Disclaimer: The findings of the next evaluation are the only real opinions of the author and shouldn’t be thought of funding recommendation

- The flag sample, though bullish, was not best

- AXS noticed some developments within the futures market which indicated speculators had a extra bearish stance

The crypto markets noticed a pointy bullish transfer over the previous two days. Bitcoin led the cost and posted positive factors of 8% from the $19.3k assist zone.

The bullish sentiment behind Bitcoin translated throughout the altcoin market. Axie Infinity posted positive factors of practically 14% in the identical interval.

Right here’s AMBCrypto’s Value Prediction for Axie Infinity [AXS] in 2022-23

Axie Infinity had been in a powerful bearish pattern beforehand. Even now, its larger timeframe bias leaned in favor of the bears. Within the subsequent few days, the $10.1 resistance zone could possibly be a hotly contested area on the charts.

Bullish flag noticed, however the 38.2% stage has different concepts

Supply: AXS/USDT on TradingView

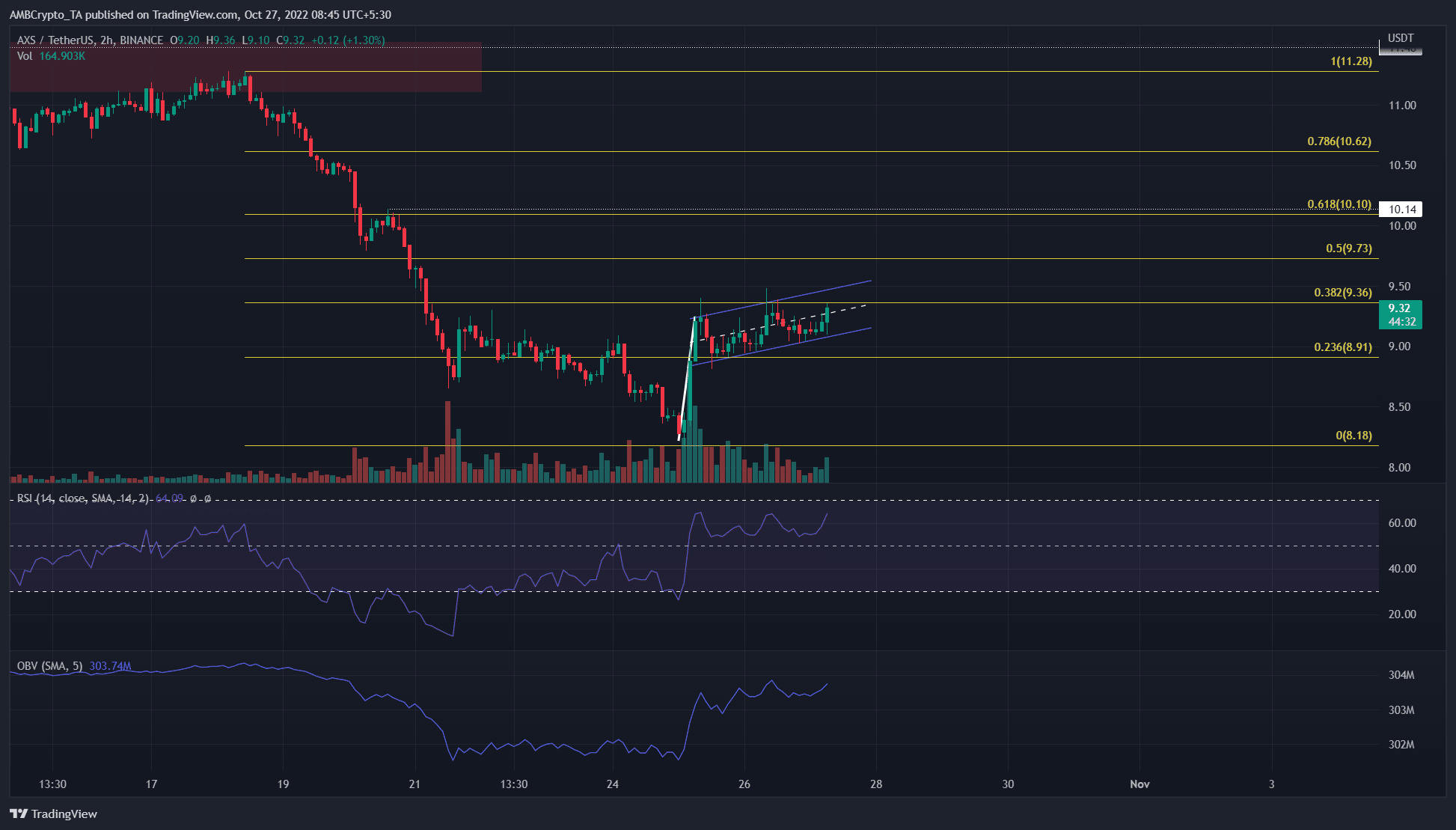

Axie Infinity dropped from $11.28 to $8.18 the earlier week. Based mostly on this transfer, a set of Fibonacci retracement ranges (yellow) was plotted. The 38.2% retracement stage was at $9.36, and this stage has not been damaged but.

