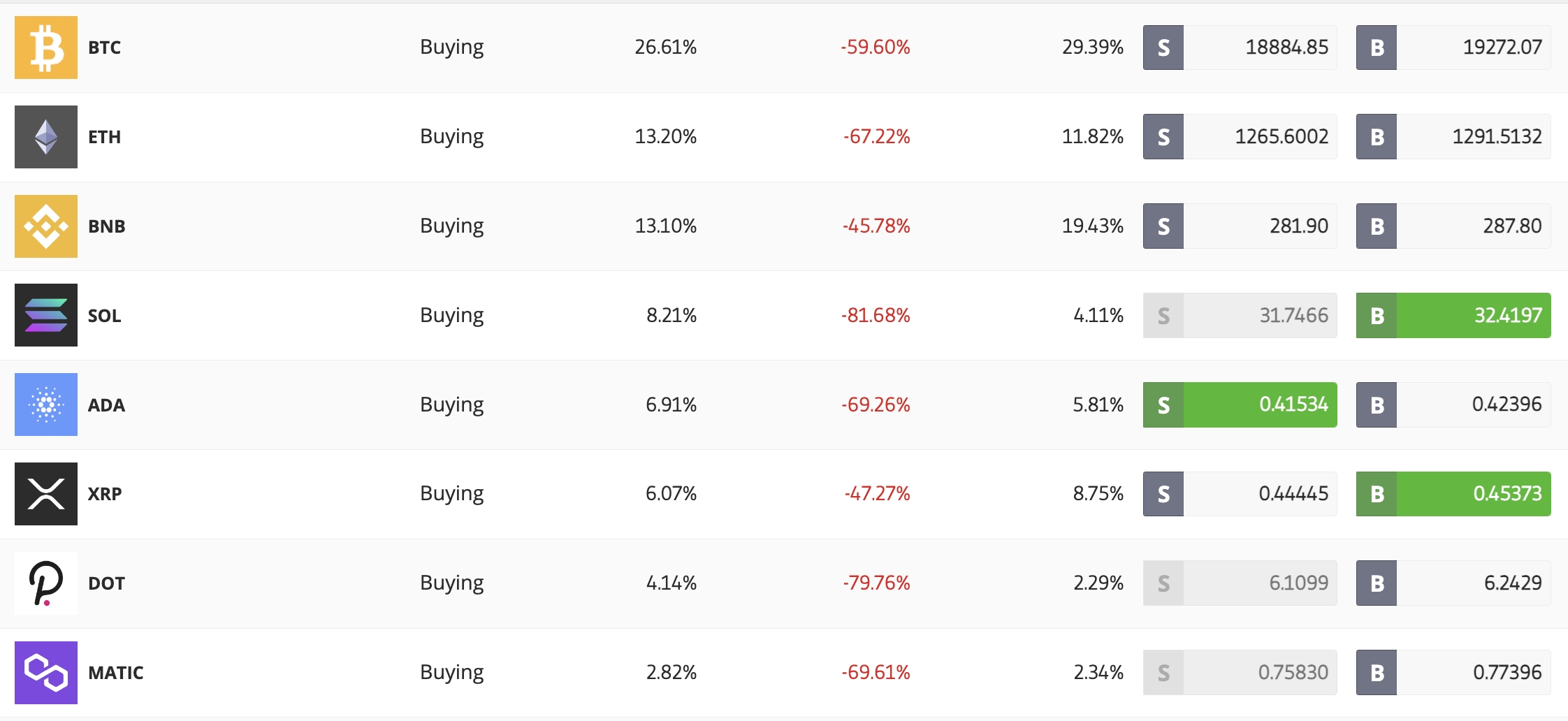

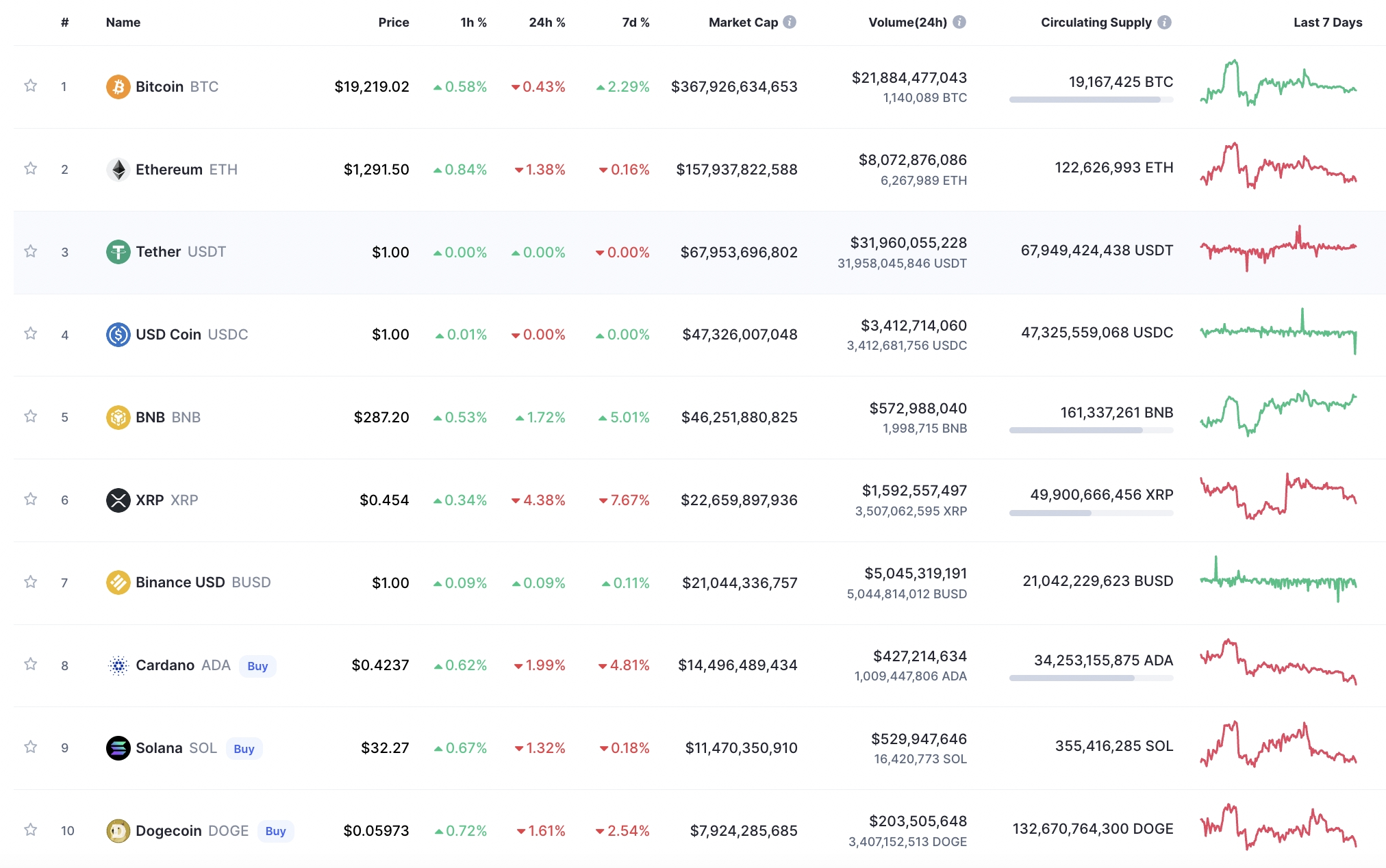

To supply some perception, traders would possibly contemplate allocating 70% of the portfolio to large-cap cryptocurrencies. Excluding stablecoins – as of writing, there are simply six crypto tasks that meet this criterion, inclusive of Bitcoin, Ethereum, BNB, XRP, Cardano, and Solana.

