Disclaimer: The findings of the next evaluation are the only real opinions of the author and shouldn’t be thought-about funding recommendation

- The upper timeframe market construction was bearish for Avalanche

- The decrease timeframe order blocks close to important ranges urged a short-term reversal may start

Avalanche has struggled within the markets in latest days. AVAX has slid from the swing excessive of $20.63 on 5 November to the swing low of $12.03 on 9 November. This represented a plunge of 41.6%. Since then, AVAX has witnessed a bounce in costs.

Learn Avalanche’s worth prediction in 2022-23

In different information, the GameFi section on the Avalanche community has witnessed outstanding development in latest days, regardless of the market sentiment being unfavorable. Nevertheless, that issue was unlikely to immediate a hike in AVAX costs.

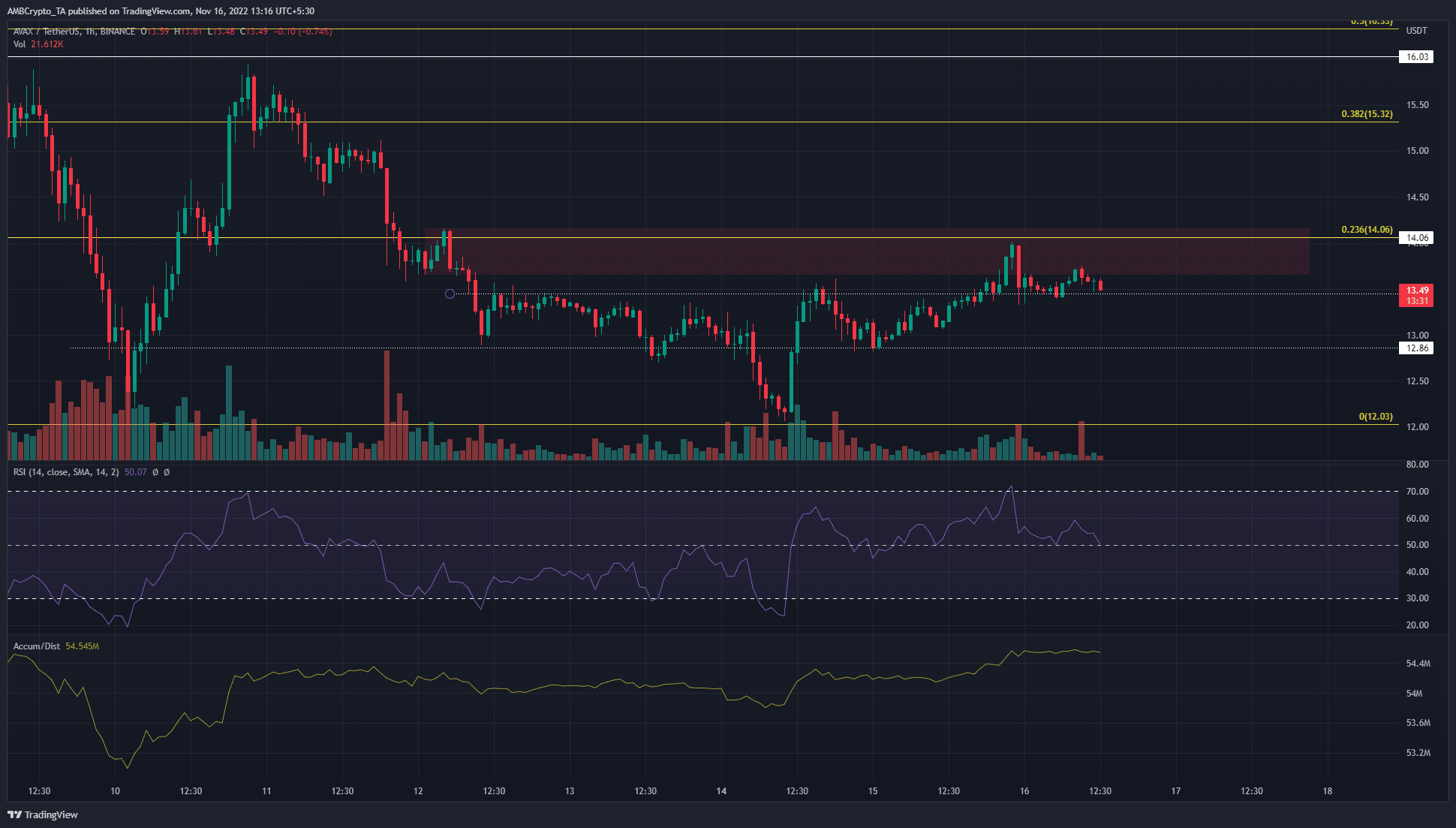

A bearish order block from the 4-hour timeframe impeded AVAX bulls’ progress

Supply: AVAX/USDT on TradingView

An inspection of the 1-day timeframe confirmed the market construction was strongly bearish. On the 4-hour chart as properly, the $13.6-$14.1 posed a hefty zone of resistance.

