Disclaimer: The knowledge offered doesn’t represent monetary, funding, buying and selling, or different kinds of recommendation and is solely the author’s opinion

- Avalanche appeared primed for one more plunge on the value charts

- A bounce towards $14 cannot be discounted however can supply a chance for sellers

Avalanche flipped its market construction from bullish to bearish earlier this month following the market-wide promoting strain witnessed lately. Bitcoin plummeted from $21.5k to $16.2k and will head decrease as soon as extra.

Learn Avalanche’s Value Prediction 2023-24

Extra daring decrease timeframe merchants can search to wager on a bullish couple of days. Nonetheless, extra risk-averse merchants can anticipate a chance to promote, with clear invalidation offered on the charts. The TVL of Avalanche noticed some advances lately, however might this be a bullish short-term catalyst for AVAX?

The market construction was bearish as sellers stay aggressive

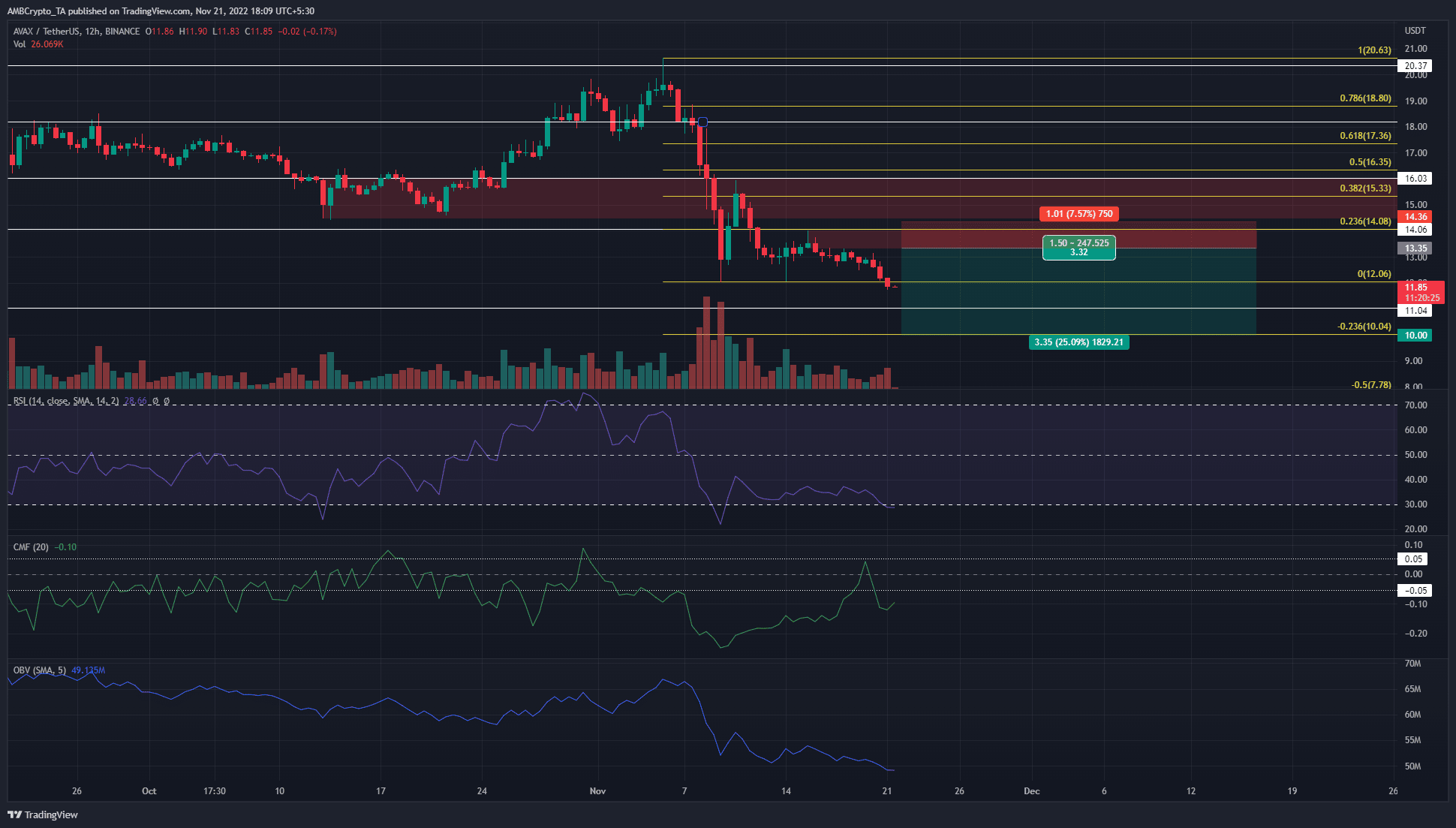

Supply: AVAX/USDT on TradingView

On the 12-hour chart, AVAX broke beneath the bullish order block at $14.5 on 9 November. It flipped its construction from bullish to bearish on 8 November when the value broke beneath a current increased low. Across the similar time, the Relative Power Index (RSI) took a nostril dive as bearish momentum seized management of the market.