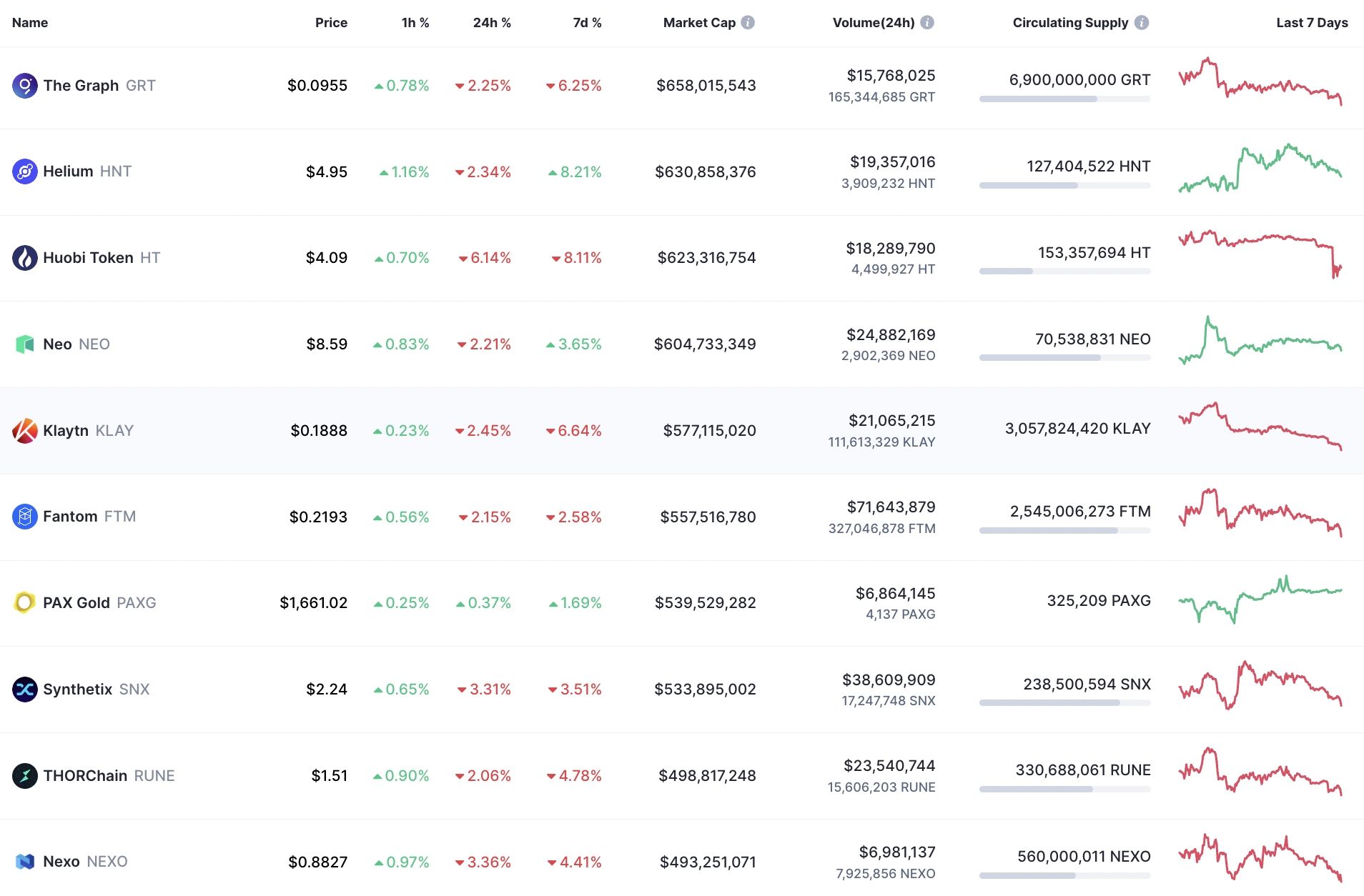

The investor would possibly then contemplate allocating 20% to medium-cap tasks which have a valuation of between $2 billion and $10 billion. As of writing, there are roughly 20 tasks that meet this criterion.

The ultimate 10% of the portfolio might go to small-cap tasks, which cowl greater than 99% of the 21,000+ tokens listed on CoinMarketCap. Inside this section of the portfolio, traders would possibly contemplate including dozens and even a whole bunch of small-cap tokens, for final diversification.

Step 4: Start Investing

As soon as the make-up of the portfolio has been recognized, the investor can then start allocating funds to every crypto asset. On this regard, you will need to select an alternate that provides entry to numerous cryptocurrencies alongside aggressive charges.

OKX is a good choice, not least as a result of the alternate presents greater than 600+markets throughout giant, medium, and small-cap cryptocurrencies. This even consists of the newly launched Tamadoge, which we mentioned extensively earlier.

Simply bear in mind, that every buy must be according to the dollar-cost averaging technique mentioned in Step 2. For instance, if 10% of the portfolio was allotted to small-cap cryptocurrencies and the month-to-month DCA funding is $500, simply $50 ought to go to tasks inside this class.