It was a bearish order block on that timeframe, highlighted by the red-tinted field. The 1-hour chart displayed above highlighted the worth’s sharp rejection from $14.01 to $13.33 on 15 November.

Nevertheless, a decrease timeframe degree of assist at $13.45 was defended. The RSI additionally stayed above impartial 50 to point out that bullish momentum had a toehold within the struggle. The A/D indicator has made greater lows up to now couple of days, in the course of the time when AVAX rallied from $12.03 to $14.

Till this bearish order block was damaged and flipped to a bullish breaker, a near-term shopping for alternative won’t come up. The upper timeframe construction discouraged lengthy positions, however a revisit to $13.45 and $12.86 may provide alternatives to scalpers.

A bullish retest of the $14.06 horizontal degree may herald a transfer greater, with the subsequent important ranges of resistance being $14.8 and $15.5.

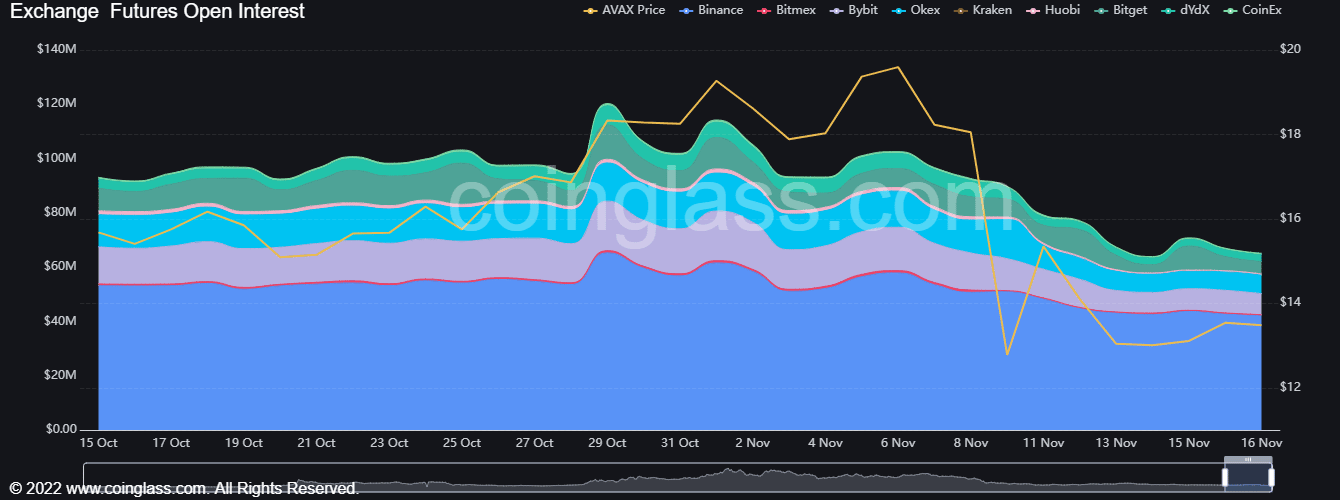

Constant decline within the Avalanche OI meant that futures market members weren’t but betting on a robust uptrend

Supply: Coinglass

The development has been strongly downward up to now week. In the meantime, Open Curiosity has additionally been in decline. This urged that quick positions didn’t get a chance to construct in the course of the run downward.

In the meantime, over the previous two days, the OI solely barely climbed greater. Mixed with the worth motion, the inference was that lengthy positions might need been tried, however the rejection on the $14 space discouraged the bulls.

Subsequently, until this order block was overwhelmed and $14.06 flipped to assist, a short-term uptrend won’t materialize. Bulls can look to bid close to the $12 mark, hoping for a robust bounce again towards the $14 degree.