The Chaikin Cash Stream (CMF) and the On-Stability Quantity (OBV) additionally took an enormous hit as promoting strain elevated enormously. The bearish outlook has not but modified. The Fibonacci retracement and extension ranges confirmed that the following assist stage to be careful for sat at $10.06. This was additionally a big psychological stage.

For extra conservative increased timeframe merchants, the bearish breaker within the $15 area could be a place the place they’ll look to enter brief positions. Extra aggressive merchants can view the $14 space as a spot to enter brief positions. In both state of affairs, the inference was that AVAX will face a considerable amount of promoting strain close to these ranges. Invalidation could be a session shut above $14.06 for the extra aggressive entry, and above $16.01 for the conservative method.

Funding charge damaging as futures contributors wager on decrease costs

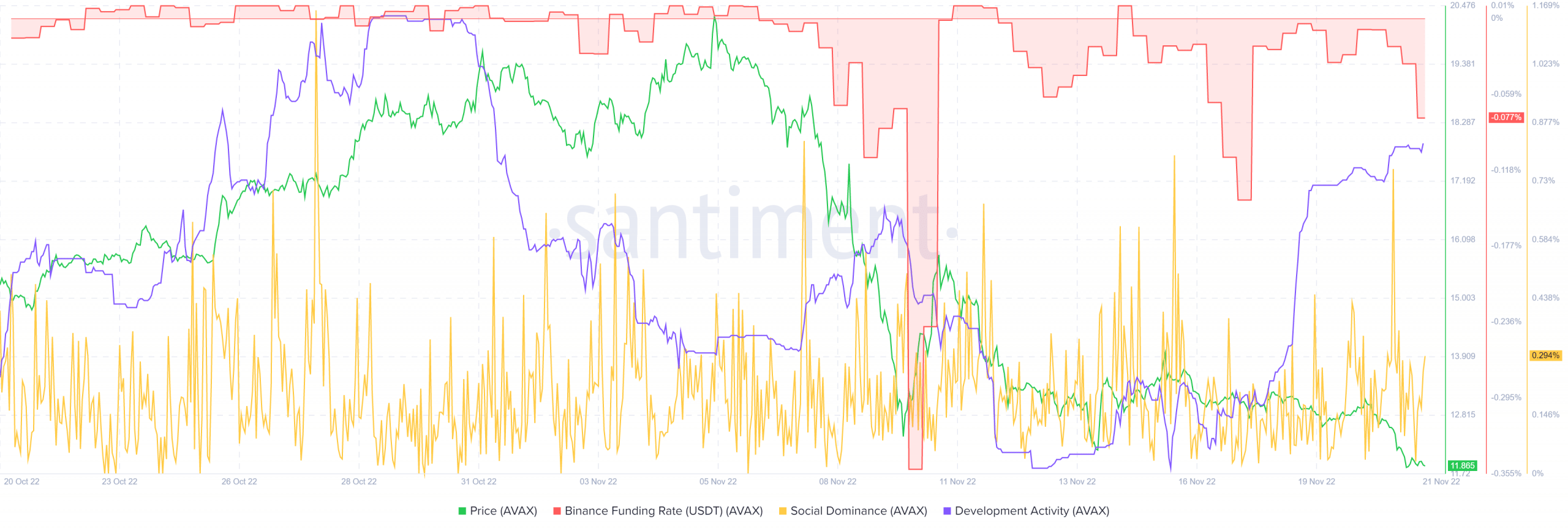

Supply: Santiment

Improvement exercise has been on the rise in current days and that was the one optimistic to remove for long-term traders. Social dominance has been considerably regular in current months with sporadic surges to the 0.7% mark.

As for the futures market, merchants gave the impression to be positioned bearishly because the funding charge noticed a dip into damaging territory. Open Interest has additionally been in a downtrend prior to now two weeks.

Technical components and sentiment was strongly in favor of the bears. This doesn’t imply a bounce towards $14 and even $15 won’t happen. As a substitute, increased timeframe merchants can search for a retest of those areas to seek for good chance shorting alternatives.