Highlighted in white and blue was a bullish flag, however the formation itself was not best. In comparison with the flagpole, the flag itself has lasted a good whereas on the decrease timeframes. A breakout above the flag will possible see AXS climb to $10.2-$10.4.

In the meantime, the $10.14 was a major horizontal stage. It was additionally within the neighborhood of the 61.8% retracement stage at $10.1. Due to this fact, it was possible that Axie Infinity will face heavy promoting strain on this space.

The RSI on the 2-hour chart was above 60 and confirmed robust bullish momentum. Over the previous couple of days, the OBV additionally registered larger lows. This meant that purchasing quantity was stronger on this interval.

OI tails off after the pump of the $9.4

Supply: Coinglass

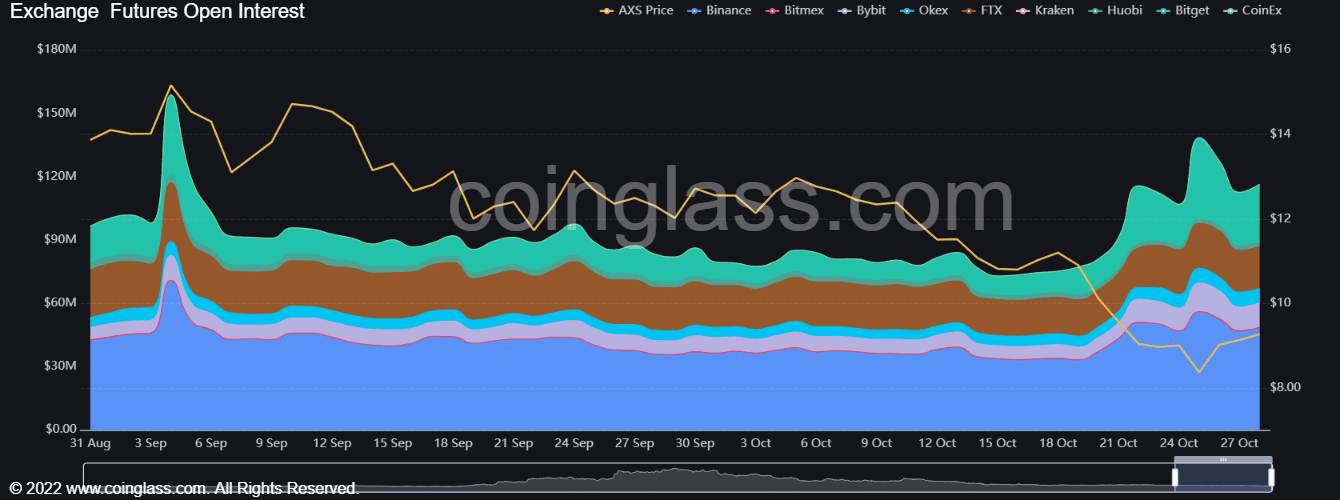

Whereas the OBV climbed larger to point out elevated shopping for strain, the Open Curiosity truly noticed a dip up to now two days. This discovering steered that the worth transfer larger noticed brief positions lined and may not be pushed by elementary demand.

Contemplate the truth that AXS has been in the next timeframe downtrend since mid-August. The dearth of an accumulation section earlier than a bullish transfer indicated that this pattern has possible not shifted.

The funding rate remained bearish to point that futures market members continued to have a bearish outlook in the marketplace. If AXS manages to see one other leg upward, this might drive these brief positions to shut and gasoline the bullish momentum behind Axie Infinity.