Australia’s Prudential Regulation Authority (APRA) launched a roadmap of its plan to totally regulate the crypto trade within the nation by 2025.

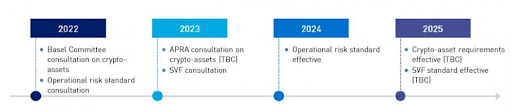

Underneath the plan, the APRA will progressively enhance its sector supervision over the approaching three years. The watchdog will perform consultations throughout 2022 and 2023, following which it should progressively introduce regulatory requirements in 2024 and 2025.

APRA Chair Wayne Byres stated:

“APRA is growing the longer-term prudential framework for crypto-assets and associated actions in Australia in session with different regulators internationally, to make sure consistency in strategy.”

2022

The Basel Committee session on crypto belongings will present insights on cautiously expose banks and different licensed deposit-taking establishments (ADIs) to crypto. These insights will decrease the operational dangers related to dealing with crypto and supply a place to begin for different APRA-regulated industries.

2023

After setting the necessities in 2022, APRA will begin shaping the articles. It is going to obtain extra consultancy providers within the course of if it wants. As well as, all associated cost, know-how, and monetary providers rules can be up to date to align them with the crypto asset necessities.

APRA will even begin engaged on prudential regulation of cost stablecoins. It likens these stablecoins to Saved-value Amenities (SVFs). Subsequently, it should search for methods to include stablecoins into the regulatory framework for SVFs. The Council of Monetary Regulators (CFR) will even step in for this motion level.

2024 and 2025

The roadmap additionally contains APRA’s expectations from crypto companies concerning danger administration and annual motion steps.

Entities that provide providers related to crypto belongings are anticipated to conduct applicable due diligence and complete danger assessments whereas complying with all conduct and disclosure necessities by Australian Securities and Investments (ASIC).

APRA plans to elaborate and enact these operational danger requirements in 2024 to incorporate directions concerning funding and lending actions, crypto-asset issuances, and partnering with third events.

After that, APRA goals to finalize the crypto asset necessities and stablecoin requirements by 2025 and finalize its regulatory framework.

Australia and crypto

Australia has been publicly supporting all facets of crypto and blockchain, together with funds, NTFs and metaverse, and DeFi. The nation additionally confirmed a pro-regulation stance in March 2022 when a senator proposed a brand new regulatory framework.

Australia has a crypto excessive adoption price. The nation has the third-highest crypto possession price, with 17.7%, based on a report from October 2021.