Examples of Properly Balanced Crypto Portfolio Allocations

To reiterate, there is no such thing as a one-size-fits-all technique when making a well-diversified and balanced crypto portfolio. Quite the opposite, the make-up of the portfolio will differ from one investor to the subsequent, primarily based on their danger profile and long-term targets.

Nonetheless, to supply some perception into what a medium-risk crypto portfolio would possibly seem like with an funding capital of $10,000, contemplate the next instance:

50% – Giant-Caps

A medium-risk crypto investor would possibly elect to allocate simply 50% of their portfolio to large-cap cash. As famous above, simply six crypto property carry a big market capitalization, excluding stablecoins.

The investor would possibly elect to carry 50% of their large-cap crypto investments in Bitcoin, with the stability unfold out throughout the remaining 5 tokens.

So, the full funding is $10,000 and 50% is allotted to large-cap tasks – so this section of the portfolio would seem like the next:

- Bitcoin – $2,500

- Ethereum – $500

- BNB – $500

- Cardano – $500

- XRP – $500

- Solana – $500

30% – Medium-Caps

Of the $10,000 capital, the investor elects to allocate 30% to medium-cap tasks – or $3,000.

The investor would possibly elect to purchase a variety of crypto property from varied markets and niches. On this instance, we’ll say the investor opts for 5 totally different mid-caps at $600 every.

- Dogecoin – $600

- Polkadot – $600

- Polygon – $600

- TRON – $600

- Shiba Inu – $600

20% – Small-Caps

The remaining 20% – or $2,000 of the portfolio shall be allotted to small-cap tasks.

On this instance, the investor opts for eight small-caps at $250 every.

An instance of this would possibly seem like the next:

- Tamadoge – $250

- Battle Infinity – $250

- DeFi Coin – $250

- Fortunate Block – $250

- Compound – $250

- Waves – $250

- Nexo – $250

- The Graph – $250

Portfolio Recap

To recap, from a $10,000 capital funding, the portfolio has opted for six large-caps ($5,000), 5 medium-caps ($3,000), and eight small-caps ($2,000).

In consequence, the portfolio owns 20 totally different crypto property from a spread of various markets. That is, nevertheless, only a simplified instance of cryptocurrency portfolio allocation.

Traders ought to decide their very own portfolio weighting and chosen tasks, as per their very own monetary targets and danger profile.

Conclusion

To make sure that traders enter and stay within the cryptocurrency area in a risk-averse method, portfolio diversification must be thought-about. A well-balanced portfolio will comprise mix of large-cap tasks, inclusive of Bitcoin, Ethereum, and BNB.

Publicity to newly launched and small-cap tasks is perhaps thought-about too for optimum upside potential. Tamadoge is a well-liked choice right here, which was lately listed on the OKX alternate after elevating greater than $19 million in presale funding.

Purchase Tamadoge on OKX CEX

Purchase Tamadoge on OKX DEX

FAQs

What’s the finest portfolio for crypto?

The perfect portfolios within the crypto house are usually well-diversified. With greater than 21,000 tasks to select from, diversification has by no means been extra necessary. Take into account allocating a big section of the portfolio to established tasks like Bitcoin and Ethereum, with the stability break up out between up-and-coming tokens similar to Tamadoge, Battle Infinity, and Fortunate Block.

How ought to I diversify my crypto portfolio?

The best and maybe handiest manner of diversifying a portfolio is to put money into dozens of various tasks. Established tokens within the portfolio would possibly embody Bitcoin, Solana, BNB, and XRP. Traders also needs to contemplate allocating funds to smaller-cap cryptocurrencies that supply a extra enticing upside. All in all, the portfolio must be balanced to mitigate the danger of being overexposed to a crypto venture that fails.

What number of cash ought to I’ve in my crypto portfolio?

There actually is not any restrict to the variety of cash that may be held in a well-balanced and diversified portfolio. The truth is, it’s typically the case that the extra totally different tasks that an investor has publicity to – the higher. Think about using an alternate like OKX for the diversification course of, which presents greater than 600 markets.

What proportion of a portfolio must be crypto?

This actually is dependent upon the danger urge for food and particular person profile of the investor. Threat-averse traders will usually restrict their publicity to crypto – with simply 5-10% of their portfolio allotted to the house. On the different finish of the spectrum, some traders select to be 100% in crypto. That is, nevertheless, a high-risk technique, particularly contemplating that the broader crypto market tends to maneuver in tandem.